ENGIE, Crédit Agricole Assurances and Mirova win bid

By ENGIE - 19 December 2019 - 17:38

ENGIE, together with its consortium partners Crédit Agricole Assurances and Mirova, an affiliate of Natixis Investment Managers, announces it has won a competitive process conducted by EDP for the acquisition of Portugal’s second largest hydroelectric portfolio, for an enterprise value and consideration of EUR 2.2 billion.

The hydroelectric portfolio has a generation capacity of 1.7 GW with a weighted average remaining concession term of 45 years, and includes three newly commissioned pump storage units along with three recently repowered run-of-river plants.

ENGIE, as the industrial partner for the consortium, will operate and maintain the hydroelectric portfolio and also provide energy management services. ENGIE has a strong track record of operating hydro generation assets, with a current global hydro capacity of 20 GW[1], and is the 2nd largest engineering company in hydro related projects on a global basis[2].

The acquisition of the hydroelectric portfolio is instrumental to the deployment of ENGIE’s zero-carbon strategy, bringing flexible renewable capacity which complements ENGIE’s existing Iberian portfolio of onshore wind (1.1 GW) and solar (50 MW) power, most of which is already in partnership with Mirova.

Through this transaction, ENGIE will secure a significant level of dispatchable renewable power generation, notably via the pump storage assets, which allows ENGIE to provide green corporate PPAs on an “as consumed” basis to its clients.

In the medium to long term, and as ENGIE further expands its wind and solar portfolio, the pump storage hydro production will become more valuable given the inherent intermittency of wind and solar assets.

ENGIE owns 40% of the consortium, while Crédit Agricole Assurances and Mirova, through managed funds, own 35% and 25%, respectively. A net debt impact of c. EUR 650 million is anticipated for ENGIE. ENGIE will not consolidate the investment. Closing of the transaction is expected during the second half of 2020.

Isabelle Kocher, CEO of ENGIE, said “Our increased focus on providing clients with 100% renewable power tailored to their needs will enable ENGIE to be the leader of the zero carbon transition. This transaction accelerates the implementation of ENGIE’s strategy. Our target to add 9 GW renewables over the period 2019 – 2021 is confirmed and this acquisition comes on top of it.”

Through this transaction, Crédit Agricole Assurances, the first insurance company in France, is strengthening its commitment to the energy transition, which is fully integrated into the Crédit Agricole group's climate strategy. "ENGIE and Mirova are partners of choice, with significant experience in hydro projects. Thanks to this new partnership in Portugal, Crédit Agricole Assurances is consolidating its presence in the energy transition in Europe, a sector in which it is the leading investor in France”, said Frédéric Thomas, CEO of Crédit Agricole Assurances.

This transaction continues a long-standing relationship between Mirova and ENGIE, developed over the past years notably by partnering in several projects in wind and solar in Europe. Mirova will invest via its fund Mirova Eurofideme 4, dedicated to the European energy transition and a dedicated co-investment fund created for the purpose of this transaction. “This investment represents a landmark opportunity for Mirova and Crédit Agricole Assurances to acquire a large portfolio of hydro in Portugal in partnership with ENGIE, and leverage on their unique expertise in managing and optimizing such specific assets, which will ultimately deliver value to our investors.” says Raphael Lance, Head of Energy Transition Funds at Mirova.

[1] Including pumped storage capacity of 3.4 GW

[2] Through Tractebel Engineering a 100% subsidiary of ENGIE. Ranks #2 in 2018 Engineering News

Record ranking of the largest construction and engineering firms.

About ENGIE

Our group is a global reference in low-carbon energy and services. In response to the urgency of climate change, our ambition is to become the world leader in the zero-carbon transition "as a service" for our customers, in particular global companies and local authorities. We rely on our key activities (renewable energy, gas, services) to offer competitive turnkey solutions. With our 160,000 employees, our customers, partners and stakeholders, we are a community of Imaginative Builders, committed every day to more harmonious progress.

Turnover in 2018: €60.6bn. The Group is listed on the Paris and Brussels stock exchanges (ENGI) and is represented in the main financial indices (CAC 40, DJ Euro Stoxx 50, Euronext 100, FTSE Eurotop 100, MSCI Europe) and non-financial indices (DJSI World, DJSI Europe and Euronext Vigeo Eiris - World 120, Eurozone 120, Europe 120, France 20, CAC 40 Governance).

- ENGIE HQ Press contact:

Tel. France : +33 (0)1 44 22 24 35

Email: engiepress@engie.com - Investors relations contact

Tel. : +33 (0)1 44 22 66 29

Email: ir@engie.com

About Crédit Agricole Assurances

Crédit Agricole Assurances, the leading insurer in France, unites together Crédit Agricole’s insurance subsidiaries. The group offers a range of savings, retirement, health, personal protection and property insurance products and services. They are distributed by Crédit Agricole Group banks in France and in 9 countries worldwide, by wealth management advisors and general agents. The Crédit Agricole Assurances companies serve individuals, professionals, farmers and businesses. Crédit Agricole Assurances has 4,600 employees. It reported 2018 revenues of €33.5 billion (IFRS).

Crédit Agricole Assurances Press contact

Françoise Bololanik +33 (0)1 57 72 46 83 / +33 (0)6 25 13 73 98

Géraldine Duprey +33 (0)1 57 72 58 80 / +33 (0)7 71 44 35 26

service.presse@ca-assurances.fr

About Mirova

Mirova is Natixis Investment Managers’ affiliate dedicated to sustainable investment. Through a conviction-driven investment approach, Mirova’s goal is to combine value creation over the long term with sustainable development. Mirova’s talents have been pioneers in many areas of sustainable finance. Their ambition is to keep innovating to propose the most impactful solutions to their clients. Mirova’s teams have been actively investing in renewable energy infrastructure assets for the past 17 years with over 2 GW of installed capacity across more than 180 wind, photovoltaic, hydro and biomass projects in Europe.

Mirova Eurofideme 4 is a Société de Libre Partenariat (French limited partnership), not subject to the approval of the French Market Authority and reserved for eligible investors only, in accordance with the Fund Regulation. Mirova Eurofideme 4 is managed by Mirova and not open to subscription anymore.

Mirova

Asset Management company - Limited liability company

RCS Paris n°394 648 216 – Regulated by AMF under n°GP 02-014

Registered Office: 59, Avenue Pierre Mendes France – 75013 - Paris

Mirova is an affiliate of Natixis Investment Managers.

About EDP and the portfolio of hydro assets

EDP (listed in Euronext Lisbon) is a global leader in the renewable energy sector with renewables representing approximately 2/3 of our EBITDA. EDP is also present in electricity networks business (c.25% of EBITDA) and in the client solutions and energy management business. EDP aims to lead the Energy Transition to create superior value through focused investments, with highlight to renewables and networks, continuous portfolio optimization, solid balance sheet and low risk profile, efficient and digitally enabled operations and attractive shareholder remuneration.

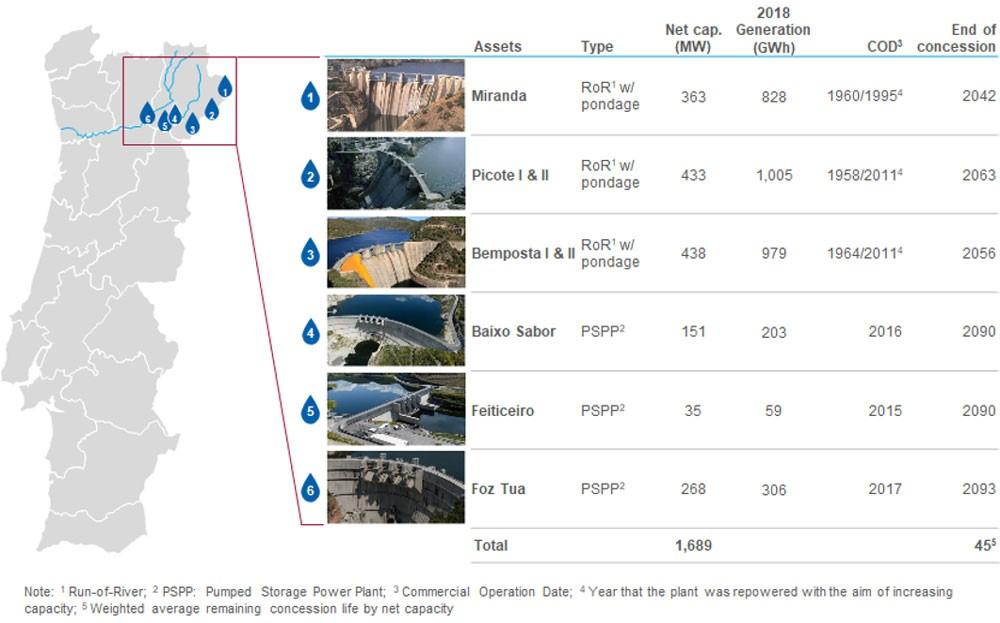

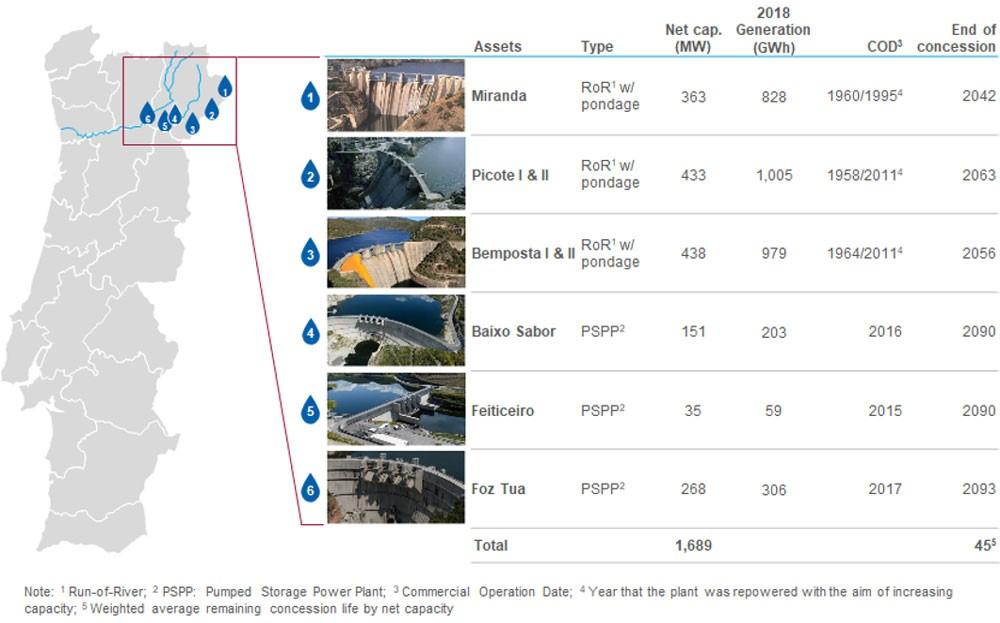

The portfolio of assets has a 1.7 GW capacity and c. 45 years of weighted average remaining concession life. The facilities are part of the Douro river system (North East of Portugal). They are composed of 6 units that can be divided into 2 categories: 3 cascade Run-of-River plants with pondage, and 3 recent Pumped storage units.

Advisors

J.P. Morgan is serving as financial advisor and Bredin Prat and Cuatrecasas are serving as legal counsel to ENGIE.

BNP Paribas is serving as financial advisor and BDGS as legal advisor to Crédit Agricole Assurances.

Mirova has been advised by CLP-Cliperton as legal counsel.

INVESTOR ANNEX

Asset description

The portfolio has a 1.7 GW capacity, c. 45 years of weighted average remaining concession life, and generated in 2018 EUR 154 million of EBITDA.

The facilities are part of the Douro river system (North East of Portugal). They are composed of 6 units that can be divided into 2 categories:

- 3 cascade Run-of-River plants with pondage (few hours of storage) – Miranda, Picote and Bemposta – on the Douro International river itself (border between Spain and Portugal). They total 1.2 GW and have a historical average yearly generation of around 3 TWh. They are mature plants, with similar characteristics, and repowered with one large unit each added on two plants in 2011 and on one in 1995 (weighted average remaining concession life of 35 years)

- 3 recent Pumped storage units, totalling 0.5 GW of net installed capacity, Baixo Sabor, Feiticeiro and Foz Tua (COD 2016 and 2017 – weighted average remaining concession life of 70 years)

Overview of the key characteristics of the assets: