Disclaimer

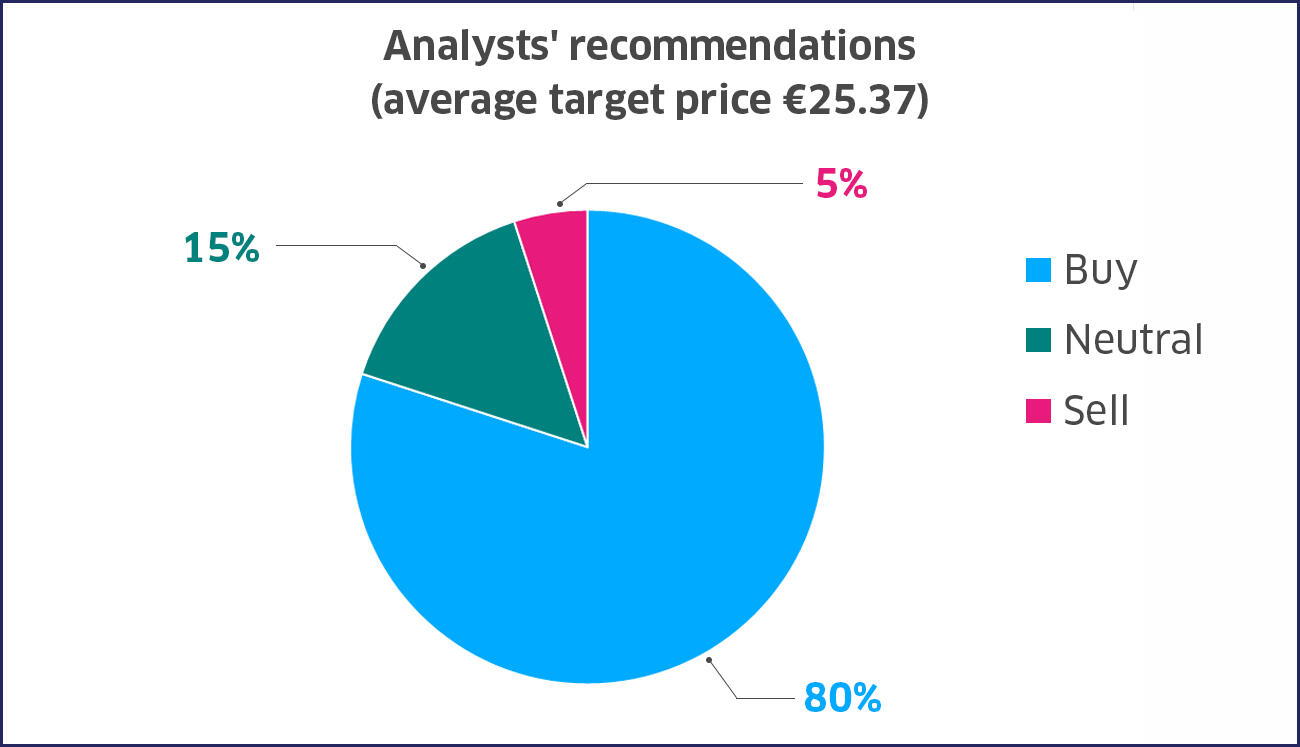

The data presented set out a summary of the recommendations, target prices and financial estimates published between January and February 2026 by the financial analysts that, to the knowledge of ENGIE, cover ENGIE shares and issue dedicated reports from which are extracted such data. Reference to these data serves only for reader information and is non-binding. These data may not be regarded as a solicitation or an offer to buy or to sell ENGIE shares. These data have been established by financial analysts under their own responsibility and do not reflect the opinion of ENGIE. ENGIE does not issue any opinion and does not give any warranty as to the accuracy and quality of these data which come from financial analysts. No warranty is given as to their completeness and ENGIE does not commit to update them.