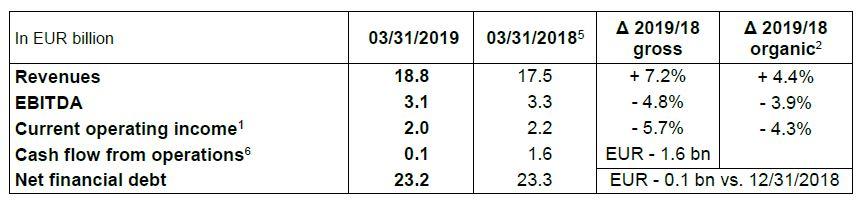

Net financial debt at EUR 23.2 billion

Net financial debt stood at EUR 23.2 billion, down EUR 0.1 billion compared with December 31, 2018 (5). This positive variation is mainly due to (i) cash flow from operations (EUR 0.1 billion), (ii) the impacts of the portfolio rotation program (EUR 2.7 billion, mainly related to the completion of the disposal of the stake of Glow). These items were almost entirely offset by (i) gross capital expenditure over the period (EUR 2.2 billion (8)), (ii) dividends paid to non-controlling interests (EUR 0.2 billion) and (iii) other elements (EUR 0.3 billion), mainly linked to foreign exchange rates and IFRS 16 new rights of use.

Cash flow from operations (6) amounted to EUR 0.1 billion, down EUR 1.6 billion. The decrease stems chiefly from temporary working capital requirement variations (EUR -1.3 billion) caused by margin calls on derivatives and mark-to-market of financial derivatives variation. The operating cash flow remained broadly stable.

At the end of March 2019, net financial debt to EBITDA ratio amounted to 2.4x, stable compared with December 31, 2018 (5) and below the target of less than or equal to 2.5x. The average cost of gross debt was 2.86%, up 18 bps compared with December 31, 2018.

Net economic debt (9) to EBITDA ratio stood at 3.7x, stable compared with December 31, 2018 (5).

2019 financial targets (3) and dividend policy

ENGIE confirms its financial anticipations for 2019 (3):

- a net recurring income, Group share (NRIgs) between EUR 2.5 and EUR 2.7 billion. This guidance is based on an indicative range for EBITDA of EUR 9.9 to 10.3 billion,

- a net financial debt / EBITDA ratio below or equal to 2.5x,

- an ‘A’ category credit rating.

ENGIE also confirms its new medium-term dividend policy, in the range of 65% to 75% NRIgs payout ratio. For the fiscal year 2019, ENGIE is aiming for a dividend at the upper end of this range.

Significant operational milestones since January 2019

Client Solutions

In Europe, the Group continued to develop its nuclear maintenance business with the acquisition by its subsidiary ENDEL of SUEZ's specialized subsidiary, ex-SRA SAVAC.

In the Middle-East and in line with the Group’s strategy to reinforce its local presence in integrated client solutions for a zero-carbon transition, ENGIE, which already owned 50% of Cofely BESIX Facility Management (CBFM), acquired the share that BESIX held (50%) and became the only shareholder of CBFM, which will be rebranded ENGIE Cofely. CBFM is a major client solutions and energy services provider, with 2,000 employees operating in the United Arab Emirates, in Qatar (with its partner Mannai) and in Oman (with its partner Daud) on many landmark sites such as the Dubai Mall, Abu Dhabi’s Zayed University and the Qatar Foundation.

ENGIE also continued its investments in innovative decentralized technologies, with the inauguration of its first PowerCorner mini-grid in Zambia, confirming its progress in off-grid renewable energy solutions to improve electricity access in Africa. This mini-grid provides energy to households and local businesses and supports public services such as the Rural Health Centre and two schools.

The Group also won landmark contracts with cities and local authorities. For example, in India, Tabreed, the leading United Arab Emirates-based international cooling systems provider, 40% owned by ENGIE, has signed a 30-year concession agreement to build, own and operate a district cooling system (DC), during the length of the contract, in Amaravati – the future capital of Andhra Pradesh.

Networks

In Brazil, ENGIE announced that the consortium in which it holds a majority stake has won the competitive bidding process conducted by Petrobras for the sale of a 90% shareholding in TAG with a final and binding offer amounting to USD 8.6bn. TAG is the largest gas transmission network owner in Brazil, a priority country within ENGIE’s recently announced strategic framework, with an asset base providing an attractive and stable regulated profit stream to ENGIE. TAG assets consists of 4,500 kilometers of gas pipelines in Brazil, which represents 47% of the country’s entire gas infrastructure. The winning offer for the 90% equity stake in TAG was made by a consortium composed of ENGIE S.A, ENGIE Brasil Energia and la Caisse de dépôt et placement du Québec (CDPQ). Petrobras will maintain a 10% equity stake in TAG. In addition to its ownership, ENGIE will be the industrial partner for TAG, managing the asset after the closing of the transaction and taking 100% of the operations and maintenance after the third year.

Renewables

In France, Futures Energies Investissements Holding (FEIH) company, jointly owned by ENGIE and Crédit Agricole Assurances at 50% each, reached 1.5 GW of solar and wind installed power capacity by the beginning of 2019. Established in 2013, FEIH has continuously invested in wind and solar power generation through a solid partnership. All the farms are operated by ENGIE Green, ENGIE’s dedicated renewable energy entity in France.

In offshore wind power, the Eoliennes en Mer Dieppe - Le Tréport project obtained the necessary prefectural authorizations, enabling it to prepare the farm’s construction (foundations, electricity substation, cables between the wind turbines, etc.) and to proceed with the calls to tender for subcontractors to manufacture and install the components. In addition, in the framework of the competitive bidding process for offshore wind turbines off the coast of Dunkerque, ENGIE and EDPR announce the addition of E.ON to the Dunkerque Eoliennes en Mer consortium: with this arrival, the consortium now brings together three European champions of renewable energies, enriching the industrial excellence of its offer.

Besides, ENGIE and farmers joined forces to develop the biomethane sector in France by signing three partnerships at the 2019 Paris International Agricultural Show: biomethane is an energy of the future and a fully-fledged opportunity for farmers to diversify their income. In addition, ENGIE acquired Vol-V Biomasse, which operates along the entire biomethane value chain (origination, development, construction monitoring and operation), and became France’s leading biomethane producer.

In Europe, ENGIE strengthened its presence on the renewable energy market in Spain with the launch of Phoenix, a new project developed in cooperation with Mirova and Forestalia. Phoenix aims to develop 10 wind farms in Aragon for a total capacity of 342 MW. ENGIE will participate as equity investor and as energy manager selling the electricity produced to the wholesale market and hedging in forward market.

In Mexico, ENGIE and Tokyo Gas Co., Ltd. announced their intention to invest in Heolios EnTG, a 50/50 joint-venture company to develop renewable energy projects. Heolios EnTG will develop, finance, construct, own, operate and maintain six renewable energy projects in Mexico: two of the plants are onshore wind while the remaining four are solar photovoltaic, totaling 899 MW, enough to power 1.3 million Mexican households. The projects were granted 15-year PPA through Mexican power auctions. One of the power plants, Tres Mesas 3, is a 50 MW wind power facility that entered into commercial operation in March 2019, ahead of schedule. The remaining plants are currently in various stages of construction and will start commercial operation in 2019 and 2020.

ENGIE also commissioned the Kathu thermodynamic solar power plant, one of South Africa's largest renewable energy projects. This thermodynamic concentrated solar power plant has a capacity of 100 MW and allows, via a molten salt storage system, to store 4.5 hours of autonomy.

Thermal

ENGIE announced the completion of the sale of its entire stake in Glow in Asia-Pacific, and thus ceased its coal-fired power plant operations in the region, in compliance with its strategy of reducing its carbon footprint. Glow is an independent energy producer that is listed on Thailand's stock exchange, owning and operating production facilities in Thailand and Laos (3.2 GW total power generation capacity made up of 1.0 GW of coal, 2.0 GW of gas and 0.2 GW of renewable energy) and employing 800 people.

ENGIE also announced the signing for the sale of its shares in coal-fired power plants in the Netherlands and in Germany. The assets sold represent a total installed capacity of 2,3 MW. This sale is subject to customary conditions, with closing expected during the second semester 2019. After this sale, coal will represent 4% of ENGIE’s global power generation capacities, down from 13% at the end of 2015 when the Group announced that it would gradually close or dispose of its coal assets and no longer build any new coal plants. In the past 3 years, ENGIE has reduced its coal-based electricity generation capacity by approximately 75%.

Supply

In order to provide solutions adapted to the needs of retail consumers, ENGIE took over tiko through a capital increase. As a pioneer in the development of intelligent energy management systems for the residential market focused on the control of domestic energy consumption, this Swiss startup offers solutions for managing a wide range of electrical equipment in private homes.

Other Group events

- January 18, 2019: On January 17, ENGIE issued its first corporate hybrid green bond of 2019, for an amount of €1 billion. With a total of €7.25 billion of green bonds issued since 2014, ENGIE strengthens its position amongst the biggest issuers of corporate green bonds. As a leader in the energy transition, ENGIE has made it a priority to support the development of sustainable finance, notably the green bond market.

- January 29, 2019: ENGIE scores CDP’s A list for climate change. For the third year in a row, ENGIE has been highlighted as a global leader on Corporate Climate action by environmental impact non-profit organization, Carbon Disclosure Project (CDP), achieving a score of ‘A’, the highest in the CDP Climate Change Assessment. ENGIE has been recognized for its actions to cut emissions, mitigate climate risks and contribute to the development of a low-carbon economy. At the end of 2017, ENGIE reduced its direct CO2 emissions by 26% compared to 2016 and reduced its ratio of emissions from energy production by 18% compared to 2012, bringing the Group significantly closer to its reduction target of - 20% in 2020.

- January 30, 2019: ENGIE joins the employee shareholding index, Euronext FAS IAS. This index gathers the most advanced listed companies for employee shareholding. Companies included in this index meet the following conditions: at least 3% of the capital is owned by employees, a minimum of 15% of the overall workforce should own shares in the company and a minimum of 25% of the workforce in France should own shares in the company. Since the Group’s most recent employee shareholding offer (Link 2018), finalized on August 2, 2018, 4% of ENGIE’s capital and 4.7% of voting rights are held by its employees, either directly or indirectly through company mutual funds.

- March 13, 2019: A streamlined Board of Directors following the General Meeting to be held on 17 May 2019. The terms of Ann-Kristin Achleitner, Edmond Alphandéry, Aldo Cardoso, Patrice Durand, Catherine Guillouard, Barbara Kux, Mari-Noëlle Jégo-Laveissière, Françoise Malrieu and Marie-José Nadeau will expire at the end of this meeting. Taking into consideration the willingness of some Board members not to seek another term and the end of the independent status of other members, it is proposed to renew, for a period of four years, the terms of office of independent Board members Françoise Malrieu and Marie-José Nadeau, together with the terms of office of Board members who are proposed by the French State Patrice Durand and Mari-Noëlle Jégo-Laveissière. After the General Meeting, if these proposed resolutions are accepted and following the designation of the Board member representing the French State, the Board of Directors will consist of 14 members. Resulting from the merger between Gaz de France and SUEZ, the size of the ENGIE’s Board of Directors is currently larger than what is generally observed in CAC 40 companies. This reduction meets expectation regularly expressed by shareholders.

- April 10, 2019: ENGIE reinforces its organization to deliver its strategy: "zero-carbon transition as a service". This evolution aims to accelerate the execution of the strategy and the delivery of integrated zero-carbon solutions "as a service", turnkey, tailor-made and co-financed. The resulting proposed organizational changes (creation of four Global Business Lines – GBL – and of ENGIE Impact) are the subject of a consultation process with the relevant employee representative bodies and will therefore take effect at the end of this process in July 2019. The GBLs (Customer Solutions, Gas and Power Networks, Renewables and Thermal) will support the local teams and transversal performance and will be led by an Executive Vice President, member of the Executive Committee, assisted by a Managing Director. Their missions would be: to propose the cross-BU strategy for their activity; to prioritize the allocation of resources (Capex) between the different Business Units; to identify and lead the main transversal digital and excellence programs; to identify and setup the global partnerships; and to support, measure and report the performance of the activities at a global level. ENGIE Impact will be implemented as a managerial entity dedicated to reinforcing access to top decision-makers and will be built on the consulting expertise of existing ENGIE entities such as Tractebel and ENGIE Insight. ENGIE Impact will structure integrated and cross-BU solutions to address the zero-carbon transition challenges of large companies and local authorities. ENGIE Impact will rely on data and analytics-based insights to develop tailored consulting missions, with an initial focus on the Americas and Western Europe.

The presentation of the Group’s first quarter 2019 financial information used during the investor conference call is available to download from ENGIE’s website: https://www.engie.com/en/finance/resultats/2019