Presenting the financial information as of September 30, 2019 Isabelle Kocher, ENGIE’s CEO, said: “Our 9M results confirm ENGIE’s ability to grow following the profound transformation undergone over the last three years. This quarter, our increased wind and solar capacity and the Microsoft PPA demonstrate the accelerated development of our Renewables portfolio. The acquisition of Conti in the United States and the launch of ENGIE Impact are two other milestones in the Group’s drive to boost the zero-carbon transition of our clients. ENGIE’s underlying organic performance in Thermal is also solid, across several regions and across both contracted and merchant operations, while we continue to optimize our Networks businesses and integrate the exciting acquisition of TAG in Brazil. Lastly, we confirm our guidance for 2019.”

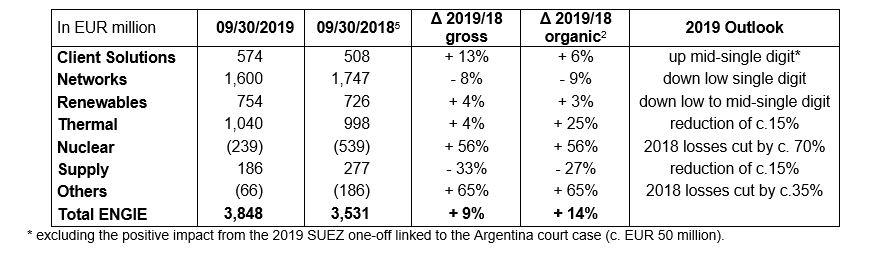

- Nuclear was driven by higher availability of Belgian production units and achieved price improvement;

- Networks were impacted by several factors in France that were expected and are mostly temporary, particularly in gas transmission with tariff linearization and in gas storage with customer penalties due to temporary technical issues. Networks also benefited from the first contribution of TAG in Brazil, acquired earlier this year;

- In Others, Energy management results were strong, mainly driven by gas contract renegotiations and international activities;

- Supply activities continued to be impacted by a difficult market context, mainly from margin contractions in French retail;

- Client Solutions results benefited from an increased level of activity, notably driven by the performance of decentralized activities. SUEZ one-offs additionally contributed positively;

- Thermal benefited from liquidated damages (LDs) and positive Power Purchase Agreement (PPA) effects in Latin America, as well as from positive contribution from gas power plants in Australia. Nevertheless, these activities were affected mainly by the disposal of Glow;

- Renewables benefited from the steep acceleration in asset commissioning and development of wind & and solar capacities with 1.8 GW installed over the first nine months and now 8.8 GW secured out of the target of 9 GW to be installed by 2021. On hydro power production, lower volumes in France had a significant negative impact year on year.

Analysis of financial data as of September 30, 2019

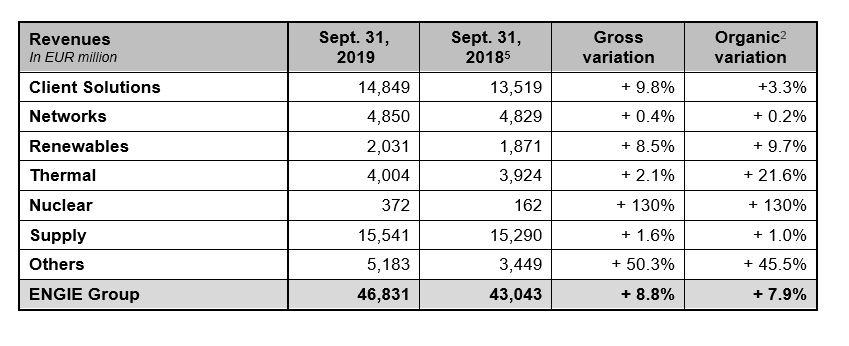

Revenues of EUR 46.8 billion

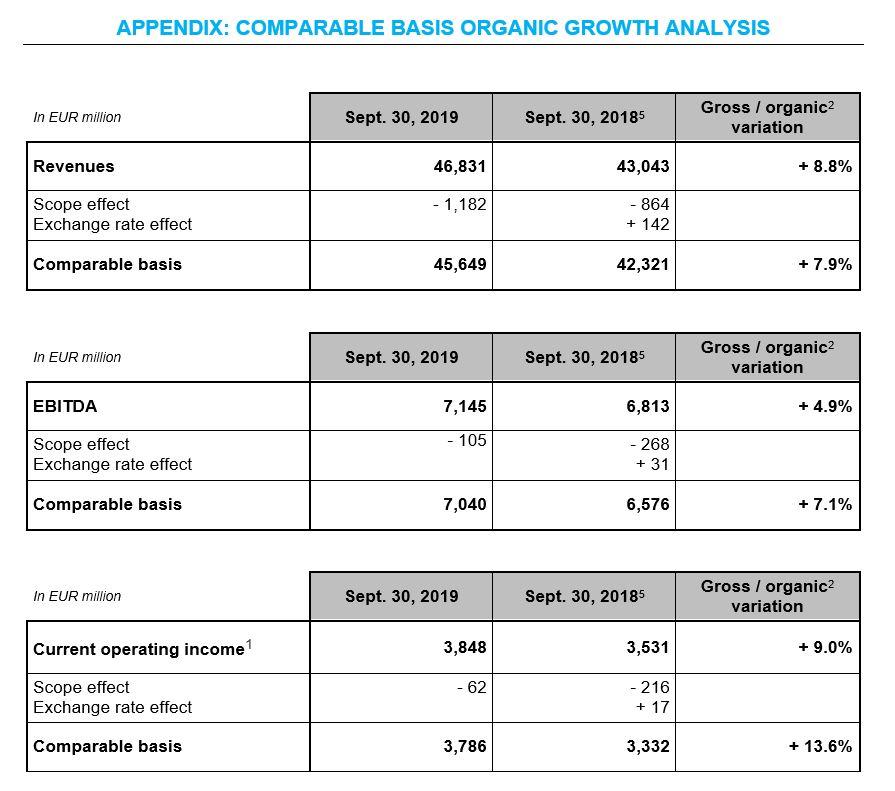

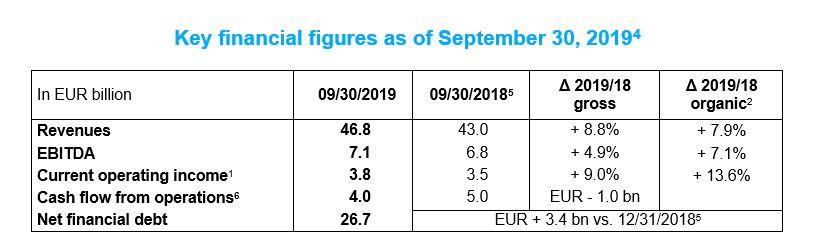

Revenues were EUR 46.8 billion, up 8.8% on a gross basis and 7.9% on an organic2 basis.

Reported revenue growth includes a slightly positive foreign exchange effect, mainly due to the appreciation of the US dollar, partly offset by the depreciation of the Argentinian peso and the Brazilian real against the euro, and to an aggregate positive scope effect. Changes in the scope of consolidation included various acquisitions in Client Solutions (primarily in the United States, in Latin America and in France) and in business Supply in the US, partly offset by the disposals of the stake of Glow in Thailand in March 2019 and of the business Supply activities in Germany at the end of 2018.

Organic2 revenue growth was primarily driven by effective energy management services and favorable market conditions for Global Energy Management (GEM) activities, by Thermal in Europe with higher volumes sold, by growth in Client Solutions in France and Europe, by a wide ranging momentum in Latin America (tariff increases in Mexican and Argentinian gas distribution activities, PPA portfolio growth in Chile and dynamic energy allocation as well as commissioning of new wind farms in Brazil), and by Supply activities (benefitting from a favorable market context for business customers in France, higher power sales in France both to business and retail customers and positive price effects in Belgium, Romania and in the United States). This growth was partly offset by lower revenues from gas storage activities with less purchase/sale operations in France and in the United Kingdom.

Clients Solutions revenues were up 10% on a gross basis and 3% on an organic2 basis.

EBITDA of EUR 7.1 billion

EBITDA was EUR 7.1 billion, up 4.9% on a gross basis and 7.1% on an organic2 basis.

These gross and organic2 variations are globally in line with current operating income1 growth, except for the positive one-offs in SUEZ (mainly linked to the settlement of the Argentina court case in 2019) which are not booked at EBITDA level.

Current operating income1 of EUR 3.8 billion

Current operating income including share of net income of entities accounted for using the equity method (COI) amounted to EUR 3.8 billion, up 9.0% on a reported basis and 13.6% on an organic2 basis.

Reported COI1 increase includes a positive foreign exchange effect, mainly due to the appreciation of the US dollar, partly offset by the depreciation of the Argentinian peso and the Brazilian real against the euro, and to an aggregate negative scope effect. This negative scope effect stems mainly from the sale of Glow, partly offset by various acquisitions predominantly in Networks (TAG), Client Solutions and Renewables.

Based on the reporting segments, the organic2 COI1 growth was mainly driven by Latin America (notably due to the favorable impact of LDs received for Thermal activities in 2019, better performance of hydroelectric power generation and commissioning of new wind and solar assets in Brazil as well as PPA portfolio growth in Chile), by the Rest of Europe (mainly driven by the very strong performance of Nuclear activities with better availability and higher prices, partly offset by decreasing Supply activities in Benelux and Romania), by the Others segment (mainly due to GEM’s good performance in market activities, positive one-offs in SUEZ, higher power margins for business Supply in France; partly offset by some headwinds at Tractebel), and by Middle East, Africa & Asia (mainly driven by higher achieved margins and generated volumes in Thermal generation in Australia; partly offset by a negative temperature effect for Australian Supply).

These positive impacts are partly offset by an organic2 COI1 decrease in France (for France excluding Infrastructures, mainly due to the impact of lower hydroelectric power generation and to margin pressure in Supply activities, partly offset by increasing wind and solar contributions and improved performance on decentralized energy; for France Infrastructures, mainly due to the transmission activity and, to a lesser extent, to the storage profits) and in USA & Canada (mainly driven by Client Solutions, notably due to negative one-offs booked in 2019, by the lower contribution from Thermal activities due to higher costs for LNG sourcing in Puerto Rico, and by the temporary margin pressure on business Supply activities; partly offset by DBSO7 sell down contribution in Renewable activities).

Organic2 COI1 performance varied also across the Group’s business lines with growth for all business lines except for Networks and Supply: