Business Highlights

- Progress at pace on new strategic orientation announced in July:

- Sale of 29.9% of shareholding in SUEZ for EUR 3.4bn completed in October

- Completed first phase of Client Solutions review, preliminary scope defined for. separation of activities

- Continued delivery of major capital projects with EUR 3.3bn growth CAPEX(1).

- Continued focus on minimising impact of new Covid-19 restrictions

Financial Performance

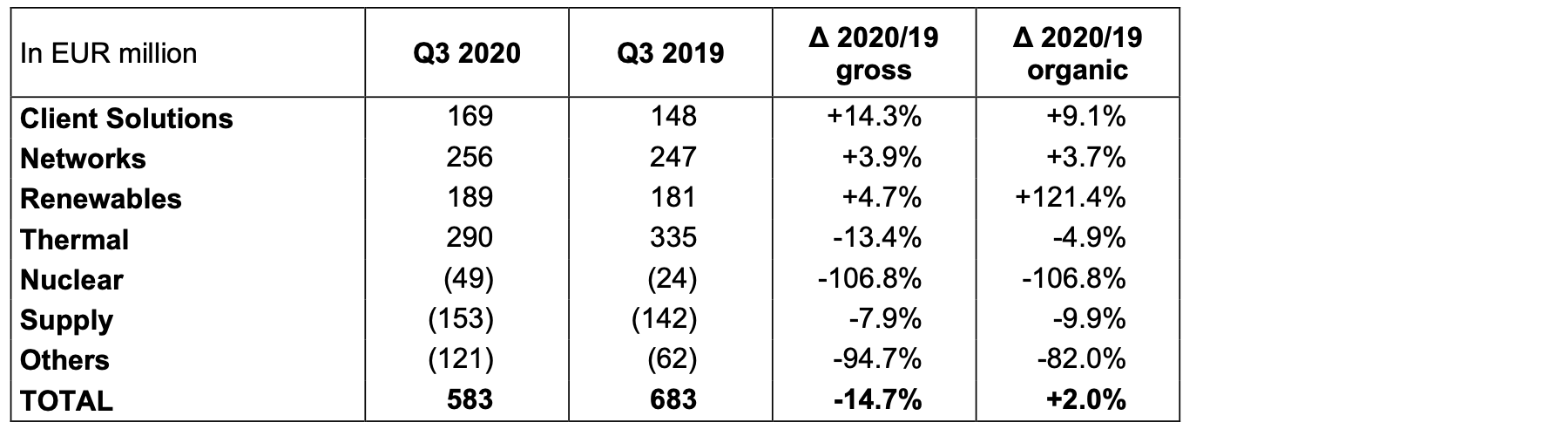

- Strong recovery following a significantly impacted Q2, with Q3 COI(2) organically(3) up +2% versus last year, reflecting growth in Renewables and more than offsetting favourable operational one-offs in 2019

- 9M significant impact of Covid-19 mainly on Client Solutions and Supply activities, c. EUR 1.0bn total Group impact at COI level

- Net financial debt EUR 0.2bn lower versus 31/12/2019; strong liquidity of EUR 22.5bn

- 2020 guidance(4) confirmed

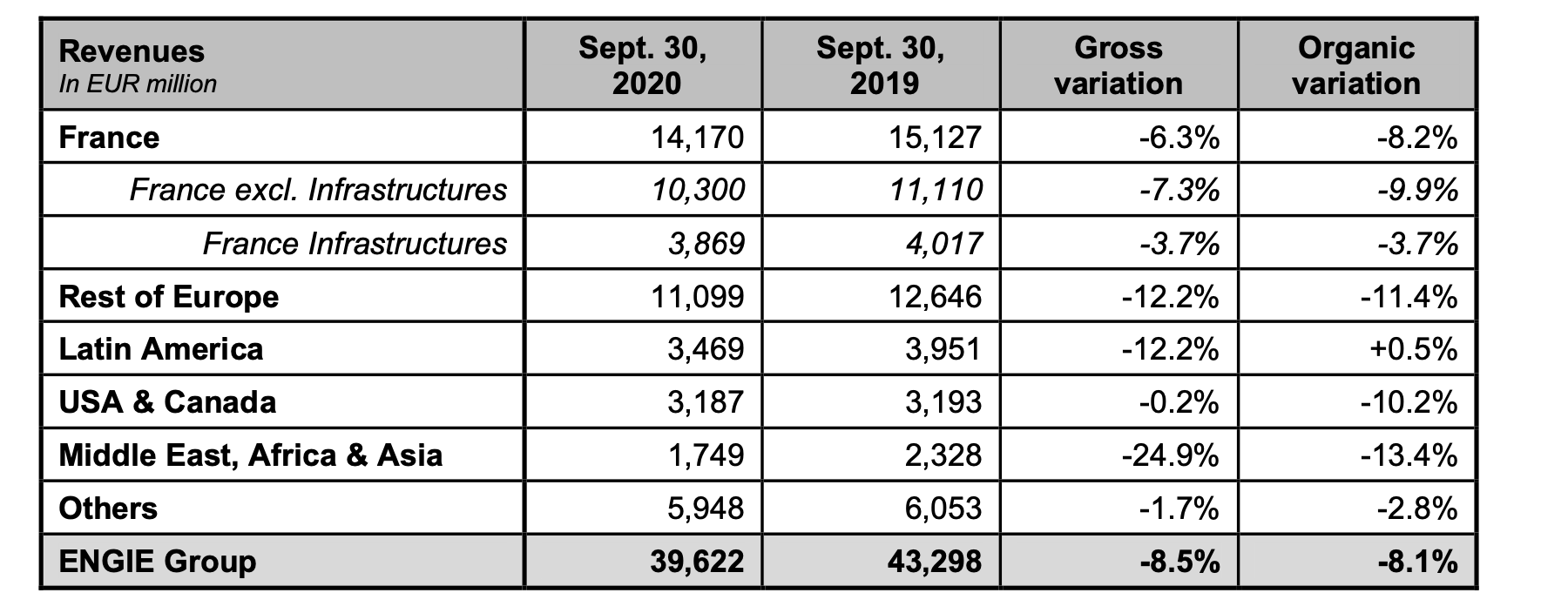

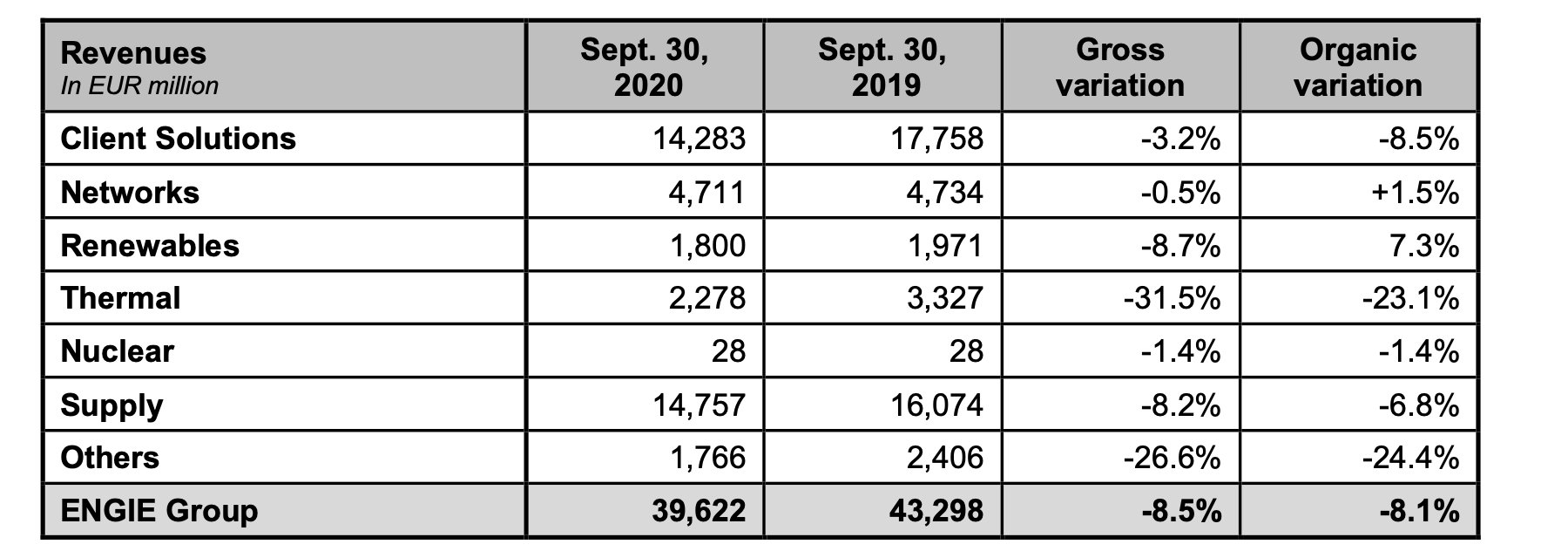

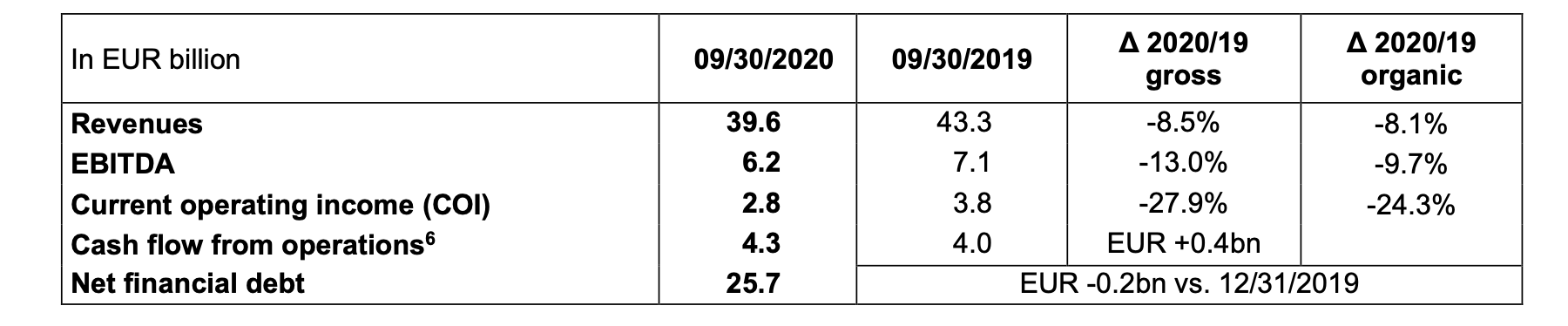

Key financial figures as of September 30, 2020 (5)

Judith Hartmann, EVP member of ENGIE’s executive leadership team and Group’s Chief Financial Officer, commented:

“ENGIE’s performance has seen a strong recovery from Q2 levels and the Group has delivered small organic growth year on year in the third quarter with a strong performance from Renewables, which are a key growth area for us. Most of our businesses are performing well and we are well prepared for the new Covid-19 restrictions introduced in some of our main geographies. As a result, we expect to deliver earnings within the stated 2020 guidance range.”

Claire Waysand, interim CEO, said:

“We are focused on continuing the delivery of essential services to our customers, while ensuring the protection of all, and mitigating the impacts of Covid-19, operationally and financially. In addition to focusing on delivery of our objectives for 2020, we have made significant progress at pace on the implementation of the new strategic orientation announced in July. The Group has completed the sale of 29.9% in SUEZ and the first phase of the Client Solutions review.”

Catherine MacGregor appointed as ENGIE’s new CEO

On October 2nd, 2020, ENGIE announced the appointment of Catherine MacGregor as the company’s new Chief Executive Officer. She will join the Group from January 1st, 2021 and her appointment as a Board member will be proposed at the Shareholders’ General Meeting in May 2021.

Focus on minimizing the impact of new restrictions

New restrictive measures have recently been announced in some of the Group’s key geographies. These new measures, however, are targeted, will have varied impacts on sectors, and Governments are focused on supporting economic activity. These measures could evolve depending on local Government views on their respective progress in tackling the pandemic.

In this context, ENGIE will take a pragmatic and flexible approach to minimise the impact of the crisis on the remainder of this year and beyond. Having taken a number of actions through the year that included establishment of new processes, variabilisation of costs, procurement of necessary personal protective equipment (PPE) and continuously adapting in a dynamic environment, ENGIE feels confident that it is well prepared to tackle these new restrictions.

2020 Outlook and Guidance

ENGIE saw a strong financial recovery in Q3 following a significantly impacted Q2.

There are new Covid-19 restrictions in some the Group’s key geographies, however as outlined above, ENGIE is well-prepared. The main activities where some impacts are expected are Client Solutions, in particular asset-light activities, and to a lesser extent, Supply activities. For the rest of the business, impacts are expected to be relatively limited.

Following the sale of 29.9% share in SUEZ for EUR 3.4 billion, Q4 earnings (COI and NRIgs) will exclude previously expected earnings contribution from SUEZ.

With respect to foreign exchange movements since July, deteriorations occurred compared to the rates assumed within guidance, in particular for the Brazilian Real.

ENGIE benefits from stability and good visibility for the majority of its operations. Networks have clarity through regulatory frameworks; Renewables and Thermal generation benefit from PPAs (Purchase Price Agreement) and long-term contracts; and expected merchant power generation output for 2020 is almost entirely hedged. Overall, ENGIE expects the resilience of these activities to largely offset the impact of the new developments outlined above. As a result, ENGIE expects to achieve results within the stated 2020 guidance range.

Further details on that guidance are provided page 9.

Looking ahead to medium-term prospects, ENGIE remains focused on driving a strong recovery. With carbon- neutrality at the heart of its strategy, ENGIE is well positioned to benefit from new growth opportunities through government actions to drive a green recovery. Following a 2020 performance significantly impacted by Covid-19, driven by the major overall economic impact of the first lockdowns in several key geographies, the Group is confident of a substantial improvement in its financial performance.

Strong progress on new strategic orientation

Following the announcement in July of a new strategic orientation to simplify the Group and accelerate growth in renewables and infrastructure assets, ENGIE has delivered progress at pace.

Increased focus on renewables and infrastructures assets

ENGIE continues to grow its renewables portfolio and is on track to achieve 9 GW of additional renewable capacity commissioned between 2019 and 2021. In July, ENGIE announced the signing of an agreement to sell 49% of its equity interest in a 2.3 GW US renewables portfolio to Hannon Armstrong, while retaining a controlling share in the portfolio and continuing to manage the assets.

Similarly, the Group also continues to increase investment in infrastructure assets that benefit from long-term commercial arrangements. In July, together with its partner Caisse de Dépôt et Placement du Québec, ENGIE successfully acquired the remaining 10% of TAG in Brazil, following the acquisition of 90% in June 2019. This acquisition is an example of the attractive opportunities ENGIE sees for expansion in international networks.

In September, ENGIE and ArianeGroup announced the signing of a cooperation agreement in the field of renewable liquid hydrogen to speed up the decarbonisation of heavy-duty and long-distance transportation. This partnership is one of many projects ENGIE is developing to drive the long-term energy transition.

Enhanced divestment programme to fund future growth

The sale of a 29.9% shareholding in SUEZ for EUR 3.4bn was completed in October. As outlined in July, ENGIE is considering opportunities to divest non-core businesses and minority stakes, and as part of this ENGIE has initiated a strategic review of options for its participation in GTT in which the Group holds a 40.4% stake. ENGIE will consider selling all or part of this stake either to a third party via a formal sale process and / or selling via equity capital markets.

Strategic review of the Client Solutions activities

The Group initiated a strategic review of Client Solutions activities with a view to maximizing value, reinforcing their leadership position and seizing future growth opportunities, through a coherent perimeter and adapted organisation.

The Group has now completed the first phase of this strategic review. The preliminary scope of activities that will be retained or those where ownership could change has been defined, with each Client Solutions activity initially assessed on its alignment with the Group’s new strategic orientation, considering 3 main criteria: business model; nature of the activity and development potential in each geography. As a result of this strategic review:

ENGIE will retain activities in Client Solutions focused on low-carbon energy production, energy infrastructure and associated services providing complex, integrated, and large-scale solutions to Cities, Communities, and Industries. These solutions, based on long-term contracts, bring visibility, resilience, and attractive growth potential. Key activities will comprise District Heating and Cooling, on-site generation, energy efficiency, smart city, green mobility, and engineering. These Client Solutions activities remaining within ENGIE representing c. 35,000 employees, will build on positions in France(7) to develop in Europe and internationally. Based on 2019 results, these activities represent between EUR 7-8 billion of revenues and between EUR 0.55-0.65 billion of COI(8).

For other Client Solutions activities, a new entity will be created as a leader in asset-light activities and related services. These activities benefit from strong growth prospects and leadership positions, however, they are less aligned with ENGIE’s new strategic orientation. The new entity will be focused on two business models: design and build projects; and recurring O&M services. Key complementary activities will include electrical installation, HVAC as well as information and communication services, mainly located in Europe(9), including Benelux with further prospects notably in North America representing c. 74,000 employees, who are well recognized experts in these different fields. Based on 2019 results, the proposed entity will represent between EUR 12-13 billion of revenue and EUR 0.35-0.45 billion of COI(8).

Following completion of this first phase, the next steps include: the organisation design and appointment of future management teams for the proposed new entity; the preparation for separation of activities and the review of options for future ownership. ENGIE has already initiated the social dialogue with employees and this will be enhanced in the coming months and the consultation process with the appointed employee representatives is expected to start in Q1 2021.

Operational and financial overview by Business Line

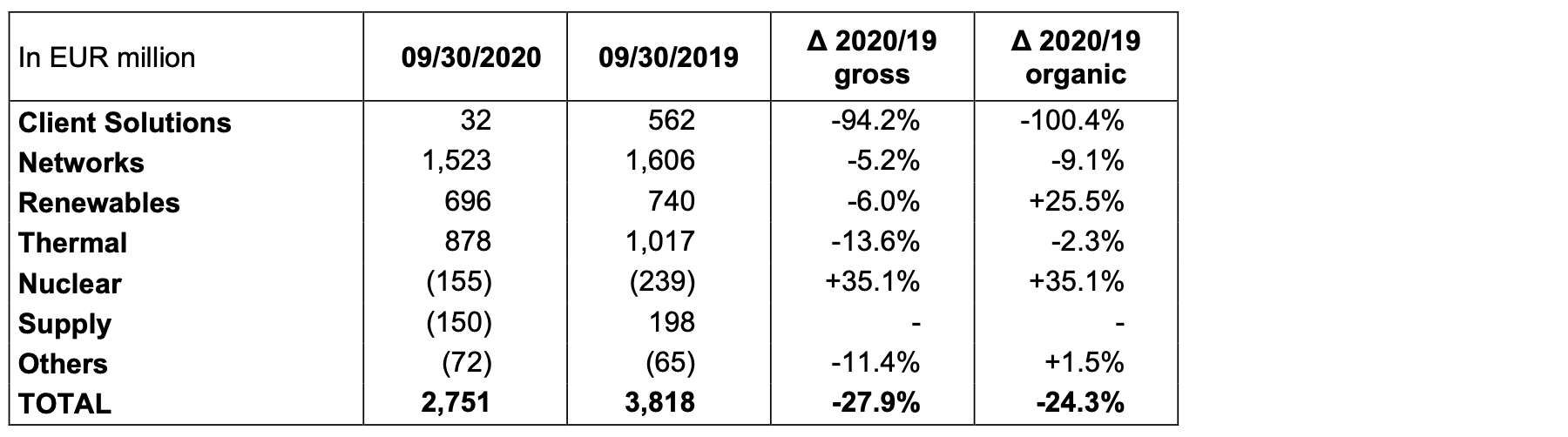

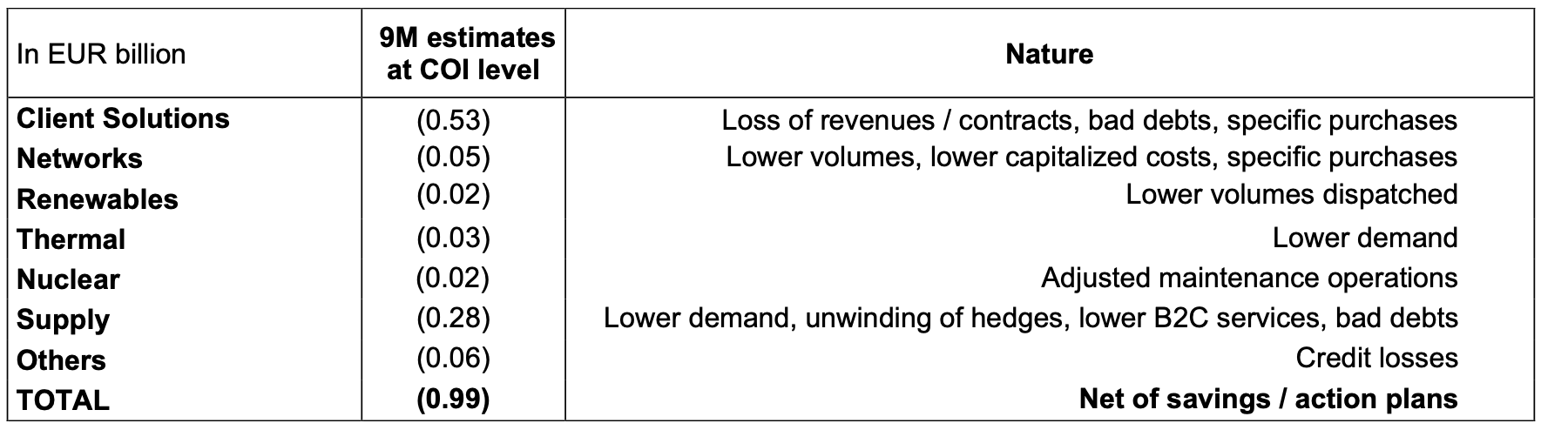

Primarily due to the impacts experienced in H1, ENGIE’s results for 9M 2020 were down significantly with an estimated COI impact of c. EUR 1.0 billion from Covid-19, including EUR 0.15 billion impact in Q3. More than 80% of this negative effect is related to Client Solutions and Supply activities, which experienced a strong decrease in activity levels and energy consumption, especially at the height of lockdown measures in Q2, while Networks, Renewables, and Thermal demonstrated resilience. Warm temperature in France impacted results, mainly in Networks and Supply with a total negative impact of EUR 187 million at COI level.

The Group’s COI also reflects deterioration of foreign exchange with a total impact of EUR 193 million mainly driven by the depreciation of the Brazilian Real. Negative scope effect of EUR 33 million follows mainly the disposals of Glow (in March 2019) and coal plants in Germany and the Netherlands, partly offset by the TAG acquisition of 90% in June 2019 and with the remaining 10% in July 2020, together with various acquisitions in Client Solutions, mainly Conti in the US and Powerlines in Europe as well as in Renewables with Renvico in Italy and in France.

Q3 results, however, showed a strong recovery following a significantly impacted Q2, with continued delivery of capital projects and businesses returning to more normalized levels. Overall, Q3 COI was up 2% organically versus last year reflecting growth in Renewables and more than offsetting favourable operational one-offs in 2019 and Covid-19 impacts.

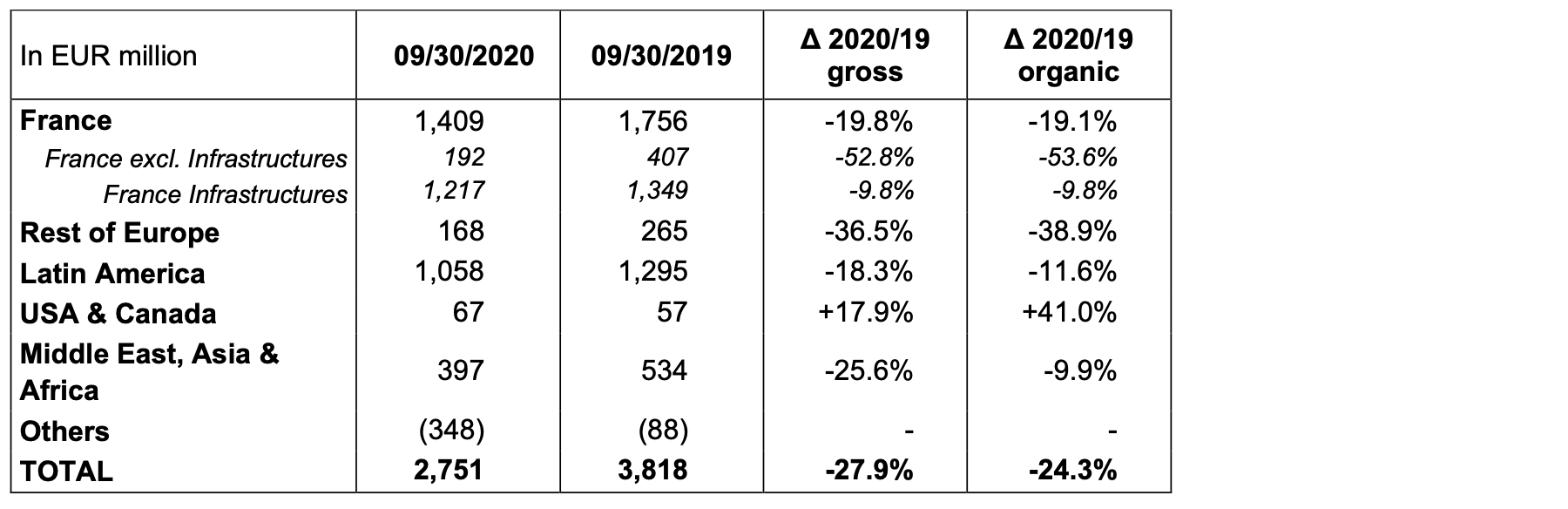

9M COI contribution by reportable segment (detailed commentary on page 10):

9M COI contribution by Business Line:

Q3 COI contribution by Business Line:

Estimated 9M Covid-19 impacts by Business Lines:

These estimates have been prepared in accordance with a standard guidance applied across businesses under a dedicated oversight process (losses of revenues being inherently subject to more judgement than the identification of specific costs incurred). These estimates relate to operating items only and are presented net of savings and mitigating management action plans. By construction, these estimates exclude foreign exchange and commodity price effects incurred in the Group’s various businesses, whether positive or negative.

Client Solutions: H1 significant Covid-19 impacts weighed on overall 9M performance – standalone Q3 up 9% (organic) versus last year

9M Client Solutions’ COI decreased significantly to EUR 32 million, mainly as a result of the Covid-19 crisis.

The business line experienced a strong impact of Covid-19 in the asset-light business model predominately in Europe and the US, mostly driven by loss of revenues, specific additional purchases, and higher bad debts. Significant cost-cutting and variabilising measures slightly mitigated the material impact of the pandemic.

In asset-based activities, Covid-19 impacted SUEZ results, as well as warmer temperature in Europe also negatively impacted these activities. Excluding temperature, DHC and on-site generation activities remained resilient.

Lastly, headwinds in some contracts as well as investments for the future and start-up costs from ENGIE Impact were also reflected in Client Solutions results.

In Q3, asset-light activity levels returned to over 90% with a small portion of industries, such as hotels, still not back to normal operating levels. This expected recovery in asset-light activities led to a +9% organic growth in COI mainly coming from France and North America.

Implementation of performance actions contributed to an organic cost reduction of EUR 0.18 billion in Q3.

Networks: resilient performance excluding temperature impact, Q3 up 4% (organic) on last year

9M Networks COI was EUR 1,523 million, down 9% on an organic basis.

In France, performance was impacted by unusually mild temperature in H1 and impact of Covid-19 on distributed volumes, partly offset by lower levels of expenditure during lockdown. Of these impacts, negative volume effects will be recovered in the medium-term under the clawback accounts mechanism.

Networks in Mexico and Argentina experienced negative volume effects, while Europe (excluding France) and Asia faced headwinds related to prices and temperature.

In Q3, the Networks business demonstrated a good performance with COI up +4% both on gross and organic basis.

Overall, the Group maintained strong operational performance with high levels of network safety and reliability. In France, along with the pick-up in activity levels, gas smart meter installation is resuming, with 6.2 million meters installed at the end of September, including 1.3 million since the beginning of the year. In Latin America, following the acquisition of 90% of TAG in June 2019, ENGIE, with its partner Caisse de Dépôt et Placement du Québec, successfully acquired the remaining 10% in July 2020. In addition, earlier this year ENGIE closed the acquisition of a 30-year greenfield concession project in northern Brazil that comprises the construction, operation and maintenance of a 1,800 km electric power transmission line, a new substation and the expansion of 3 additional substations.

Renewables: Continued growth and operational progress; strong organic growth of 25% on 9M

9M Renewables COI contribution was EUR 696 million, up 25% on an organic basis. This is mainly due to good results in France with higher hydroelectric and wind generation volumes and improved prices for hydro. Relatively favourable wind conditions in most European countries were partly offset by less favourable hydro conditions in Brazil. Successful commissioning in North America also contributed to this increase, including first effects from the tax equity financing.

During the first 9M of 2020, more than 1.4 GW of onshore wind and solar capacity was added, including 1.1 GW of capacity commissioned and, as of September 30, 2020 5.4 GW of renewables capacity is under construction. ENGIE is on track to commission 9 GW over 2019-2021.

In October, in Australia, to further accelerate the development of renewable energy projects that deliver affordable green energy, ENGIE and its partner Mitsui, have launched an innovative equity finance platform, in partnership with Infrastructure Capital Group. This platform will help develop more renewable energy projects in Australia.

On July 27th, 2020, ENGIE and its partners finalized the commissioning of WindFloat Atlantic, a 25 MW floating wind farm in Portugal, the world’s first semi-submersible floating wind farm. This commissioning is an important achievement for the sector as floating wind technology contributes to the diversification of energy sources and provides access to untapped marine areas.

On July 21st, 2020, ENGIE and EDP Renováveis announced the creation of Ocean Winds, a joint venture in the floating and fixed offshore wind energy sector equally controlled by both partners. The new company will act as the exclusive investment vehicle of each partner to capture offshore wind opportunities around the world and aims to become a top five offshore global operator by combining the development potential of both partners.

On July 2nd, 2020, ENGIE announced the signing of an agreement to sell 49% of its equity interest in a 2.3 GW US renewables portfolio to Hannon Armstrong, a leading investor in climate change solutions. ENGIE will retain a controlling share in the portfolio and continue to manage the assets. When commissioned, this 2.3 GW portfolio, will comprise 1.8 GW onshore wind and 0.5 GW solar photovoltaic projects. ENGIE has secured nearly USD 2 billion of tax equity commitments for this portfolio. Tax equity financing is the traditional structure used in the United States to support the development of renewable projects. This tax equity financing – the largest ever in the US – demonstrates ENGIE’s successful development in this market.

Lastly, in March 2020, ENGIE finalized Renvico’s acquisition to strengthen its growth in onshore wind in Italy and France. This acquisition has enabled ENGIE to double its installed onshore wind capacity in Italy to over 300 MW.

Thermal: negative scope effects, but flat organic evolution despite positive operational one-offs in 2019

Thermal COI amounted to EUR 878 million, flat on an organic basis despite the non-repeat of favourable operational one-offs in 2019, mainly liquidated damages received in Chile and Brazil.

Thermal COI saw limited Covid-19 impact of c. EUR -30 million, mainly through lower demand in Chile and Peru. These negative impacts were offset by a better performance of European merchant gas fleet, Pampa Sul commissioning and higher margins in Brazil, and the positive timing effect on the reinstatement of the Capacity Remuneration Mechanism in the UK.

Overall, the Thermal business has shown resilience, as a result of its highly contracted portfolio outside Europe and the optionality value of its merchant fleet in Europe.

In June 2020, the sale of a minority stake in New York’s Astoria Energy facilities was finalized. In March 2020, the commissioning of Fadhili’s 1.5 GW gas plant, a cogeneration plant in Saudi Arabia in which ENGIE has a 40% equity ownership, reaffirmed ENGIE’s leading position as an independent power producer in the Middle East.

Nuclear: Performance benefitted from improved achieved prices

Nuclear COI reached EUR -155 million, improving 35% on an organic basis.

Nuclear activities benefited from higher achieved prices, and lower OPEX, partly offset by lower availability of Belgian power plants and higher depreciation.

The ongoing Long-Term Operations (LTO) works have continued well and will be completed by the end of 2020. Including these LTO, the Belgian nuclear availability rate for 9M 2020 stood at 61%. This availability rate is expected to increase significantly in 2021.

As disclosed in 2019 financial statements accounts, ENGIE’s 2019 impairment test takes into account the 10-year extension through to and until the end of 2025, of the operating life of Tihange 1, Doel 1 and Doel 2. In addition, regarding Belgian nuclear activities beyond 2025, in calculating value in use, the Group assumes a 20-year extension of the operating life of Tihange 3 and Doel 4 which represent half of the second generation reactors (Doel 3 and 4, Tihange 2 and 3), while taking into account a mechanism of nuclear contributions to be paid to the Belgian government. With respect to second-generation reactors, the principle of a gradual phase-out of nuclear power and the schedule for this phase-out, with the shutdown of the reactors Doel 3 in 2022, Tihange 2 in 2023 and Tihange 3 and Doel 4 in 2025, has been reaffirmed in the government programme of 30 September 2020, however with the option of adjusting the legal timetable for a capacity of up to 2 GW if the circumstances require it. The sensitivity of impairment tests to this assumption is described in the Group's consolidated financial statements at June 30, 2020, together with the sensitivity to mid and long-term power prices assumptions.

Supply: H1 significant Covid-19 and temperature impacts weighed on overall performance

Supply COI strongly decreased by EUR -348 million to EUR -150 million.

Financial performance was highly affected by Covid-19 (net c. EUR 280 million) in Europe and in the US due to lower gas and electricity consumption during the lockdown periods (primarily B2B). This sharp and unexpected reduction in demand led to a negative volume effect as related margins have been booked, together with a negative price effect as power and gas positions had to be unwound in a lower price environment. B2C services provided were lower during the lockdowns and as a result of the economic context level of bad debts increased.

Warm temperature in France and Benelux also contributed to the strong decrease. These effects were only marginally offset by mitigation actions, better results in Romania and B2C margins in France.

Others

Others’ COI of EUR -72 million was overall similar to last year.

Year-on-Year comparison was negatively impacted by the positive effect in 2019 of a partial sale of a gas supply contract and by the Covid-19 impact due to credit losses for GEM (Global Energy Management). These headwinds were almost fully offset by GEM’s good performance in a context of high market volatility and by the higher contribution of GTT thanks to an strong past order book intake.

Strong Financial Position and Liquidity

ENGIE has maintained a sharp focus on maintaining a robust financial position through securing a strong liquidity position, disciplined capital allocation and OPEX and SG&A reduction. The Group has one of the strongest balance sheets in its sector, with EUR 22.5 billion of liquidity (net cash + undrawn credit facilities – outstanding commercial paper) including EUR 11.8 billion of cash, as of end of September, before SUEZ proceeds.

Issuances of a triple tranche senior bond for a total of EUR 2.5 billion in March 2020 and EUR 750 million in June 2020 further improved ENGIE’s financial position.

Net financial debt stood at EUR 25.7 billion, down EUR 0.2 billion compared with December 31, 2019. This variation was mainly due to (i) cash flow from operations (EUR 4.3 billion), (ii) other elements (EUR 0.8 billion) mainly related to foreign exchange rates and partly offset by new right-of-use assets, and (iii) the impact of the portfolio rotation program (EUR 0.7 billion). These items were partly offset by (i) capital expenditures over the period (EUR 5.2 billion) and (ii) dividend paid to non-controlling interests and treasury stocks changes (EUR 0.4 billion). The EUR 3.4 bn reduction in net financial debt following the sale of 29.9% stake in Suez will be accounted for in Q4.

Cash flow from operations amounted to EUR 4.3 billion, up EUR 0.4 billion, in the context of Covid-19 impacts, driven by action plans. This increase resulted from lower working capital requirements: firstly, from margin calls on derivatives for EUR 0.8 billion; and secondly from cash action plans at the working capital requirement level of EUR 0.7 billion, partly offset by the EBITDA decrease.

At the end of September 2020, the net financial debt to EBITDA ratio amounted to 2.7x, increasing compared with the end of 2019. The average cost of gross debt was 2.41%, down 29bps compared with the end of 2019, thanks to optimized liability management as well as to a slight decrease in interest rates in Brazil and to a lesser extent in Europe. In addition, Brazilian real depreciation has reduced the proportion of higher-rate debt to lower- rate euro-denominated debt.

At the end of September 2020, net economic debt(10) to EBITDA ratio stood at 4.4x, also increasing compared with the end of 2019.

On November 9th Moody’s lowered its long-term rating to Baa1 with a stable outlook.

On September 24th Fitch affirmed its long-term rating of A and changed the outlook from stable to negative. On April 24th S&P lowered its long-term rating to BBB+ and its short-term rating to A-2.

Dividend policy maintained

As previously communicated at the Group’s General Meeting on May 14th, 2020, ENGIE affirms its intent to resume dividend payment, within the framework of the policy announced last year, i.e. 65% to 75% of pay-out ratio on the basis of net recurring income Group share. The Board will decide on the dividend to be proposed at the time of the 2020 financial closing.

2020 Guidance

As outlined previously, ENGIE expects to achieve COI and net recurring income within the stated 2020 guidance range.

As a reminder, ENGIE’s financial anticipations for 2020 are:

- a net recurring income Group share between EUR 1.7 billion and EUR 1.9 billion. This guidance is based on an indicative EBITDA range of EUR 9.0 billion to EUR 9.2 billion and COI range of EUR 4.2 billion to EUR 4.4 billion.

- an economic net debt/EBITDA ratio above 4.0x for 2020 and below or equal to 4.0x over the long-term.

- CAPEX to be between EUR 7.5 billion and EUR 8.0 billion, including c. EUR 4.0 billion of growth investments, c. EUR 2.5 billion of maintenance CAPEX and c. EUR 1.3 billion of nuclear funding.

9M financial review

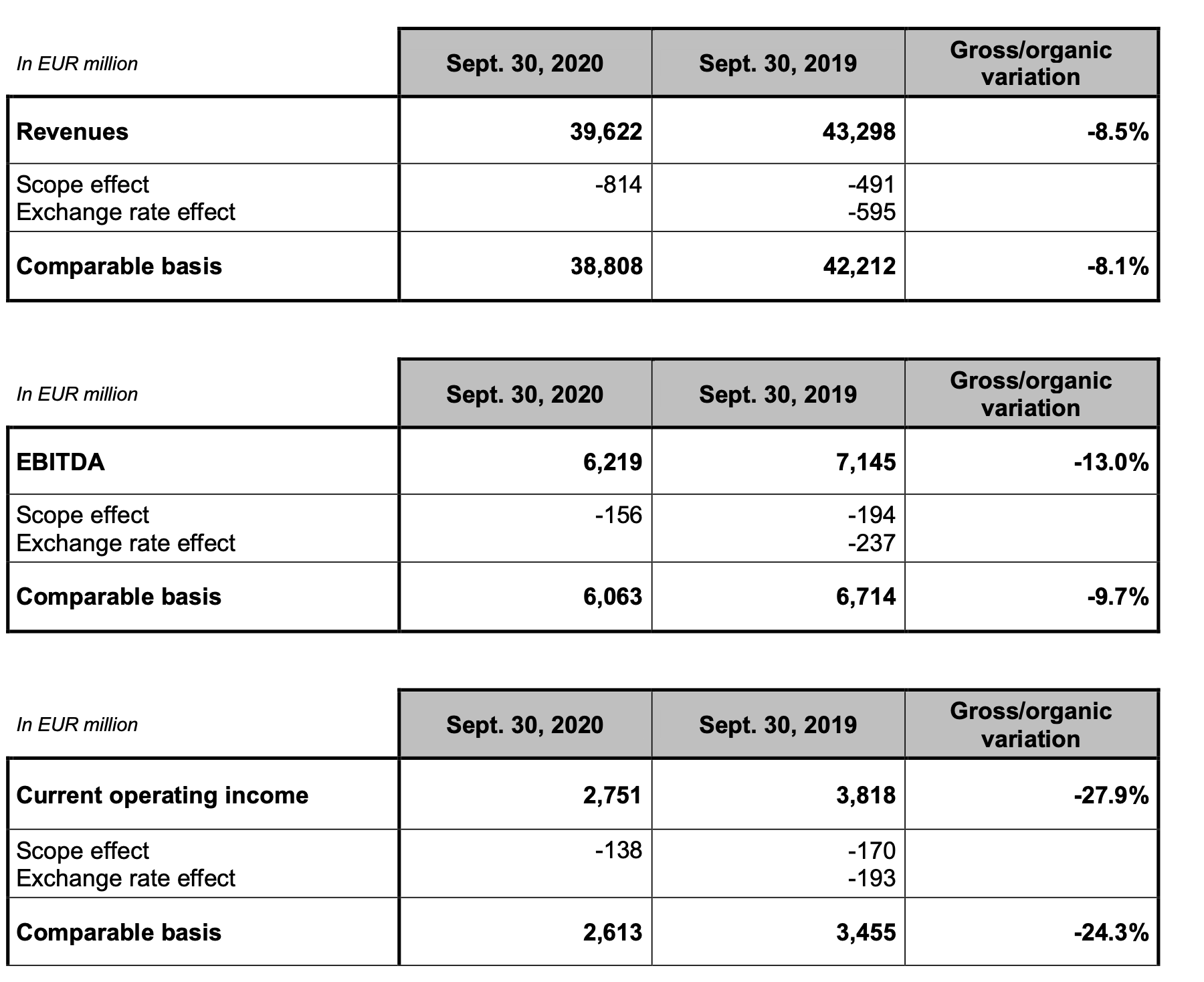

Revenues of EUR 39.6 billion

Revenues were EUR 39.6 billion, down 8.5% on a gross basis and 8.1% on an organic basis.

The reported revenue decrease includes a negative foreign exchange effect, mainly due to the depreciation of the Brazilian real against the euro and to a lesser extent to the depreciation of the Argentinian peso and the Australian dollar against the euro only partly offset by an aggregate positive scope effect. Changes in the scope of consolidation included various acquisitions in Client Solutions, primarily in the United States with Conti and in Europe with Powerlines, partly offset by the disposals of the stake of Glow in Thailand in March 2019, the B2C Supply activities in the UK at the beginning of 2020 and coal assets in Germany and the Netherlands.

The organic revenue decrease was primarily driven by the Covid-19 crisis and mild temperatures, impacting mainly Supply and to a lesser extent, Client Solutions activities across all geographies, the termination of an LNG contract in North America and to a lesser degree lower distribution revenues in Networks.

These impacts have only been partly offset by higher revenues in Brazil thanks to the commissioning of Pampa Sul in Thermal and Umburanas in Renewables and a higher level of thermal dispatch.

EBITDA of EUR 6.2 billion

EBITDA was EUR 6.2 billion, down 13.0% on a gross basis and 9.7% on an organic basis.

These gross and organic variations are overall in line with the current operating income decrease, except for the increase in depreciation attributable to the increase of the dismantling asset resulting from the triennial review of nuclear provisions that occurred at the end of last year, higher depreciation in nuclear activities linked with LTO works and to the amortization of some gas distribution assets in France, which are not taken into account at EBITDA level.

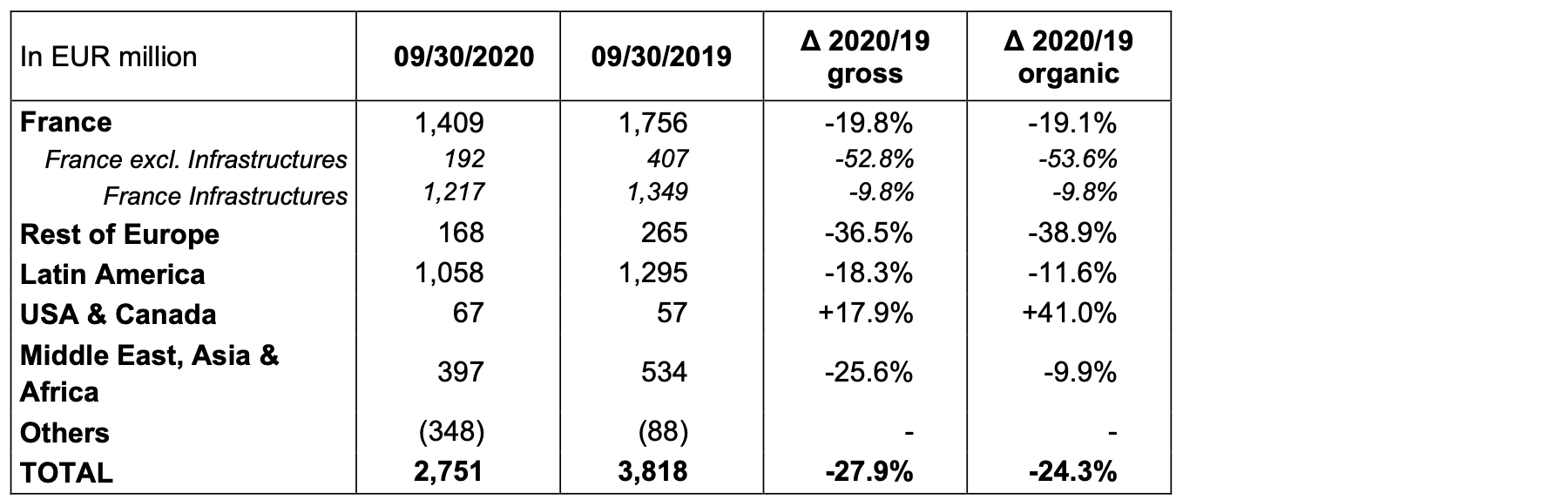

Current operating income of EUR 2.8 billion

Current operating income amounted to EUR 2.8 billion, down 27.9% on a reported basis and 24.3% on an organic basis.

France reported an organic COI decrease. For France excluding Infrastructures, the organic decrease was driven by Covid-19 impacts and negative temperature effects on Supply and Client Solutions, partly offset by higher hydroelectric and wind power generation and higher hydro prices. For France Infrastructures activities, the decrease was due to lower revenues in distribution mainly impacted by record high winter temperatures, the adverse impact of Covid-19 as well as accelerated amortization of assets. These effects were partly offset by lower costs in distribution and transmission activities. COI remained stable versus last year in LNG terminal activities as well as in storage activities, where the impact of new tariffs in effect since April 1st, 2020 was offset by a better commercial performance in the UK and the absence of customer penalties recorded in 2019.

Rest of Europe showed an organic COI decrease. This decrease was mainly driven by Client Solutions notably in Benelux, the UK and Italy as a result of the Covid-19 crisis. Supply activities were also negatively impacted by warm temperatures and the impact of the Covid-19 crisis which resulted in a drop of consumption of B2B and B2C professional clients, partly offset by a better performance of Supply in Romania. Networks’ contribution decreased in Romania with a significant negative climate effect, the impact of Covid-19 and a reduction of the distribution tariff. These negative effects were only partially compensated by Nuclear activities that benefited from higher prices and lower operational expenditures partly offset by lower volumes and higher depreciation, by Thermal activities, which demonstrated good performance in Italy driven by high level of ancillaries received, as well as higher spreads captured throughout Europe, and in the UK with a 2020 catch-up in Capacity Market remuneration and by Renewables activities, which recorded good performance thanks to favourable wind conditions in most countries.

Latin America reported an organic COI decrease, mainly due to positive operational one-offs in 2019 related to liquidated damages received in Chile and Brazil, lower power demand and PPA prices in Peru, lower gas volume distributed in Argentina and Mexico and price effect in Brazil. These impacts were partly offset by organic growth in Brazil mainly thanks to commissioning of Pampa Sul (Thermal) and Umburanas (Wind farm), higher Jorge Lacerda generation (Thermal) and construction revenues from Gralha Azul.

USA & Canada reported an organic COI increase, mainly driven by the contributions of four renewable projects commissioned since last year and margin recovery in services, partly offset by the end of a LNG contract, a weaker performance in Supply activities mainly due to the Covid-19 crisis and warm temperatures to a lesser extent.

Middle East, Asia & Africa reported an organic COI decrease. The organic decrease mainly resulted from Thermal with unfavourable net negative one-offs in the Middle East, the expiry of a PPA in Turkey as well as from lower contributions in Supply in Australia and Africa. These negative effects were slightly offset by the higher performance in Renewables and in Client Solutions.

Others reported a significant organic COI decrease. This decrease was mainly due the Covid-19 crisis impact on SUEZ, Entreprises & Collectivités (also impacted by temperatures), new businesses and GEM that despite a sound performance of market activities, was impacted by the 2019 positive one-off following the partial sale of gas supply contract. These negative impacts were partly offset by the good contribution of GTT.

The presentation of the Group’s 9M 2020 financial information used during the investor conference call is available to download from ENGIE’s website: https://www.engie.com/en/finance/results/2020

UPCOMING EVENTS

- February 26, 2021: Publication of FY 2020 results

- May 18, 2021: Publication of financial information as of March 31

- May 20, 2021: 2021 Shareholders General meeting

- July 30, 2021: Publication of H1 2021 results

Footnotes

1 Net of DBSO (Develop, Build, Share & Operate) and tax equity proceeds

2 New Current Operating Income (COI) definition excludes the non-recurring share in net income of equity method entities

3 Organic variation: gross variation without scope and foreign exchange effect

4 Main assumptions for these targets and indications: average weather in France for H2 2020, full pass through of supply costs in French regulated gas tariffs, no major regulatory, accounting or macro-economic changes, market commodity prices as of 06/30/2020, average forex for 2020: €/$: 1.11; €/BRL: 5.79, no significant impacts from disposals not already announced, continued/gradual return from lockdowns across key geographies with no new major lockdowns in key regions

5 Variations vs. 9M 2019

6 Cash Flow from operations= Free Cash Flow before maintenance CAPEX

7 Including the activities of Engie Energies Services (for all companies in the Cofely and France Réseaux perimeters representing a turnover of around EUR 4.5 billion)

8 Based on 2019 results; ranges to be further narrowed for the preparation of related financial statements (accounting principles and intercompany transactions)

9 Including in France the activities of Ineo and Axima representing a turnover of around EUR 4.8 billion

10 Net economic debt amounted to EUR 41.3 billion at the end of September 2020, up EUR 0.2 billion compared with the level at end of December 2019; it includes, in particular, nuclear provisions and post-employment benefits

Important notice

The figures presented here are those customarily used and communicated to the markets by ENGIE. This message includes forward-looking information and statements. Such statements include financial projections and estimates, the assumptions on which they are based, as well as statements about projects, objectives and expectations regarding future operations, profits, or services, or future performance. Although ENGIE management believes that these forward-looking statements are reasonable, investors and ENGIE shareholders should be aware that such forward-looking information and statements are subject to many risks and uncertainties that are generally difficult to predict and beyond the control of ENGIE, and may cause results and developments to differ significantly from those expressed, implied or predicted in the forward-looking statements or information. Such risks include those explained or identified in the public documents filed by ENGIE with the French Financial Markets Authority (AMF), including those listed in the “Risk Factors” section of the ENGIE (ex GDF SUEZ) reference document filed with the AMF on March 18, 2020 (under number D.20-141). Investors and ENGIE shareholders should note that if some or all of these risks are realized they may have a significant unfavourable impact on ENGIE.