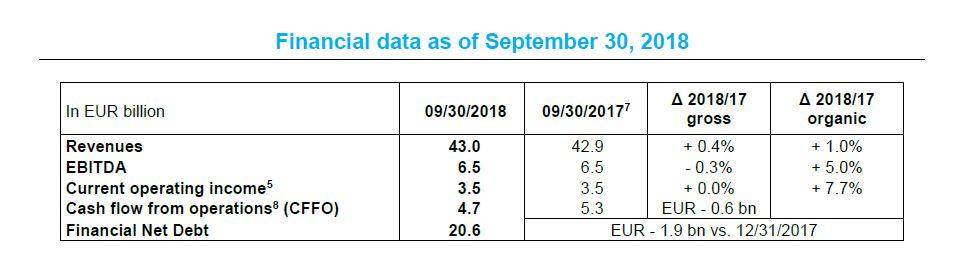

Analysis of financial data as of September 30, 2018

Revenues of EUR 43.0 billion

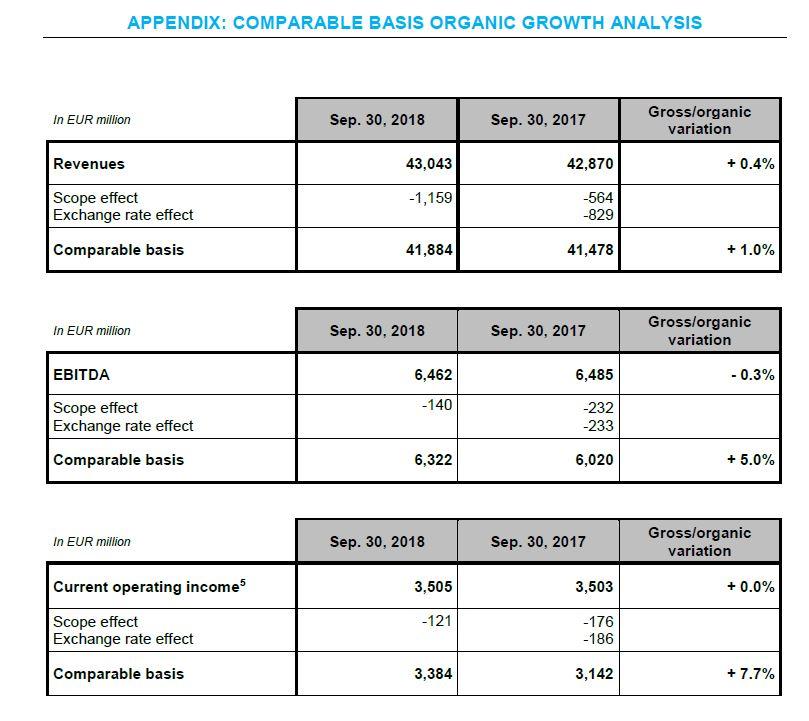

Revenues amounted to EUR 43.0 billion as of September 30, 2018, up 0.4% on a reported basis and 1.0% on an organic basis.

Reported revenue growth was affected by an adverse exchange rate against the euro on almost all foreign currencies (mainly on US dollar, Brazilian real and Australian dollar) offset by an overall positive scope effect.

Organic revenue growth was mainly driven by a sharp increase in renewable power generation, mainly hydro power, in France and Brazil, and by the introduction of gas storage regulation in France. These positive effects were partly offset in particular by the lower contribution of nuclear activities in Belgium stemming from lower volumes due to higher unavailabilities and from lower achieved price. Furthermore, revenues are also impacted by the new accounting treatment of long-term gas supply contracts in Europe since the end of 2017, with no impact on EBITDA, and by less favorable market conditions for merchant power generation in Europe.

EBITDA of EUR 6.5 billion

EBITDA of the period amounted to EUR 6.5 billion, down 0.3% on a reported basis and up 5.0% on an organic basis.

Reported EBITDA growth included an adverse exchange rate effect, notably due to the depreciation of the Brazilian real and US dollar against the euro. It also included a negative scope effect stemming chiefly from the sale of the Loy Yang B coal-fired power plant in Australia in early 2018 and of the thermal power generation business in the United Kingdom and Poland in 2017. This negative scope effect is partly offset by two new hydro power station concessions acquired in Brazil in late 2017 and by several acquisitions in 2017, including Tabreed, the leader in district cooling networks in the Middle East, and Keepmoat Regeneration, the leader in regeneration services for local authorities in the United Kingdom.

The organic EBITDA growth was mainly driven by the good performance from the energy management activities, due to favorable market conditions in Europe and to the impact of the change of management set up for some of GEM (Global Energy Management) Business Unit’s long-term contracts, by revenue-related developments and by the impacts of the Lean 2018 performance program. These impacts more than offset the outages at the Belgian nuclear power plants during the period.

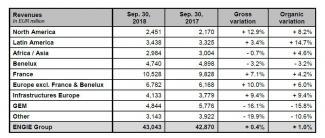

Organic EBITDA performance varied across segments:

- North America delivered an organic EBITDA growth driven by favorable climate effects in the USA and in Canada for thermal and renewable power generation activities and by the contribution of the Holman solar farm in Texas, commissioned in the second half of 2017.

- Latin America reported an organic EBITDA growth driven mainly by an improvement in the contribution from hydro power generation in Brazil, by increasing tariffs in gas distribution in Mexico and Argentina and by new long-term power purchase agreements (PPA) in Chile. These impacts are partly offset by the expiration of long-term PPAs in Peru at the end of 2017.

- Africa/Asia reported an organic EBITDA decrease, mainly due to the unfavorable impacts relating to positive one-offs in 2017 related to the Fadhili contract in Saudi Arabia and to the resolution of disputes in the Middle East, as well as to the closure of the Hazelwood coal-fired power plant in Australia in March 2017.

- Benelux reported an organic EBITDA decrease, mainly due to lower volumes caused by prolonged outages of different nuclear units (mainly Doel 3 from September 22, 2017 to August 5, 2018 and Tihange 3 since March 31, 2018) and also to a decrease in hedged power prices. These negative impacts were partially offset by higher volumes in the energy retail business.

- France reported an organic EBITDA growth, driven primarily by a sharp increase in renewable hydro power generation, partly offset by a decrease in the retail gas activities margins.

- Europe excluding France & Benelux reported an organic EBITDA growth, mainly due to a better performance of energy sales in Italy and Romania and to favorable hydrological conditions in Spain.

- Infrastructures Europe delivered an organic EBITDA growth mainly due to the introduction of gas storage regulation in France on January 1, 2018 coupled with a good performance in gas storage business in the United Kingdom.

- GEM (Global Energy Management) delivered an organic EBITDA growth, mainly driven by the good performance from the energy management activities in a favorable market environment, compared to the first quarter of 2017 which had suffered supply difficulties in the south of France, and by the impact of the change of management set up for some long-term contracts.

- The Other segment reported an organic EBITDA growth despite the lower contribution from merchant thermal power activities in Europe, having benefitted from exceptionally good market conditions in 2017, because this lower contribution is more than offset by cost savings under the Lean 2018 program.

Current operating income (5) of EUR 3.5 billion

Current operating income after share in net income of entities accounted for using the equity method amounted to EUR 3.5 billion, stable on a reported basis and up 7.7% on an organic basis, supported by the increase in EBITDA and lower amortizations compared with 2017.

Net financial debt at EUR 20.6 billion

Net financial debt stood at EUR 20.6 billion, down EUR 1.9 billion compared with December 31, 2017. This variation was mainly due to EUR 4.7 billion of cash flow from operations (8), EUR 4.2 billion of impacts of the portfolio rotation program (including in particular the closing of the sale of the exploration and production business, of the LNG midstream and upstream business, of the Loy Yang B coal-fired power plant in Australia and of the distribution business in Hungary, as well as the classification as “Assets held for sale” of the interest in Glow, a power plant operator in the Asia-Pacific region), EUR 0.4 billion net change in hybrid bonds outstanding and a slightly favorable exchange rate effect. These items were partially offset by gross investments of EUR 5.7 billion in the period, dividends paid to ENGIE SA shareholders of EUR 0.8 billion and to non-controlling interests of EUR 0.6 billion.

Cash flow from operations (CFFO) (8) amounted to EUR 4.7 billion, down EUR 0.6 billion. The decrease stemmed chiefly from the return to a normalized EUR -1.0 billion level of change in working capital, partly offset by an increase in operating cash flow generated (6), by lower tax expenses and by a reduction in the cost of debt.

At the end of September 2018, the net financial debt / EBITDA ratio stood at 2.25x, below the target of ≤2.5x and slightly up compared to end of 2017. The average cost of gross debt decreased slightly compared to end of 2017, reaching 2.53%.

The net economic debt (9) / EBITDA ratio stood at 3.8x, stable compared to end of 2017.

On April 30, 2018, S&P upgraded its outlook for ENGIE from negative to stable, maintaining an A- rating.

On June 13, 2018, Moody’s confirmed its A2 rating with a stable outlook on ENGIE.

Successful strategic repositioning for ENGIE

ENGIE successfully pursued its strategic repositioning:

- the portfolio rotation program stands to date at EUR 12.9 billion (10) of announced and already entirely closed divestments (without taking into account the disposal of the interest in Glow);

- the investments program is finalized with EUR 13.8 billion (10) invested in growth Capex since 2016 and EUR 1.1 billion in investments secured at the end of September 2018;

- the Lean 2018 performance program reported, at the end of September 2018, EUR 1.2 billion (10) of cumulated net gains accretive to EBITDA. To date, the Group has identified all actions required to reach the target of EUR 1.3 billion in savings by the end of 2018.

This strategic repositioning is reflected in the Group's leading positions in renewable activities, which now represent around 24% of the Group's installed capacity and include a pipeline of projects of more than 10 GW. In networks, the Group holds more than EUR 27 billion in regulated assets in France and is pursuing important international developments, in particular in Central and Latin America. In client solutions, the Group has more than 24 million B2C contracts and has added more than EUR 2 billion revenues in B2B through acquisitions since 2015.

Furthermore, this successful strategic repositioning materializes by a higher profitability of the Group, with notably a ROCEp expected up 30bps over the 2016-18 period (11).

2018 financial targets

The Group confirms its 2018 financial targets (12):

- Net recurring income Group share between EUR 2.45 and 2.65 billion, expected at the low end of the range. This target is based notably on the assumption of a restart of Belgian nuclear units according to the schedule published in REMIT as of today and on an estimated EBITDA slightly below (3) the EUR 9.3 and 9.7 billion indicative range communicated to the market on March 8, 2018;

- Net financial debt / EBITDA ratio below or equal to 2.5x and a maintained “A” category rating;

- Dividend of EUR 0.75/share, in cash, for fiscal year 2018.

Group significant events

- January 10, 2018: ENGIE sets new hybrid bond record with the lowest coupon ever achieved by a Corporate. ENGIE took advantage of the attractive market conditions to place its first Green Hybrid Bond (Deeply Subordinated Perpetual Bond) of an amount of EUR 1 billion, with a coupon of 1.375% and a first Non-Call period of 5.25 years. The bond is intended to replace the outstanding notes of EUR 600 million, 3.875%, Non-Call 2018 and of GBP 300 million, 4.625%, Non-Call 2019. With these issues, the total amount of bonds issued by ENGIE in Green Bond format since 2014 reaches EUR 6.25 billion, confirming ENGIE’s commitment to play a leading role in the energy transition whilst supporting the development of green finance.

- May 18, 2018: Decision of the Board of Directors: Jean-Pierre Clamadieu new ENGIE Chairman. Following the General Shareholders’ Meeting which marked the end of Gérard Mestrallet’s term as Chairman of the Board and the designation of Jean-Pierre Clamadieu as an independent administrator, the ENGIE Board met and unanimously appointed Jean-Pierre Clamadieu as new Chairman. The Board also appointed Gérard Mestrallet as Chairman of Honour of the Group, acknowledging the whole of his action. In addition, the Board registered the resignation of Stéphane Pallez. Ross McInnes, appointed as an independent administrator by the General Shareholders’ Meeting, joins the Audit Committee. Christophe Agogué, who succeeds Olivier Marquer whose term as employee administrator for the “engineers, managers and equivalent college” expired, is appointed as member of the Ethics, Environment and Sustainable Development Committee. The Board of Directors is now composed of 19 members, including 9 independents, 8 women and 5 different nationalities.

- May 18, 2018: Reaction concerning the French Conseil d’Etat’s decision on regulated tariffs for the sale of electricity in France. ENGIE acknowledges the Conseil d’Etat’s decision, announced on May 18, 2018, ruling that regulated tariffs for the sale of electricity do not comply with the European law, due to the absence of a mechanism allowing for a periodic re-examination of the tariffs in addition to their overly broad application engulfing private and professional customers. ENGIE welcomes this beneficial decision for professional clients who will have a real choice through more competitive prices and easier access to innovative offers proposed by suppliers such as ENGIE. ENGIE nonetheless regrets the Conseil d’Etat’s analysis which diverges from its viewpoint dating back to July 19, 2017 when it considered, for different reasons, that the pursuit of regulated tariffs for natural gas did not comply with the European Law, after having called upon the European Union’s Court of Justice. ENGIE will therefore be attentive to the periodic re-examination of regulated tariffs for the sale of electricity to private consumers enabling alternative suppliers to provide competitive offers and efficiently compete with the historic operator. Indeed, the Group considers that the pursuit of regulated tariffs for the sale of electricity to private customers would prolong a deep distortion of competition which exists on the energy markets, where the same actors are active, excessively reinforcing the dominant position of France’s historical electricity operator. It will belong to the European authorities and Courts, which were not questioned on the matter, in contrast with regulated tariffs for the sale of natural gas, to express their point of view.

- June 20, 2018: ENGIE denies having received any State aid from Luxembourg. ENGIE takes note of the European Commission’s decision issued on June 20, 2018, against Luxembourg. The latter relates to two tax rulings dated 2008 and 2010 regarding the tax treatment of the financing operations of the Group’s activities in Luxembourg. ENGIE has fully complied with the applicable tax legislation and considers that it has not benefited from a State aid. In addition, ENGIE was transparent by requesting, from the Luxembourg authorities, a ruling confirming its correct interpretation of Luxembourg law. ENGIE will assert all its rights to challenge the State aid classification considering that the Commission did not demonstrate that a selective tax advantage was granted. Therefore, ENGIE will apply for annulment of this Commission’s decision before the relevant courts.

- July 06, 2018: Change to ENGIE’s Executive Committee as of July 6, 2018. In order to coordinate the performance efforts of ENGIE’s operational entities, Paulo Almirante becomes Chief Operating Officer (COO) of the Group. With strong and acknowledged industrial expertise and international experience, he will support the action of the members of the Executive Committee in relation to the current performance and development programs. He remains Executive Vice President, in charge of the Generation Europe, Brazil, NECST (North, South and Eastern Europe), MESCAT (Middle East, South and Central Asia and Turkey) Business Units, and of Environmental and Social Responsibility.

- July 13, 2018: ENGIE, in partnership with Nexity, plans to create its future campus in an exemplary eco-district near Paris. ENGIE and Nexity have concluded a financial and technological partnership to acquire and together develop an exemplary eco-district, a 9-hectares plot of industrial land at La Garenne-Colombes, in the Hauts-de-Seine department (92) in France. This new Paris La Défense centre will host the future ENGIE eco-campus. The two groups will pool their respective expertise in sustainable cities and energy transition in order to develop this general interest urban project, in close collaboration with the municipality and the public stakeholders. For ENGIE, in compliance with the prerogatives of the representative bodies of the staff concerned, this would mean creating, by 2022-2023, a bespoke campus of more than 120,000 m², conceived according to the highest standards for quality of life at work, thereby bringing together the Île-de-France teams in one place, promoting cooperation, cross-disciplinarity and openness.

- August 3, 2018: Results of the ‘Link 2018’ plan: ENGIE reaches 4% employee shareholding with 40,000 new subscriptions. Launched by ENGIE on 15 February 2018 and concluded on 2 August, the Link 2018 employee shareholding plan enabled more than 40,000 Group employees in 18 countries to take part, with a total amount of 340 million euros in subscriptions, representing 33 million shares.This is the first employee shareholding operation since the strategic shift made by ENGIE in 2016 aimed at refocusing the Group on growth businesses, a move whose realisation is the result of the commitment of its employees. The number of subscribers increased by more than 25% compared to the previous initiative, Link 2014, demonstrating employees' confidence in the transformation plan. In France, more than 30,000 employees have made a 10-year commitment by subscribing to the new Link+ scheme. Employee shareholders now hold more than 4% of ENGIE's capital. The Group is thus allowing its employees to contribute in a different way to its transformation, by acquiring shares in the company on preferential terms.

- September 18, 2018 : ENGIE, the leading utility of the Dow Jones Sustainability Index World. ENGIE’s CSR performance has once again been recognised by the extra-financial rating agency RobecoSAM which has confirmed the Group’s membership of the Dow Jones Sustainability Index (DJSI) World and Europe indices in 2018. The 2018 assessment places the Group as “industry leader” in its sector (Multi and Water Utilities) with a score of 82 out of 100. Launched in 1999, the DJSI World is the first global index to distinguish the best performing companies with respect to sustainability. Companies included in the DJSI are recommended for sustainable investment by RobecoSAM, whose rating is considered the most renowned among experts (including NGOs, public administrations, universities, businesses, media) and as the most credible, after the CDP (formerly the Carbon Disclosure Project).

The presentation of the Group’s financial results as of September 30, 2018 used during the investor conference call is available from the Group’s website:

https://www.engie.com/en/financial-results-2018