On February 27, 2014, Gérard Mestrallet, Chairman and Chief Executive Officer of GDF SUEZ, presented the 2013 annual results of the Group to the press.

By ENGIE - 27 February 2014 - 12:33

On February 27, 2014, Gérard Mestrallet, Chairman and Chief Executive Officer of GDF SUEZ, presented the 2013 annual results of the Group to the press.

For the full year results presentation, Gérard Mestrallet, Chairman and Chief Executive Officer of GDF SUEZ, stated: “The Group’s operational results in 2013 are strong and confirm our strategy in a very difficult economic environment for thermal power production and gas storage in Europe. We have been the first to sound the alarm since May 2013 with the Magritte group. Our industrial vision forced to decide significant impairments of some of our European businesses, which do not affect the growth perspectives of the Group worldwide. In fact, we have raised our financial targets for 2014. Moreover, GDF SUEZ will increase its development capex program, already the most ambitious in the industry. Our strategy is clear: to be the benchmark energy player in fast growing markets and to be leader in the energy transition in Europe.”

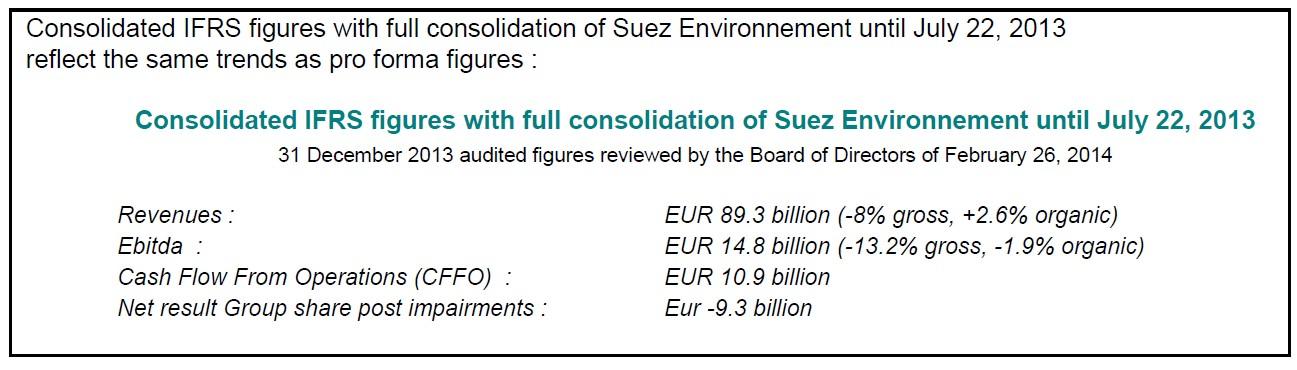

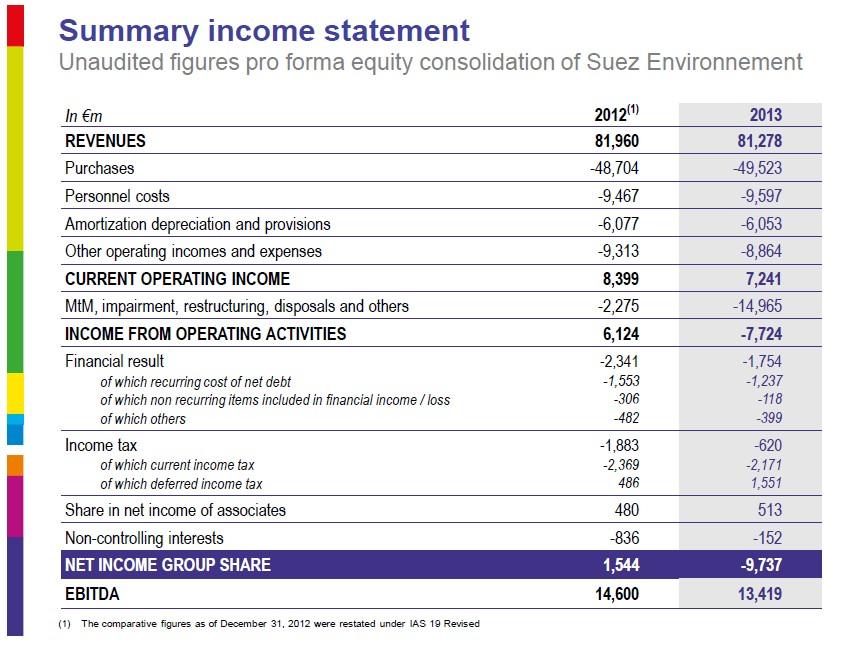

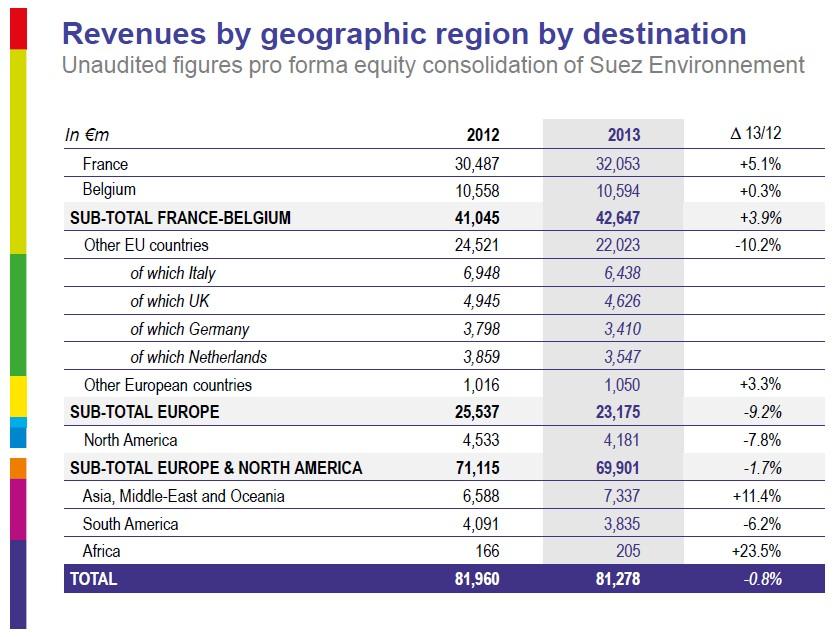

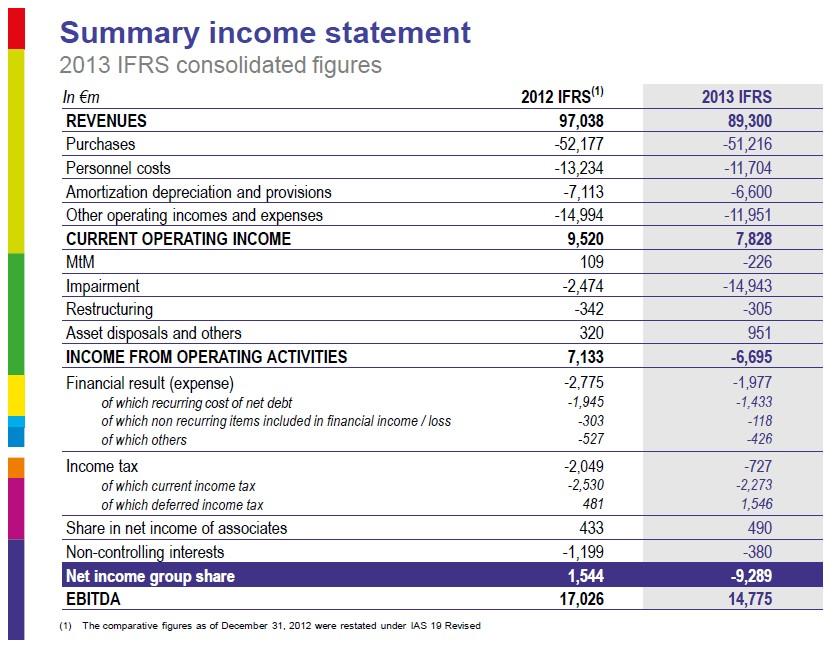

Revenues of EUR 81.3 billion are in slight decrease of -0.8 % (gross) compared to 2012 (organic growth of +3.0%). Negative impacts from scope and foreign exchange are partly compensated by increased gas and electricity sales in France due to cold weather conditions during the first two quarters, and by higher LNG sales as a result of cargos diversions early 2013 as well as growth in international activities.

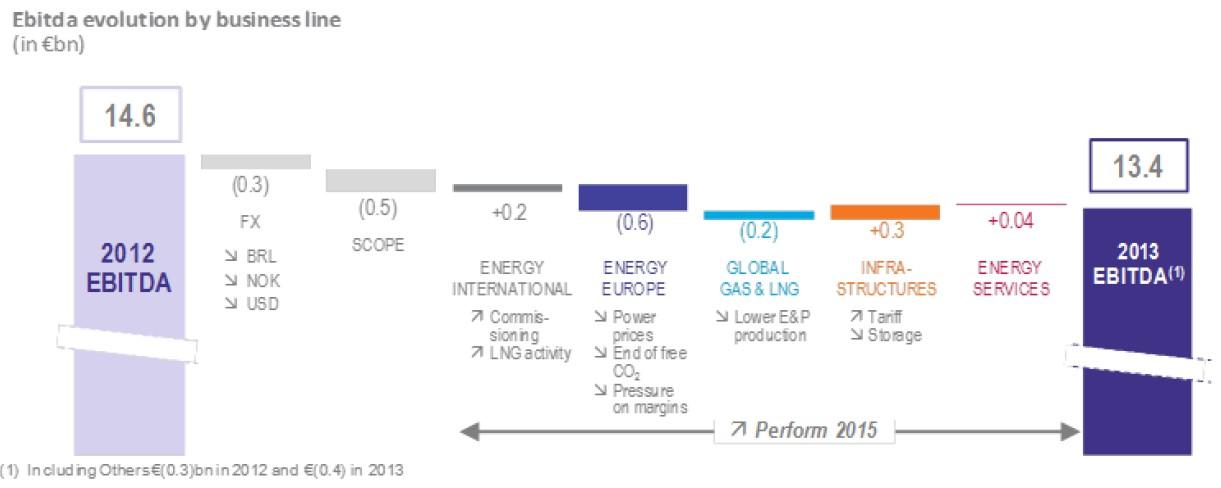

Ebitda came to EUR 13.4 billion decreasing on a gross basis (-8.1%) and an organic basis (-2.7%). Ebitda benefited from positive effect of new assets commissioning, from colder weather conditions in France, from operational performances and progress made in the context of Perform 2015 Group performance plan. However these positive effects have been offset by negative foreign exchange variations in fast growing markets but also in mature countries, by the loss of Ebitda from companies sold in connection with the Group’s asset optimization program, by the decrease of electricity prices and by the temporary decrease in E&P production.

Ebitda for the Energy International business line grew by +4,2% organically to EUR 3,871 million, benefiting from contributions from new assets commissioning, in particular in Brazil, Peru and Thailand, from higher prices in Australia and from the good performance of the LNG activity in the United States. Adverse market conditions in the United Kingdom and the weather conditions in the United States have partly offset these favorable elements.

Ebitda for the Energy Europe business line, at EUR 3,415 million, decreased organically by -14.8% as a result of lower market power prices and of the end of free CO2 allowances. These unfavorable elements have only been partly compensated by the cold weather in 2013 and by gas tariff adjustment in France.

Global Gas & LNG business line reported an Ebitda of EUR 2,124 million, representing an organic decline of - 8.2 % in line with forecast because of natural depletion of some fields before the commissioning of Gudrun, Amstel, L5 Sierra and Juliet in 2014.

Ebitda for Infrastructures business line came to EUR 3,370 million, for organic growth of +10.5% compared to 2012, thanks to particularly favorable weather conditions in 2013, annual revision of access tariffs for infrastructures, and despite lower storage capacity sales in France.

Energy Services Ebitda increasing to EUR 1,068 million (+ 3.8 % organic growth), with all its businesses contributing to this good performance.

All business lines contributed to the Perform 2015 performance plan launched during the second semester of 2012, which resulted in a favorable impact on 2013 Ebitda of + EUR 550 million, exceeding targets.

Net recurring income, Group share, at EUR 3.4 billion, is at the high end of the range of guidance previously indicated of EUR 3.1 to 3.5 billion. Lower current operating income is partly mitigated by lower recurring financial expenses thanks to active debt management. Moreover, income tax are lower despite a higher recurrent effective tax rate.

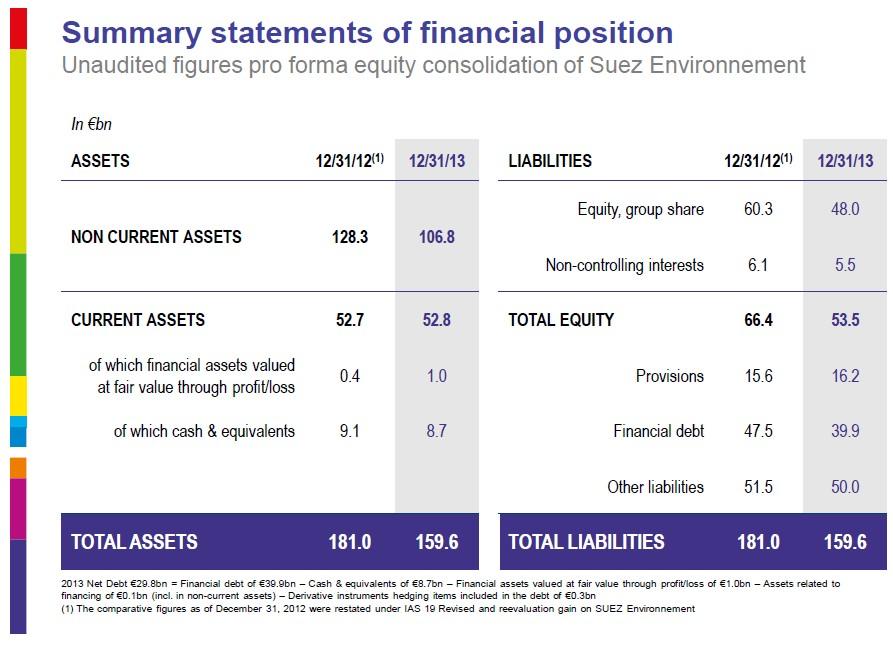

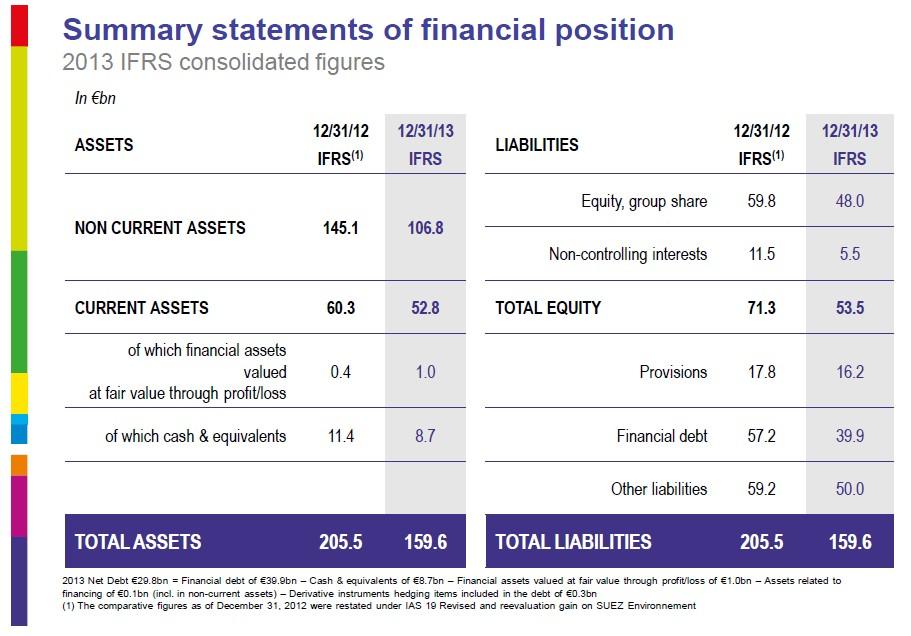

The Group believes that the change in environment in Europe is now serious and long-lasting and has therefore decided to draw the consequences for its asset values by recognizing impairments on assets for EUR 9.1 billion, mainly attributed to thermal power plants and gas storage capacities in Europe (c.a. EUR 8.0 billion), and on goodwill for EUR 5.8 billion (EUR 5.7 billion of which related to Europe).

The magnitude of these impairments is explained among others by the size of the Group’s balance sheet (EUR 160 billion) resulting in particular from massive revaluation of assets in application of IFRS standards booked on the occasion of different mergers, especially the GDF SUEZ one, realized without cash payment.

These impairments will have a positive impact of EUR 350 million on Group net recurring income as from 2014 thanks to lower depreciation charges. After these impairments, the total value of non current assets of the Group will amount to EUR 107 billion at 31 December 2013.

These impairments have no impact on the cash position of the Group nor on the net recurring result, but they have a direct impact on the net income Group share post impairments which comes out at EUR -9.7 billion.

GDF SUEZ distributive capacity stands at EUR 41 billion at 31 December 2013.

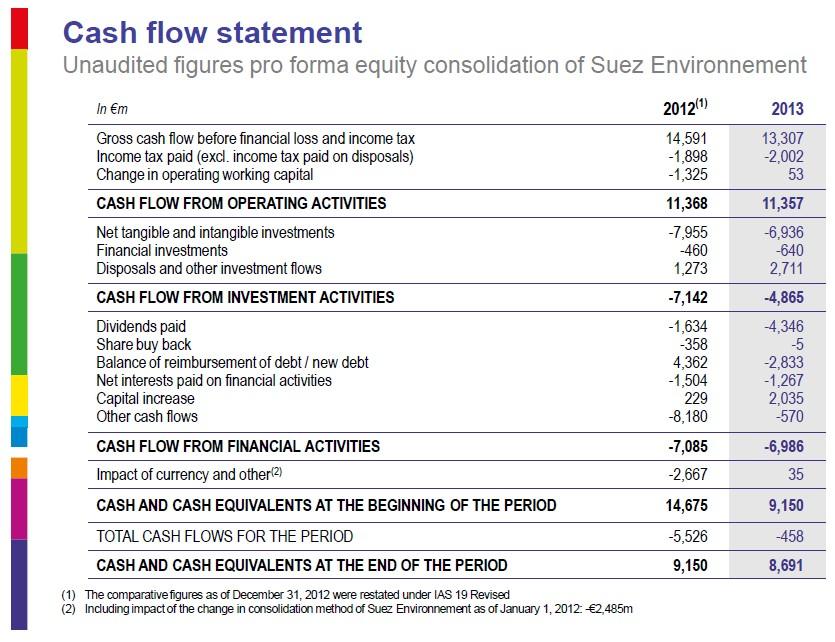

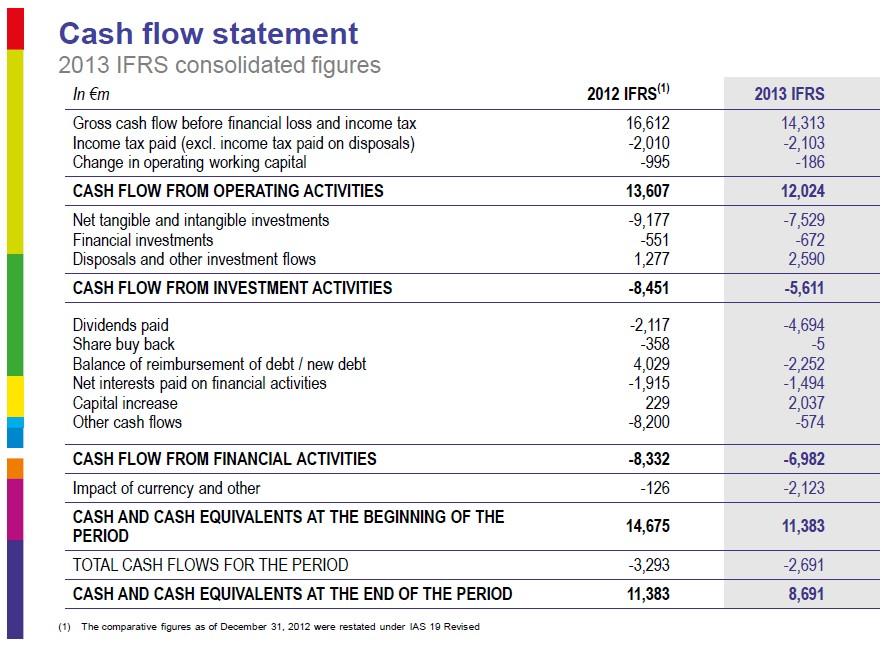

At the end of December 2013, net debt was reduced by EUR 6.8 billion compared to the end of December 2012, to EUR 29.8 billion, one year ahead of 2014 target. Net debt evolution results from Cash Flow From Operations of EUR 10.4 billion up by 2%, gross capex of EUR 7.5 billion, payment of dividends to GDF SUEZ SA shareholders for EUR 3.5 billion, EUR 1.7 billion from the GDF SUEZ SA hybrid bond issue in early July, and the positive impact of the portfolio optimization program.

At the end of December 2013, the Group has a high level of liquidity of EUR 17.5 billion, of which EUR 8.8 billion in cash, and the average cost of gross debt is 3.68%, more than 50 basis points lower than at the end of December 2012.

In fast growing markets, GDF SUEZ accelerated its development, positioning itself along the whole value chain and by entering into new businesses and regions. In 2013, the Group continued to develop itself in the field of independent power production in countries where it already holds strong positions, such as in Middle-East (Kuwait), Brazil or Peru. GDF SUEZ commissioned 3.3 GW9 of new power capacities, mostly outside Europe.

The Group also entered new attractive markets:

Past year was also marked by numerous successes along the gas value chain:

In energy services, the Group reinforced its presence at the international level with the acquisition of Emac in Brazil and with an equity stake in an Australian company. It concluded the acquisition of a stake in the cooling network of Cyberjaya, in Malaysia. The Group also signed a 6-year agreement with Sanofi for the implementation of energy projects on Sanofi’s industrial sites worldwide. Lastly, it finalized the acquisitions of Balfour Beatty Workplace, a company active in facility management in the United Kingdom, and of district heating networks in Poland.

In Europe, the Group adapts itself to the profound change of the energy sector and is focusing its development priorities in renewable energies. GDF SUEZ entered into strategic partnerships in Portugal with Marubeni and in France with Crédit Agricole Assurances in order to pursue its development. In 2013, GDF SUEZ also took part to the tender offer process for offshore wind in France for the Tréport and Yeu and Noirmoutier zones (2 x 500 MW).

GDF SUEZ wishes to pursue and to accelerate the implementation of its industrial strategy, with two clear objectives:

and

GDF SUEZ pursues in all its businesses ambitious industrial objectives:

Finally, GDF SUEZ objective is to prepare the future by reinforcing innovation and research and by positioning itself on new businesses (biogas, retail LNG, demand management, digitalization…). It has therefore set up a dedicated new entity "Innovation and new business" in order to stimulate innovation within the Group and to capture new growth drivers.

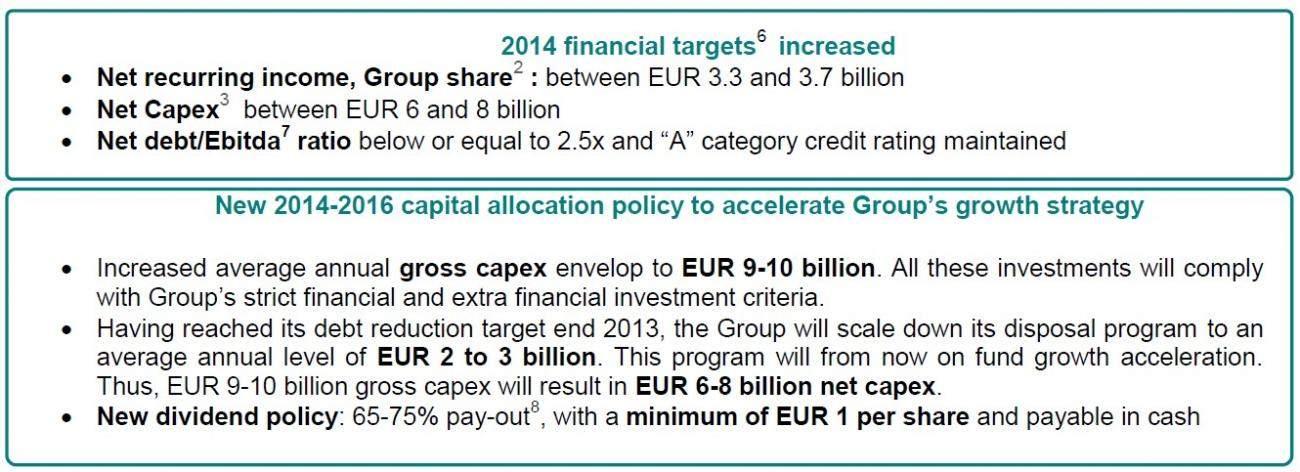

For 2014, the Group increases its financial objectives11:

In light of the fact that the objective to reduce net debt below EUR 30 billion by end 2014 has already been reached, the Group has decided :

Given the progress made in 2013 on Perform 2015 and the continued depressed economic conditions in Europe, GDF SUEZ has decided to accelerate the plan’s implementation and to add EUR 800 million to its gross cumulated objectives for end 2015. The 2015 cumulated objective on the net recurring income Group share has been raised to EUR 0.9 billion.

At the Shareholders’ General Meeting on April 28, 2014, the Board will propose to shareholders a stable dividend, payable in cash, of EUR 1.5 per share for the fiscal year 2013.

For the period 2014-2016, the Group commits to a dividend policy based on a payout ratio of 65-75%14 with a minimum of EUR 1 per share, payable in cash and with an interim payment.

At the occasion of the Shareholders’ General Meeting on April 28, 2014, the Board will also propose to shareholders a 10% loyalty dividend for shares in registered form for more than two years. This measure will be applicable for the first time to the dividend payment related to fiscal year 2016 and will be capped to 0.5% of social capital for a single shareholder.

GDF SUEZ is also well on the way to achieving its extra financial targets by 2015, with its training target already met with 69% of employees trained in 2013:

In France, GDF SUEZ is one of the largest employers with 74,000 employees. Worldwide, GDF SUEZ is present in more than 70 countries and employs close to 150,000 collaborators; it expects to recruit 15,000 people per year worldwide of which 9,000 per year in France over 2014-2015 period.

The presentation of 2013 results and the annual financial report, including the management report, consolidated financial statements and notes, are available on our website:

https://www.engie.com/en/finance/results/2013

The Group’s consolidated accounts and the parent company financial statements for GDF SUEZ SA as of December 31, 2013 were approved by the Board of Directors on February 26, 2014. The Group’s statutory auditors have performed their audit of these accounts. The relevant audit report is currently being issued.

Important notice

The figures presented here are those customarily used and communicated to the markets by GDF SUEZ. This message includes forward-looking information and statements. Such statements include financial projections and estimates, the assumptions on which they are based as well as statements about projects, objectives and expectations regarding future operations, profits, or services, or future performance. Although GDF SUEZ management believes that these forward-looking statements are reasonable, investors and holders of GDF SUEZ securities should be aware that such forward-looking information and statements are subject to many risks and uncertainties that are generally difficult to predict and beyond the control of GDF SUEZ, and may cause results and developments to differ significantly from those expressed, implied or predicted in the forward-looking statements or information. Such risks include those explained or identified in the public documents filed by GDF SUEZ with the French Financial Market Authority (AMF), including those listed in the “Risk Factors” section of the GDF SUEZ reference document filed with the AMF on March 22, 2013 (under number D.13-0206). Investors and holders of GDF SUEZ securities should note that if some or all of these risks are realized they may have a significant unfavorable impact on GDF SUEZ.

About GDF SUEZ

GDF SUEZ develops its businesses (power, natural gas, energy services) around a model based on responsible growth to take up today’s major energy and environmental challenges: meeting energy needs, ensuring the security of supply, fighting against climate change and maximizing the use of resources. The Group provides highly efficient and innovative solutions to individuals, cities and businesses by relying on diversified gas-supply sources, flexible and low-emission power generation as well as unique expertise in four key sectors: independent power production, liquefied natural gas, renewable energy and energy efficiency services. GDF SUEZ employs 147,200 people worldwide and achieved revenues of €81.3 billion in 2013. The Group is listed on the Paris, Brussels and Luxembourg stock exchanges and is represented in the main international indices: CAC 40, BEL 20, DJ Euro Stoxx 50, Euronext 100, FTSE Eurotop 100, MSCI Europe, ASPI Eurozone, Euronext Vigeo Eurozone 120, Vigeo World 120, Vigeo Europe 120 and Vigeo France 20.

1 Consolidated IFRS figures presented on page 2 have been reviewed by the Board of Directors of February 26, 2014 and have been audited by Group’s auditors. Pro forma figures as if the equity consolidation of Suez Environnement had taken place on January 1st, 2013, have been reviewed by auditors and are included in a specific report.

2 Net income excluding restructuring costs, MtM, impairments, disposals, other non-recurring items and associated tax impacts and nuclear contribution in Belgium.

3 Net Capex = gross capex – disposals ; (cash and net debt effect)

4 S&P/ Moody’s Long-term ratings with negative outlook.

5 Dividend subject to approval of the Annual Shareholders’ Meeting scheduled April 28, 2014, with a dividend balance of EUR 0.67/share to be paid in cash on May 6, 2014. The ex-date for final dividend is set for April 30, 2014.

6 These targets assume average weather conditions, full pass through of supply costs in French regulated gas tariffs, no other significant regulatory and macro economic changes, commodity prices assumptions based on market conditions as of end of December 2013 for the non-hedged part of the production, and average foreign exchange rates as follow for 2014: €/$1.38, €/BRL 3.38.

7 New Ebitda definition includes share in net income of associates, concessions, provisions and cash share based payments

8 Based on net recurring income group share

9 At 100%

10 At 100%

11 These targets assume average weather conditions, no substantial regulatory or macro-economic changes, commodity price assumptions based on market conditions as of the end of December 2013 for the non-hedged portion of production, and average foreign exchange rates for 2014 as follows: €/$1.38, €/BRL3.38.

12 Net result Excluding restructuring costs, MtM, impairments, disposals, other non-recurring items and associated tax impact and nuclear contribution in Belgium.

13 Net Capex = gross Capex – disposals; (cash and net debt impact)

14 Based on net recurring result Group share

15 Dividend subject to the approval of the Annual Shareholders’ Meeting on April 28, 2014.