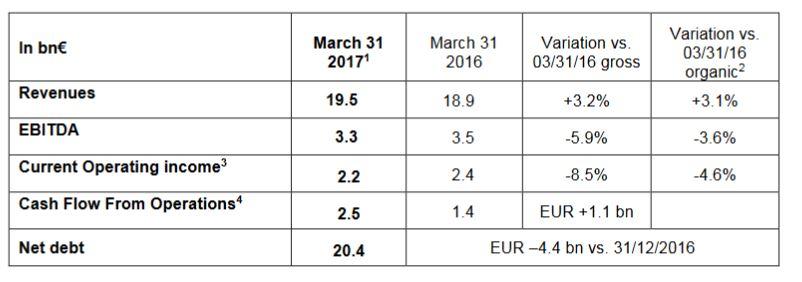

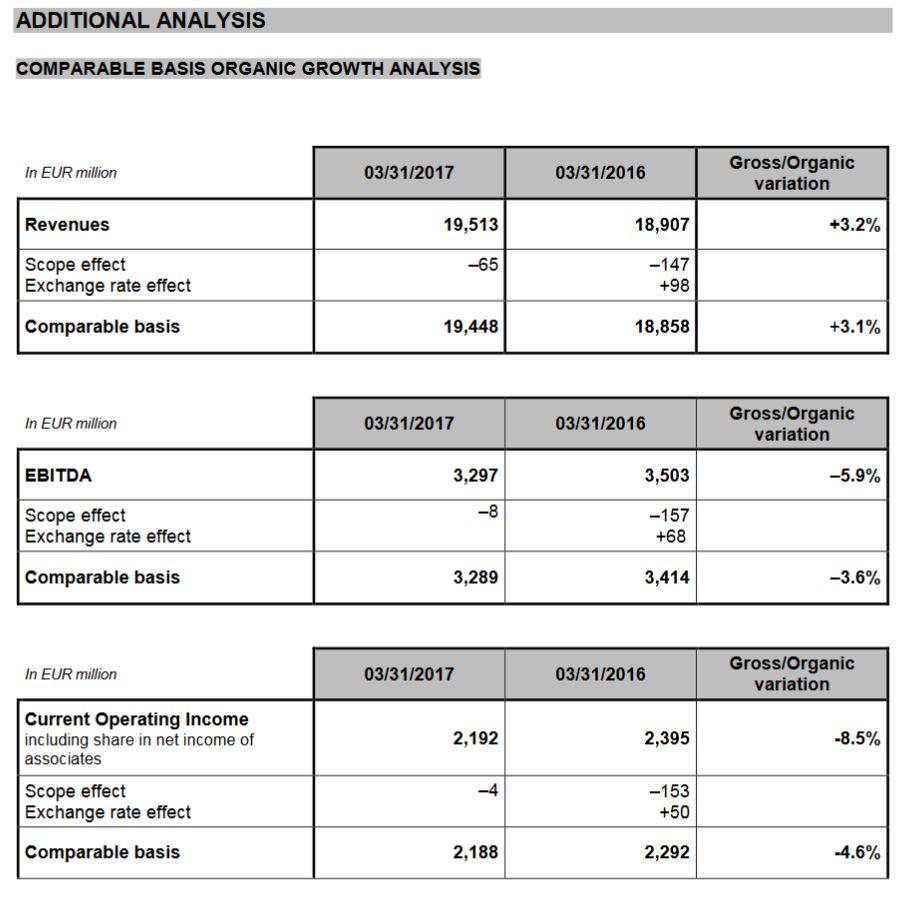

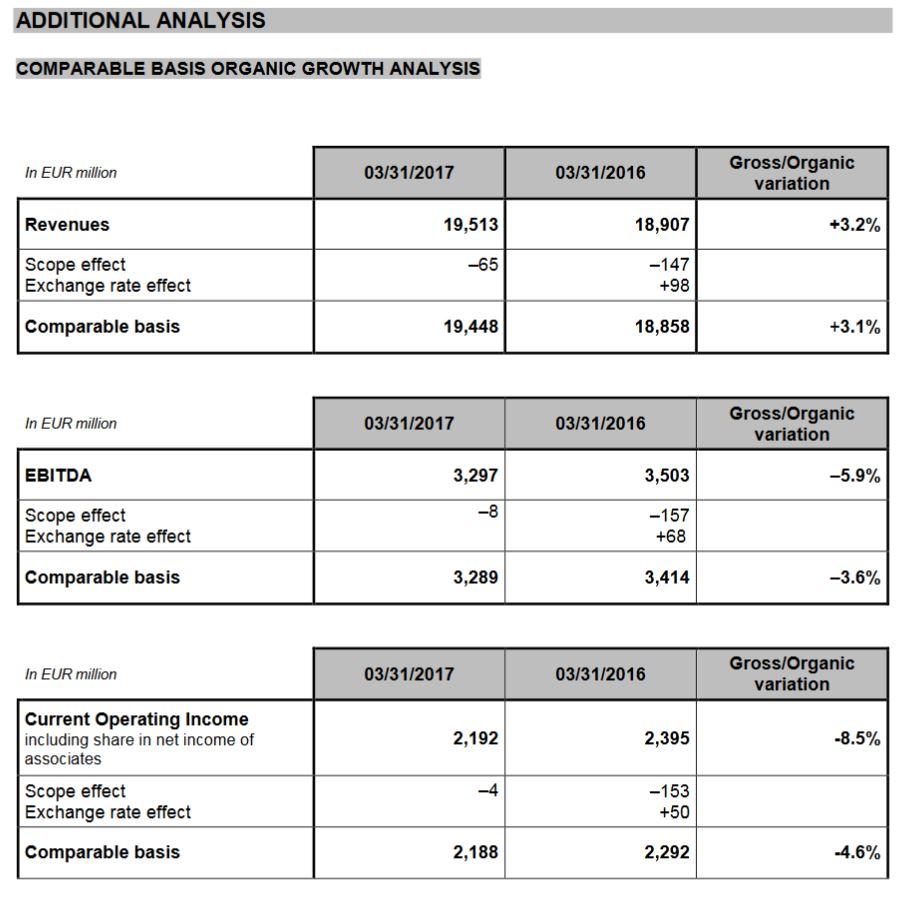

Revenues as of March 31, 2017 were EUR 19,513 million, up +3.2% on a gross basis and +3.1% on an organic basis. This growth is notably due to the increase of gas purchase/sale activities, to the commissioning of new assets in Latin America (Mexico and Peru) and to tariff revisions for gas infrastructures. It is also driven by the performance of thermal gas generation activities in Europe as well as by a slightly favorable temperature impact, temperatures in France being less warm over the first three months of 2017 compared to the same period last year. This increase is also due to favorable price effects that did not impact the margins.

EBITDA for the period was EUR 3,297 million, down -5.9% on a gross basis and -3.6% on an organic basis, impacted by unfavorable scope effects as well as by a decrease of hydro production in France, by hydrocarbon production and by the shutdown of the Tihange 1 nuclear power plant since September 2016. These effects are partially compensated by the sustained performance of the Group’s growth engines, by the activities of thermal gas generation activities in Europe and by a favorable foreign exchange effect.

Organic EBITDA performance is very contrasted between segments:

- EBITDA for the North America segment is flat due to lower performance of power generation activities compensated by a better performance of commercialisation activities as well as costs savings;

- EBITDA for the Latin America segment is sharply up thanks to the commissioning of new assets in Mexico and Peru, to tariff revisions in Mexico and in Argentina and to improved performance of hydro power plants in Brazil;

- EBITDA for the segment Africa/Asia is up thanks to the good performance of assets in Australia due to the increase in power prices, to the commissioning of the AzZour North power plant in the Middle East, partly compensated by lower availability of assets in Thailand;

- EBITDA for the segment Benelux is sharply down, mainly due to the shut down of the Tihange 1 power plant since September 2016 and to lower power sales prices compared to the first quarter of 2016. These effects are partly compensated by the good performance of gas and power commercialisation activities in Belgium;

- EBITDA for the segment France is down due to lower power generation from renewables, mainly hydro, as well as to lower volumes and gas commercialisation margins for B2C customers. These effects are partially compensated by higher power commercialisation volumes for the B2C segment and by improved performance of services activities for B2B clients and of network activities;

- EBITDA for the segment Europe excluding France and Benelux is up due to improved margins captured on First Hydro power plants in the United Kingdom as well as to favorable weather conditions in Romania;

- EBITDA for the segment Infrastructures Europe increases thanks to higher revenues related to the positive impact from tariff increases for Transportation and Distribution activities in the course of 2016, partly compensated by lower volumes and prices achieved at Storengy;

- EBITDA for the segment GEM & LNG is sharply down compared to end of March 2016, mainly due to negative price effects and to difficult gas sourcing conditions in the South of France in January 2017 during the cold snap;

- EBITDA for the segment Exploration & Production is down due to hydrocarbon production decreasing by -2.2 Mboe (13.4 Mboe at end March 2017 versus 15.6 Mboe at end March 2016) related namely to the shutdown for modernization of the Njørd platform in Norway and to natural fields depletion in the Netherlands and in Germany. This decrease in volumes is partly compensated by the increase in prices;

- EBITDA for the segment Other is sharply up compared to the end of March 2016, mainly due to the good performance of thermal gas generation activities in Europe and of power commercialization activities to professional clients in France.

Current Operating Income reached EUR 2,192 million, down -8.5% on a gross basis and -4.6% on an organic basis compared to the end of March 2016, for the same reasons as for EBITDA, depreciation remaining stable compared to the first quarter 2016.

As of March 31, 2017, net debt reached EUR 20.4 billion, down EUR -4.4 billion from year-end 2016, mainly due to the effects of the portfolio rotation program (EUR 3.4 billion) namely with the closing of the sale of thermal merchant activities in the United States in February 2017, which reduced net debt by EUR 3.1 billion.

The cash flow from operations (CFFO) stands at EUR 2.5 billion over the first quarter of 2017, increasing by 1.1 billion Euros compared to the end of March 2016. This year-on-year evolution reflects, on the one hand, a solid operational cash flow generation and, on the other hand, a favorable evolution of WCR variation of 1.5 billion Euros (mainly linked to margin calls and financial instruments derivatives), sharply improved regarding the situation at the end of March 2016.

At end March 2017, the net debt/EBITDA ratio at 1.95x is well below the target of ≤2.5x. The Group’s average cost of gross debt slightly decreased compared to end December at 2.74%.

The Group confirms its 2017 financial targets (5):

- Net Recurring Income Group share between EUR 2.4 and 2.6 billion. This target is based on estimated EBITDA between EUR 10.7 and 11.3 billion;

- a net debt/EBITDA ratio less than or equal to 2.5x and an “A” category rating;

- a dividend of EUR 0.7/share, in cash, for fiscal year 2017.

Significant events

Develop low CO2 activities

- From 1st of January to 31st of March 2017:

- Construction in Indonesia of the first ENGIE geothermal power generation plant in the world;

- Fadhili independent power project awarded in Saudi Arabia;

- Announcement of the closing of asset disposals in the United States and in Asia;

- ENGIE won nearly 78 MW of photovoltaic projects in France, strengthening its leading position in solar in the country;

- As from 1st of April 2017:

- Acquisition of 100% of La Compagnie du Vent in France;

- 338 MW solar project won in India;

- In China, 30% equity investment in UNISUN, a solar photovoltaic company;

- ENGIE and EDPR bidding in the third offshore wind call for tenders in Dunkirk in France;

- Successful issuance of a second Green Bond of 1.5 billion Euros;

- Decision to transfer its 40% stake in NuGen project in the UK to Toshiba.

Develop infrastructures, mainly gas

- From 1st of January to 31st of March 2017:

- Planned acquisition of 100% of Elengy by GRTgaz;

- SUEZ, ENGIE and CHRYSO join forces for the 1st industrial processing of liquified biomethane issued from used waters in France;

- As from 1st of April 2017:

- Signing of financing agreements for Nord Stream 2.

Develop integrated solutions for clients

- From 1st of January to 31st of March 2017:

- Collaboration with Schneider Electric to digitize the energy sector;

- Acquisition of Keepmoat Regeneration, which enables ENGIE to become the leading provider of regeneration services for local authorities;

- ENGIE will sign up to the capital increase of SUEZ in the context of its acquisition of GE Water & Processes Technologies, to the extent of its stake in SUEZ, that is about 240 million Euros;

- Acceleration of the installation of Natural Gas Vehicles (NGV) stations, with the opening of more than 20 new stations in France over the coming twelve months;

- Acquisition of EV-Box, the largest European electric vehicle charging player ;

- 100% of the projects presented in the context of the auction of the energy regulation Commission on photovoltaic self-consumption have been won by ENGIE;

- As from 1st of April 2017:

- The shipyard MV Werften chose ENGIE for the construction of 2 XXL cruise ships;

- ENGIE and Axium secure 50-year Comprehensive Energy Management Contract with The Ohio State University in the US.

ENGIE continues its transformation, adapting its headquarters organization. After the implementation as of January 1, 2016 of an organization which led to the reinforcement of the geographical Business Units, ENGIE pursues its decentralization so as to become more agile and closer to its customers. The missions and location of the Group’s headquarters would be streamlined. This project could lead to the net job cut of 504 filled positions, including 312 in France, 116 in Belgium and 76 in the United Kingdom.

The Group’s transformation plan is very well advanced today on its three programs.

On the portfolio rotation program (EUR 15 billion net debt impact targeted over 2016-18), the Group has announced to date EUR 8.1 billion of disposals [6] (i.e. 54% of total program), of which EUR 7.6 billion already closed.

On the investments program (EUR 16 billion growth capex over 2016-18), EUR 5.5 billion are already invested, at end March 2017.

As regards to the “Lean 2018” performance plan, at end March 2017, EUR 0.6 billion of net gains at Ebitda were achieved. More than 80% actions are already identified to reach the target of EUR 1.2 billion savings at the end of 2018.