The Group’s electricity generation capacity mix evolved between 2014 and 2018 under the impulse of its transformation plan and its portfolio rotation program aimed at phasing out activities considered non-strategic (production from coal or production gas merchant) to reinvest in renewable or energy efficiency projects.

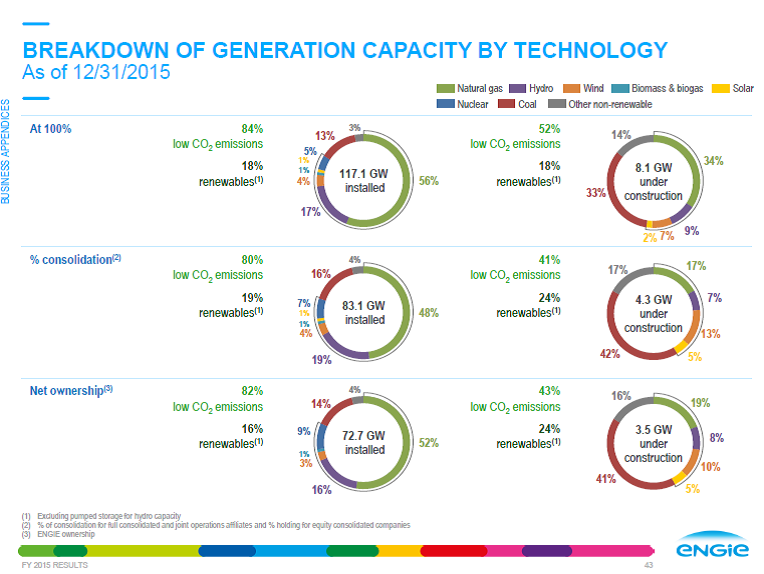

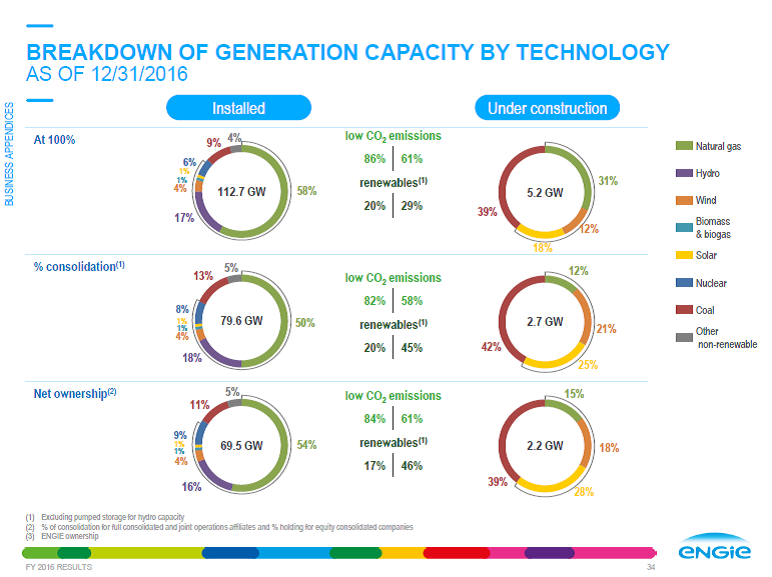

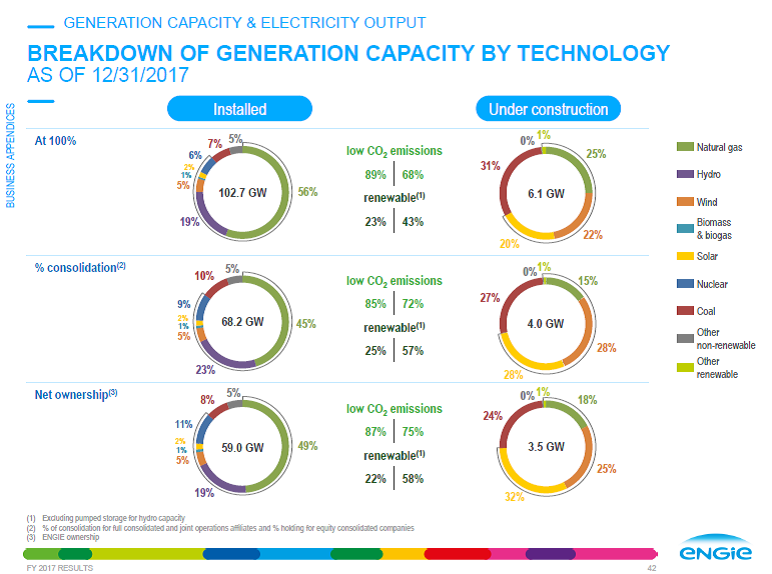

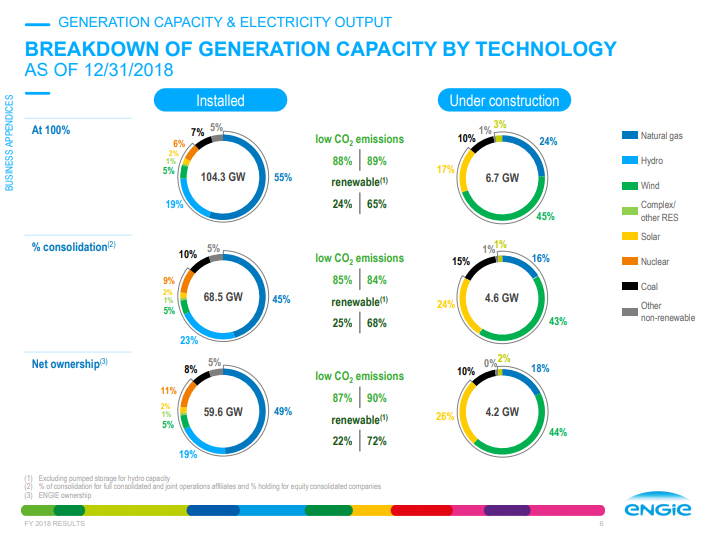

At the half-yearly presentations of its accounts, the Group publishes its mix of electrical production capacity by technology, distinguishing between in-service and construction capacities.

Three methods are presented:

- 100% accounting, which corresponds to take into account 100% of the production capacity of the asset regardless of the detention rate.

- % of consolidation accounting which corresponds to take into account production capacities that are consistent with the financial consolidation of their results, ie 100% for fully consolidated assets, the detention rate for proportionally consolidated assets and 0 % for equity method and financial participations.

- Net ownership accounting which corresponds to take into account the production capacity of the asset in prorata to the detention of the asset by ENGIE.

Low-carbon production capacity include natural gas, nuclear, hydro, wind, solar, biogas and biomass.

The renewable production capacities are: hydraulics (except pumped storage), wind, solar, biomass and biogas.

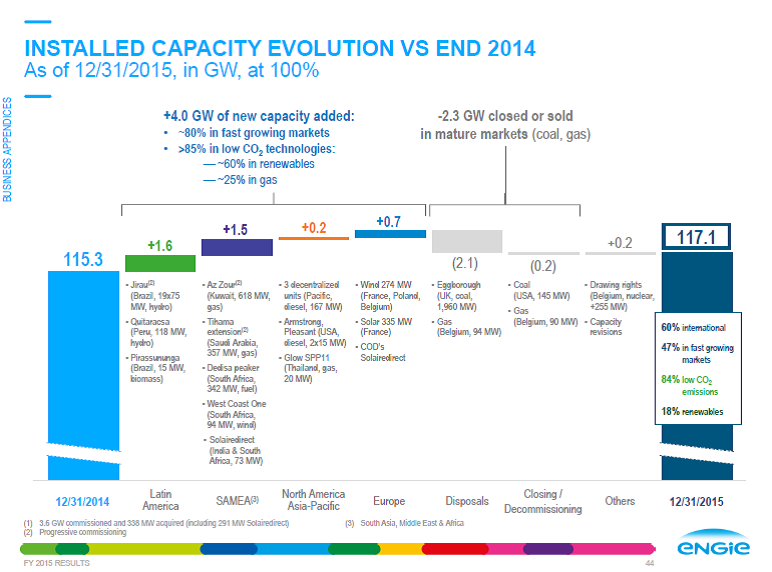

Generation capacity by technology at end of 2015

The evolution of production capacity at 100% by technology between 2014 and 2015 shows the launch of the coal exit program (-2 105 MW) over the period.

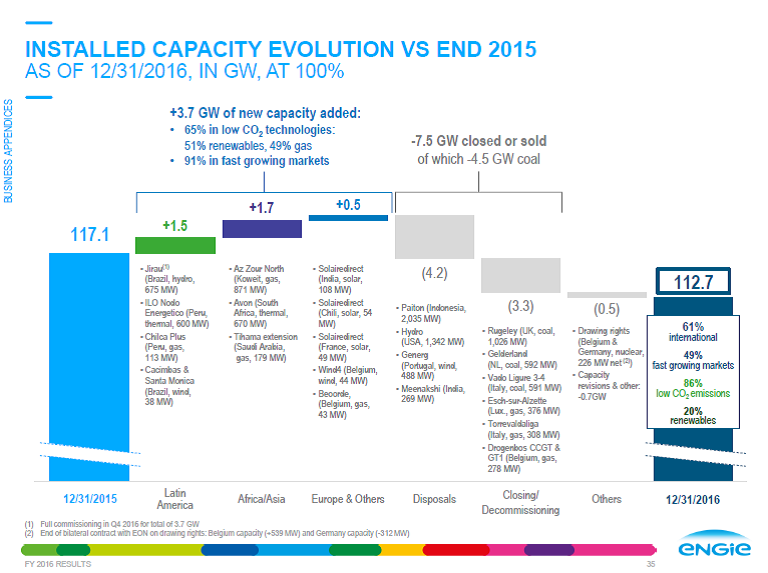

Generation capacity by technology at the end of 2016

The evolution of production capacity at 100% by technology between 2015 and 2016 shows the continuation of the coal exit program (-4,513 MW) over the period.

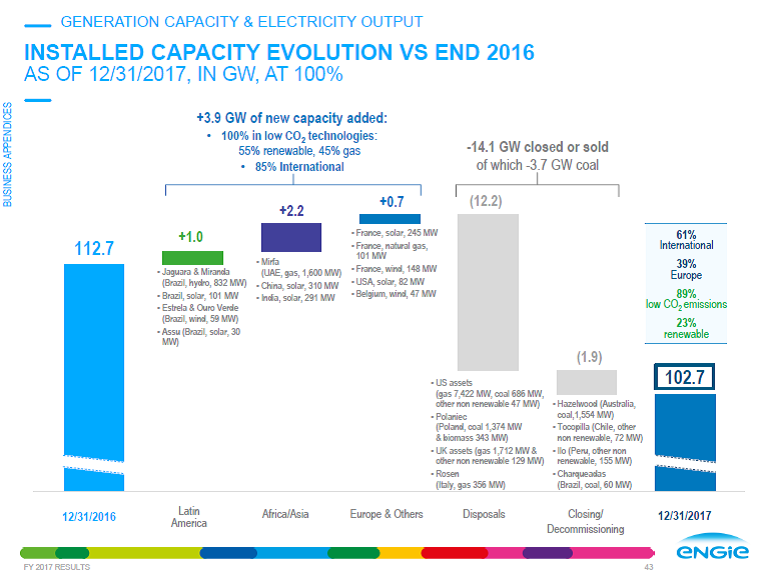

Generation capacity by technology at the end of 2017

The evolution of production capacity at 100% by technology between 2016 and 2017 shows the continuation of the coal exit program (-3,674 MW) over the period.

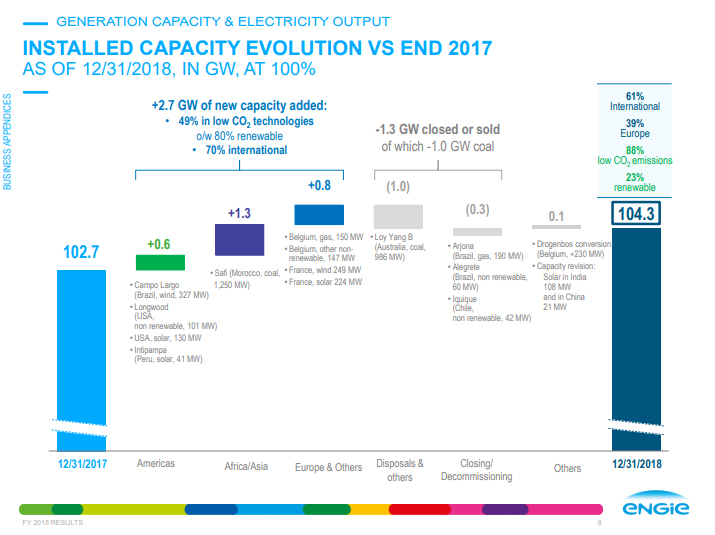

Generation capacity by technology at the end of 2018

The evolution of production capacity at 100% by technology between 2017 and 2018 shows the continuation of the coal exit program (-1 GW) over the period

26 th April 2019 : ENGIE announces the signing of an agreement with Riverstone Holdings LLC, a global energy-focused investment firm, for the sale of its shares in coal-fired power plants in the Netherlands and in Germany.

The assets sold are the coal-fired power plants of Rotterdam1 in the Netherlands, Farge1, Zolling3 and Wilhelmshaven4 in Germany. These assets represent a total installed capacity of 2,345 MW. The proposed transaction will reduce ENGIE’s net consolidated debt by approximately 200 million euros. This sale is subject to customary conditions, with closing expected during the second semester 2019.

After this sale, coal will represent 4% of ENGIE’s global power generation capacities, down from 13% at the end of 2015.

Find out more