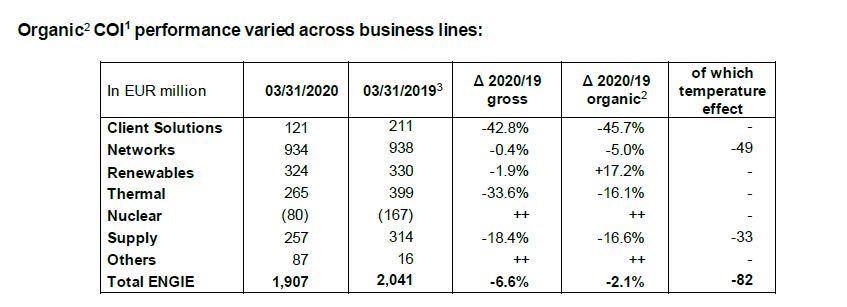

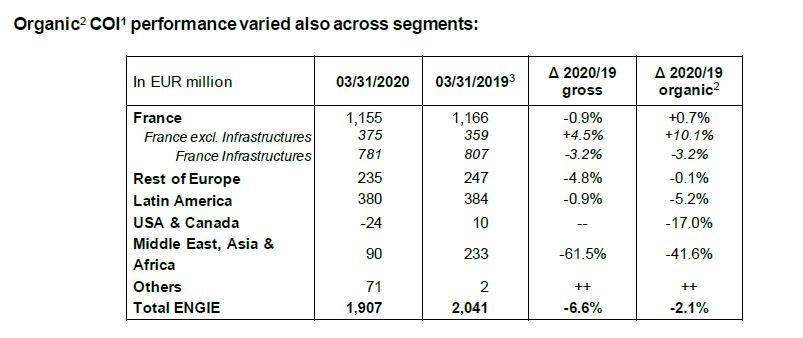

- France COI1 increased by 0.7% on an organic2 basis, mainly driven by higher hydroelectric, wind and solar power generation, higher B2C margins while unfavorable temperature weighed on Networks and Supply businesses and the Covid-19 crisis on Client Solutions and Supply performances.

- Rest of Europe organic2 COI1 remained flat with higher achieved prices and lower operational expenditures in Nuclear, good wind conditions on onshore activities in most European countries, better results of the supply activities in Romania and Capacity Market reinstatement in the UK, partly offset by lower spreads in Thermal, mild temperature in Belgium and Client Solutions significant decrease as a result of lower activity mainly related to the Covid-19 crisis.

- Latin America organic2 COI1 decreased by 5.2% notably due to lower hydroelectric power production in Brazil and lower prices in Chile.

- USA & Canada organic2 COI1 decreased by 17% mainly due to cumulated losses in services companies, timing in asset-based activities partly offset by contributions of renewable projects commissioned in the second half of 2019.

- Middle East, Africa & Asia organic2 COI1 decreased by 41.6% mainly driven by lower performance in Supply in Australia and the expiry of a PPA in Turkey in April 2019.

- In the Others segment, the EUR 37 million organic2 COI1 increase is mainly related to the strong performance of Energy Management and GTT. These favorable impacts were partly offset by difficulties in SUEZ mainly due to Covid-19 and a decrease in French B2B supply mainly due to climate and Covid-19 and by development costs on new, growth businesses.

Net financial debt at EUR 27.9 billion

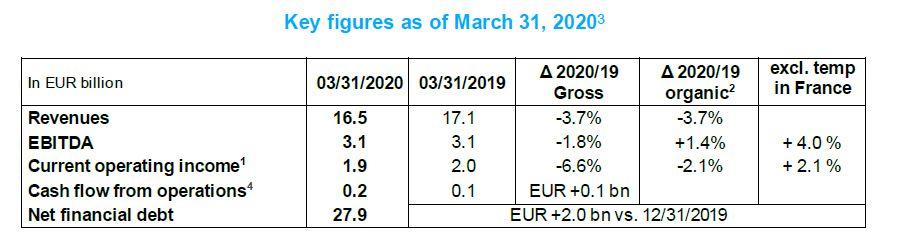

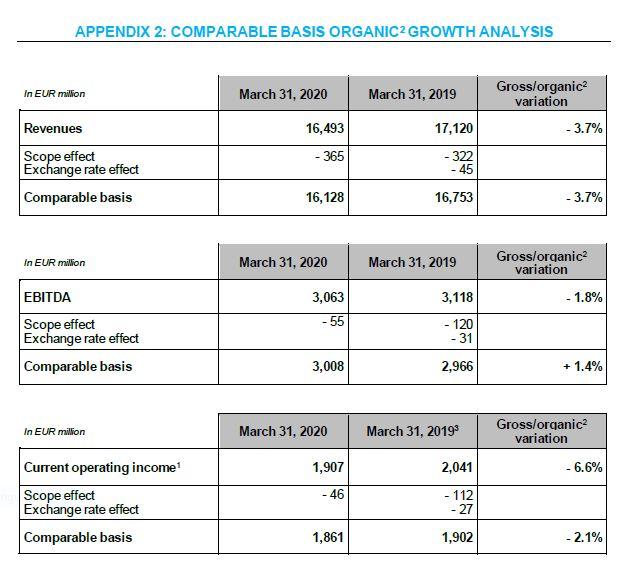

Net financial debt stood at EUR 27.9 billion, up EUR 2.0 billion compared with December 31, 2019. This negative variation is mainly due to capital expenditures throughout the businesses.

Cash flow from operations4 amounted to EUR 0.2 billion, up EUR 0.1 billion due to timing effects from commodity related margin calls, and lower taxes paid.

ENGIE continues to maintain one of the strongest balance sheets in its sector, with EUR 19.2 billion of liquidity (net cash + undrawn credit facilities – outstanding commercial paper) including EUR 12.7 billion of cash, as of end of March.

On March 20, the issuance of a triple tranche senior bond for a total of EUR 2.5 billion further improved ENGIE’s financial position.

At the end of March 2020, the net financial debt to EBITDA ratio amounted to 2.7x, a slight increase compared with December 31, 2019. The average cost of gross debt was 2.80%, up 10 bps compared with December 31, 2019.

Economic net debt5 to EBITDA ratio stood at 4.3x, an increase of 0.3x compared with December 31, 2019.

On April 24th, 2020; S&P lowered its long-term rating to BBB+ and its short-term rating to A-2.

On May 5th, 2020; Moody’s affirmed its long-term rating of A3 and changed the outlook from stable to negative.

Covid-19 impacts by business line

Regarding Covid-19 impacts, our current assessment of the post lockdown situation stands as follows:

- In Client Solutions: we currently expect a significant impact from Covid-19, as there are still uncertainties due to site closures and lifting of restrictions, extent of governmental support on temporary unemployment, the slope of the post-crisis recovery and the impact from customer claims.

- In Networks: we currently expect a rather low impact from Covid-19, primarily related to phasing as the regulatory mechanism in France allows us to recoup in the future the shortfall in 2020 distributed volumes. Uncertainties remain on timing of work sites reopening and impact of the crisis on international activities.

- In Renewables: we currently expect a low impact from Covid-19 as current projects, supply chains and facility operations are largely unaffected. Uncertainties remain on potential delays of commissioning and sell-downs, foreign exchange and timing of favourable rulings in Brazil.

- In Thermal and Nuclear: we currently expect a low impact from Covid-19. There are still uncertainties on evolution of power prices and spreads, impact on demand in some countries and the nuclear maintenance schedule in Belgium. Workers are continuously mobilized to secure energy supply and ongoing Long-Term Operations (LTO) works.

- In Supply: we currently expect a medium impact on this activity from Covid-19 with uncertainties around recovery profile in industrial demand, duration of retail consumers services freeze and impact of bad debt.

Adaptation and mitigation plans targeting swift recovery

Since the beginning of the Covid-19 crisis ENGIE has been immediately implemented a comprehensive action plan to ensure: (i) the health and safety of Group employees, their families, and ENGIE’s providers, (ii) continuity of essential internal and selected client operations, and (iii) limitation of financial impacts and protection of financial liquidity.

Robust actions have been taken to protect employees, ensure financial support for smaller suppliers, deliver essential services to customers and maintain critical energy supply by putting in place a comprehensive crisis management framework and implementing home office for all employees whose roles allow this.

ENGIE has continuously worked to mitigate the impacts of the Covid-19 crisis by securing its liquidity position, optimizing capital expenditures and reducing operational expenditures. A strong liquidity position above EUR 19bn has been achieved, reinforced by the recent bond placement, and strict operational expenditure management on fixed and variable costs have been put in place. The timing of certain growth CAPEX projects has been adjusted and reduced, and, when possible and without putting assets at risk, maintenance CAPEX is being also reduced or postponed.

Operational expenditures are scrutinized at all levels of the company through demand management, optimized partnerships with major suppliers and longer-term expense rationalization are all steps being taken to limit the margin contraction. Finally, variabilization of costs to the fullest extent possible in Client Solutions, such as reducing the use of subcontractors, is also being carefully examined.

Strategy acceleration pursued for greater selectivity

Despite the COVID-19 crisis, ENGIE is further progressing on its evolution path. Climate change is the biggest risk our society has to cope with in the coming decades; its impacts on the environment but more generally on health, political and economic issues will certainly be much more significant than the ones we are currently experiencing. ENGIE will be taking part in this challenge.

In order to be much more impactful on the markets it operates in, ENGIE will increase its business and geographical selectivity in the next few months as announced at the 2019 FY results presentation. Market-level profit pools and return expectations are scrutinized to drive greater geographic selectivity, differentiated by business segment. There will be greater strategic focus on markets with significant existing or potential scale, attractive growth profiles and transparent, stable regulatory dynamics.

ENGIE intends to further rationalize its Client Solutions activities, exiting business with low profitability or non-core in the context of its strategy.

ENGIE has fine-tuned its market rationalization target with a decision to exit over 25 countries by 2021. It includes business development activities in countries to be explored and existing activities in Tier 2 countries.

The impact on COI1 should be limited.

Forward financial outlook

The Covid-19 health crisis is having a significant impact on some of ENGIE’s customers and operations. As the impact on the Group’s financial statements remains at this stage unquantifiable and subject to uncertain assumptions regarding the length and profile of this crisis, ENGIE will update its forward financial outlook in due course.

The presentation of the Group’s first quarter 2020 financial information used during the investor conference call is available to download from ENGIE’s website: https://www.engie.com/en/finance/resultats/2020/