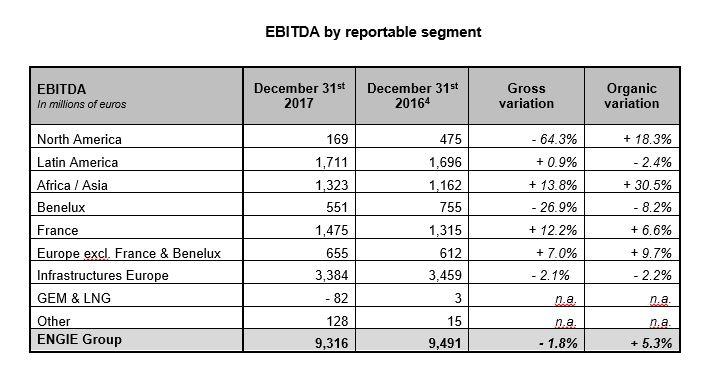

- EBITDA for the North America segment was up sharply thanks to a good performance from the client solutions businesses coupled with cost savings under the Lean 2018 program, despite a weaker performance from the remaining power generation activities.

- EBITDA for the Latin America segment contracted slightly on an organic basis, mainly due to the positive impact of a provision reversal in 2016 in Brazil, partially offset by the commissioning of new assets in Mexico and Peru, positive tariffs revisions in Mexico and Argentina, and an improvement in the contribution of hydroelectric power generation activities in Brazil.

- EBITDA for the Africa/Asia segment reflected a very strong performance as growth engines benefited mainly from the commissioning of the Az Zour North power and water desalination plant in Kuwait at the end of 2016 and the successful closing of the Fadhili power plant contract in Saudi Arabia, the solid performance of retail businesses in Australia, and from higher margins in the gas distribution business in Thailand. These factors were partially offset by lower availability of assets in Thailand and Turkey and higher taxes for entities accounted for using the equity method in Oman and Saudi Arabia. Besides, on merchant activities, the power generation business in Australia benefited from increase in both prices and volumes.

- EBITDA for the Benelux segment decreased on an organic basis. This was mainly due to merchant activities as the nuclear power generation business was impacted by a decline in captured power prices and the non-scheduled unavailabilities of Tihange 1, Tihange 2 and Doel 3. These impacts were partially offset by a good performance in growth engines from services, gas and electricity sales activities, and renewable power generation businesses, as well as cost savings under the Lean 2018 program.

- EBITDA for the France segment improved due to renewable and client solutions, resulting from higher power volumes sold on the retail segment, margins from DBSO activities in wind and solar and a good performance from networks activities. These impacts were partially offset by a decrease in hydro power production, lower volumes and margins in the gas retail business, as well as an adverse temperature effect.

- EBITDA for the Europe excluding the French and Benelux segment increased thanks to the good performance of the growth engines. It is mainly due to an improvement in margins and volumes in gas and electricity retail businesses in the United Kingdom, to client solutions notably in Italy, to gas distribution activities in Romania, as well as to cost savings under the Lean 2018 program.

- EBITDA for the Infrastructures Europe segment decreased organically due to lower storage capacity sales in France, the negative impact of price revisions in 2017 in the gas transport and distribution business and the unfavorable evolution of temperatures in France.

- EBITDA for the GEM & LNG segment was down compared with 2016. This is mainly explained by merchant activities due to negative price impacts, less significant revisions of gas supply conditions in 2017 than in 2016, and to gas supply difficulties in the south of France in January 2017 during the cold spell. These negative impacts were partially offset by price revisions for LNG supply contracts in 2017, coupled with cost savings under the Lean 2018 program.

- EBITDA for the Other segment benefited from strong organic growth, mainly driven by a good performance from gas fired thermal power generation in Europe (merchant activity), from B2B electricity sales in France and from cost savings under the Lean 2018 program, notably at corporate level.

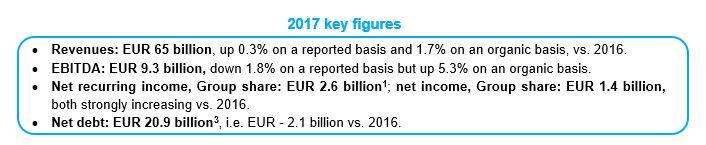

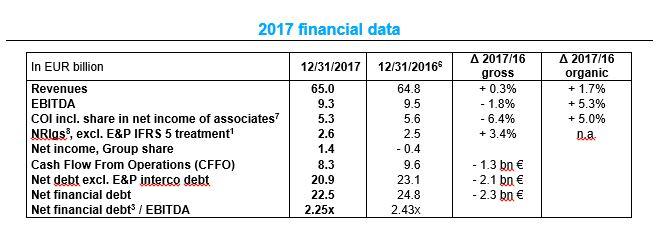

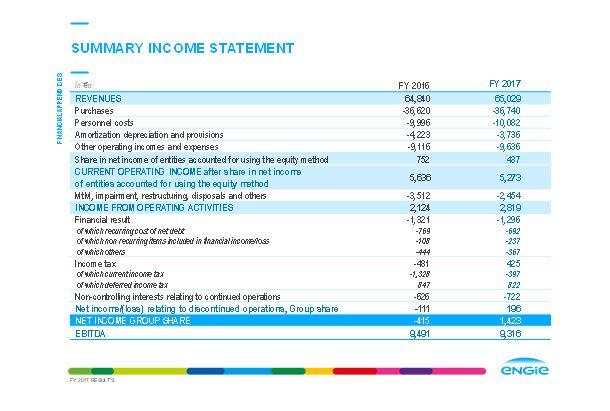

Current operating income of EUR 5.3 billion

Current operating income after share in net income of entities accounted for using the equity method decreased by 6.4% on a reported basis but increased by 5.0% on an organic basis to EUR 5.3 billion. The organic growth in EBITDA was mitigated by higher depreciation expenses following the increase at the end 2016 in dismantling provisions (booked against an asset) related to Belgian nuclear power plants.

Net recurring income, Group share of EUR 2.6 billion (1) and net income, Group share of EUR 1.4 billion

Net recurring income, Group share with E&P underlying contribution at EUR 2.6 billion is improving compared with 2016. It includes EUR 0.2 billion of net recurring income Group share of ENGIE E&P International underlying contribution (“discontinued operations”) and excludes EUR 0.1 billion of D&A upside under IFRS 5. Taking into account this upside, reported net recurring income, Group share amounted to EUR 2.7 billion, including EUR 0.3 billion related to discontinued operations.

Net recurring income, Group share relating to continued operations amounted to EUR 2.4 billion for the year ended December 31, 2017, down 2.4% on a reported basis compared to 2016. The decrease in current operating income after the share in net income of companies accounted for using the equity method is partially offset by an improvement in recurring net financial and tax results.

Net income, Group share amounted to EUR 1.4 billion for 2017, including EUR 0.2 billion from ENGIE E&P International activities classified as "Discontinued operations". It includes notably lower impairments compared to 2016 (gross amounts of EUR 1.3 billion in 2017 vs. EUR 4.0 billion in 2016).

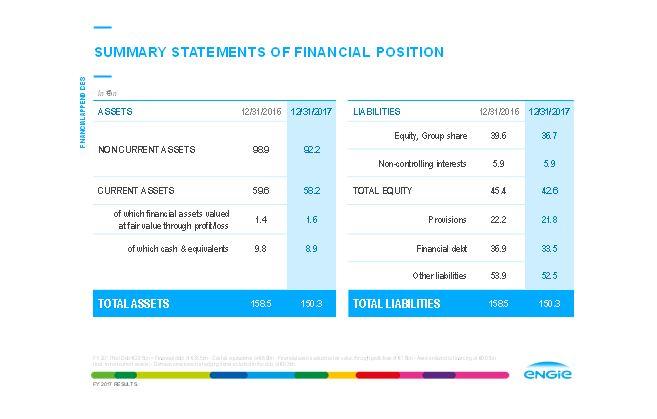

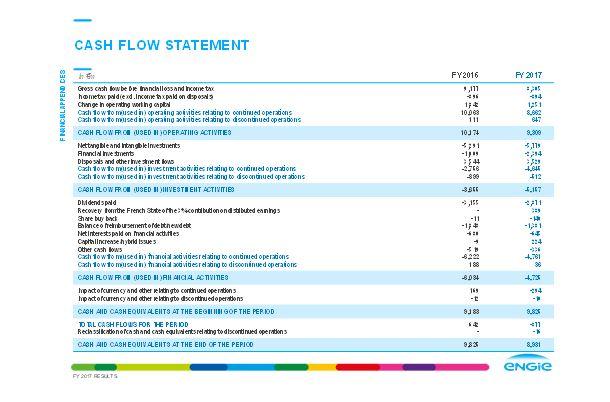

Net financial debt at EUR 22.5 billion

At December 31, 2017, net financial debt stood at EUR 22.5 billion, down EUR 2.3 billion compared with December 31, 2016, mainly due to (i) cash flow from operations (EUR 8.3 billion), (ii) the impact of the portfolio rotation program (EUR 4.8 billion), including notably the completion of the disposal of the thermal merchant power plant portfolio in the United States, Poland and the United Kingdom, the disposal of interests in Opus Energy and NuGen in the United Kingdom, the classification of the Loy Yang B coal-fired power plant in Australia under "Assets held for sale", the disposal of a 25% interest in Elengy (through the transfer of 100% of Elengy to GRTgaz) and the disposal of an interest in Petronet LNG in India, and (iii) a favorable exchange rate effect (EUR 0.7 billion). These items were partially offset by (i) gross investments in the period (EUR 9.3 billion), cf. page 6, and (ii) dividends paid to ENGIE SA shareholders (EUR 2.0 billion) and to non-controlling interests (EUR 0.6 billion). Net debt also improved thanks to the impact of the recovery from the French State of the 3% tax on dividends (EUR 0.4 billion).

Excluding E&P intercompany debt, the net financial debt stands at EUR 20.9 billion.

The net financial debt/EBITDA ratio stands at 2.25x (vs. 2.43x in 2016) and is in line with the target of ≤ 2.5x.

The net economic debt (10) /EBITDA ratio stands at 3.9x, an improvement compared with 2016 (4.0x).

The average cost of gross debt continues to decrease for the 6th consecutive year, reaching 2.63%.

At the end of December 2017, ENGIE posted a high level of available liquidity at EUR 19.1 billion, of which EUR 9.6 billion (11) was held in cash.

In April 2017, S&P confirmed ENGIE long term credit rating of ‘A-‘ with negative outlook. In June 2017, Moody’s confirmed ENGIE long term credit rating of ‘A2’ with stable outlook. In October 2017, Fitch assigned ENGIE a strong investment grade issuer rating of ‘A’ with stable outlook. ENGIE holds the highest rating among its utilities peers. According to Fitch, the assigned ratings reflect ENGIE scale and diversification and the increasing share of regulated and contracted EBITDA which helped limit the commodity price exposure, the ambitious growth in client solutions, and its conservative financial policy.

ENGIE’s successful repositioning

At end 2017, ENGIE has announced EUR 13.2 billion of disposals (i.e. almost 90% of total program of EUR 15 billion reduction of net debt). To date, EUR 11.6 billion are already closed. In November 2017, ENGIE announced the signing with Total of an agreement for the sale of its upstream and midstream Liquefied Natural Gas (LNG) activities, that should be closed during 2018. In 2018, ENGIE closed the disposal of the E&P International activity and of Loy Yang B coal-fired power plant in Australia.

ENGIE has invested and secured EUR 13.9 billion (i.e. 97% of total program of EUR 14.3 billion (12) growth capex over 2016-18), of which EUR 10.2 billion have been closed. This includes notably acquisitions for EUR 1.2 billion in client solutions activities: Keepmoat Regeneration (leader of regeneration services for local authorities in the United Kingdom), EVBox (largest European electric vehicle charging player), Icomera (Swedish company, leader of onboard communications solutions for public transport), and a 40% stake in Tabreed (leader of district cooling networks in the Middle East). Besides, the Group invested in renewable energy with, for example, the acquisition of the remaining 41% stake in La Compagnie du Vent (wind and solar projects developer, now integrated in ENGIE Green) allowing ENGIE to become its 100% shareholder, a 30% stake in Unisun (a Chinese solar photovoltaic company), and more recently two significant concession contracts won in Brazil for two hydropower plants.

As regards the Lean 2018 performance plan, thanks to the significant progress made to date, ENGIE decided to raise its 2018 target by EUR 100 million, for a total of EUR 1.3 billion of net gains expected at EBITDA level by 2018. At end December 2017, EUR 947 million of cumulated net gains were recorded at EBITDA level (including EUR 417 million in 2017), which is higher than the initial cumulated target of EUR 850 million by end 2017. The entire revised program has already been identified.

Finally, on the front of innovation and digital transformation, ENGIE continues to invest in preparing for the future and confirms its pioneer position in the energy and digital revolutions. In 2017, the acquisitions of EVBox and Icomera are fully in line with ENGIE’s transformation strategy at the service of smarter and greener mobility. ENGIE also announced in 2018 that it had signed an agreement for the control of Electro Power System (EPS), a specialist in energy storage solutions and microgrids that enable intermittent renewable sources to be transformed into a stable power source. Furthermore, ENGIE inaugurated last year in La Rochelle the installation of the first organic photovoltaic roof in the world. This technology has been developed by Heliatek, in which ENGIE has held a stake since 2016. ENGIE is also pursuing the worldwide deployment of Darwin, its unique digital platform for data management, which aims at boosting the performances of its renewable power generating facilities, at optimizing costs, and at developing predictive maintenance. In parallel, ENGIE develops NEMO, a global platform for supervising its heating and cooling networks. Lastly, convinced of the major role that green gases, biogas and renewable hydrogen are called to play in the energy transition, ENGIE continues to invest in their development. In 2017, ENGIE inaugurated the GAYA platform, near Lyon in France, which aims at testing the production of biomethane from dry biomass. ENGIE also participates in the deployment of the first hydrogen bus line in Pau, France, and announced the creation of a global entity dedicated to the development of renewable hydrogen in the world. The objectives of ENGIE in renewable gases in France are ambitious: 30% in 2030 and 100% in 2050.

2018 Financial targets (4)

ENGIE anticipates for 2018 a net recurring income Group share between EUR 2.45 and EUR 2.65 billion. Based on a net recurring income Group share excluding E&P and LNG of EUR 2,36 billion in 2017, this target implies a gross variation of 8% and a strong underlying organic increase.

This guidance is based on an indicative range for EBITDA of EUR 9,3 to 9,7 billion, also growing strongly organically.

For 2018, ENGIE anticipates:

- a net financial debt/EBITDA ratio below or equal to 2.5x, and

- an ‘A’ category credit rating.

Dividend policy

For fiscal year 2017, ENGIE confirms the payment of a EUR 0.70 per share dividend, payable in cash.

For fiscal year 2018, ENGIE announces a new dividend policy, with a dividend increased to EUR 0.75 per share (+7.1%), payable in cash.

Group significant events

- To support its ambitious development strategy in renewable energies and energy efficiency, ENGIE issued on March 15 and on September 19, 2017 its second and third Green Bonds for respectively EUR 1.5 billion and EUR 1.25 billion. Furthermore, on January 10, 2018, ENGIE sets a new hybrid bond record with the lowest coupon ever achieved by a corporate. ENGIE took advantage of the attractive market conditions to place its first Green Hybrid Bond (Deeply Subordinated Perpetual Bond) of an amount of EUR 1 billion, with a coupon of 1.375% and a first Non-Call period of 5.25 years. The bond is intended to replace the outstanding notes of EUR 600 million, 3.875%, Non-Call 2018 and of GBP 300 million, 4.625%, Non-Call 2019. With these issues, the total amount of bonds issued by ENGIE in Green Bond format since 2014 reaches EUR 6.25 billion, confirming ENGIE’s commitment to play a leading role in the energy transition whilst supporting the development of green finance.

- Early in September 2017, ENGIE accompanied the sale of shares launched by the French State as part of its share buyback program authorized by the General Meeting of May 12, 2017 and therefore undertook to acquire, concurrently with the placement among institutional investors through an accelerated book building process, 11.1 million of its own shares (i.e. 0.46% of its capital).

- ENGIE took note of the decision of October 6th, 2017 of the Conseil Constitutionnel in France to cancel the 3% tax on dividend payments and to refund taxes paid since 2013.

- ENGIE Board of Directors met on February 13, 2018 and decided to submit to the vote of the Shareholders’ Meeting of May 18, 2018 the appointment of Mr. Jean-Pierre Clamadieu as member of the Board of Directors in replacement of Mr. Gérard Mestrallet. The Board acknowledged Mr. Gérard Mestrallet’s resignation from his Director position, effective at the close of the Shareholders’ Meeting. Subject to approval at the Shareholders’ Meeting, the Board of Directors will appoint Mr. Jean-Pierre Clamadieu to the position of Chairman of the Board, in replacement of Gérard Mestrallet, Founder of ENGIE and Chairman of its Board of Directors. The Board also decided to appoint Mr. Gérard Mestrallet as Honorary Chairman in recognition of the 23 years he devoted to developing the Group.

Footnotes

(1) NRIgs excluding IFRS 5 treatment for E&P, i.e. excluding the D&A upside (EUR 0.1 billion) from IFRS 5 accounting treatment (ENGIE E&P International business classified as “discontinued operations”), therefore underlying contribution of of E&P of EUR 0.2 billion.

(2) Organic variation: gross variation without scope and foreign exchange impacts.

(3) Net debt is pro forma E&P intercompany debt, whereas reported net debt amounts to EUR 22.5 bn in 2017.

(4) Return on Capital Employed based on productive capital employed end of period, i.e. excluding assets under construction for EUR 5.1 billion.

(5) These targets and this indication, excluding E&P and LNG contributions, assume average weather conditions in France, full pass through of supply costs in French regulated gas tariffs, no significant accounting changes except for IFRS 9 and IFRS 15, no major regulatory and macro-economic changes, commodity price assumptions based on market conditions as of December 31, 2017 for the non-hedged part of the production, and average foreign exchange rates as follows for 2018: €/$: 1.22; €/BRL: 3.89, and without significant impacts from disposals not already announced.

(6) 2016 figures have been restated following the classification of ENGIE E&P International as “discontinued operations” as from May 11, 2017.

(7) Current operating income including share in net income of associates.

(8) Excluding restructuring costs, MtM, impairments, disposals, other non-recurring items, including financial and fiscal ones, and associated tax impacts.

(9) Develop, Build, Sell and Operate.

(10) The economic net debt reaches EUR 36.4 billion at December 31, 2017 (versus EUR 38.4 billion at December 31, 2016); it includes notably the nuclear provisions and post-employment provisions; the detailed calculation can be found in the 2017 notes to the financial statements (§ 5.7).

(11) Of which cash and cash equivalent (EUR +8.9 billion), financial assets qualifying as at fair value through income (EUR + 1,1 billion), nets of bank overdrafts (EUR -0.5 billion).

(12) Net of DBSO proceeds; excluding Capex related to E&P and upstream / midstream LNG (including Touat and Cameron) for EUR 0.3 billion and Corporate Capex for EUR 0.2 billion.

The 2017 results presentation, used during the investor conference call, is available to download from ENGIE’s website: https://www.engie.com/en/investors/results/results-2017/

The Group’s consolidated accounts and the parent company financial statements for ENGIE SA as of December 31, 2017 were approved by the Board of Directors on March 7, 2018. ENGIE’s statutory auditors have performed their audit of these accounts. The relevant audit report is currently being issued.

The complete notice of the Annual Shareholders Meeting, draft resolutions and Board of Directors’ report will be published in the second half of March.

UPCOMING EVENTS

- May 15, 2018: Publication of 1st quarter 2018 financial information

- May 18, 2018: Shareholders meeting

- May 24, 2018: Payment of the dividend balance for fiscal year 2017

- Q4 2018: Investor day

Comparable figures as of December 31st 2016 have been restated following the classification of ENGIE E&P International as "Discontinued operations" as of May 11, 2017.