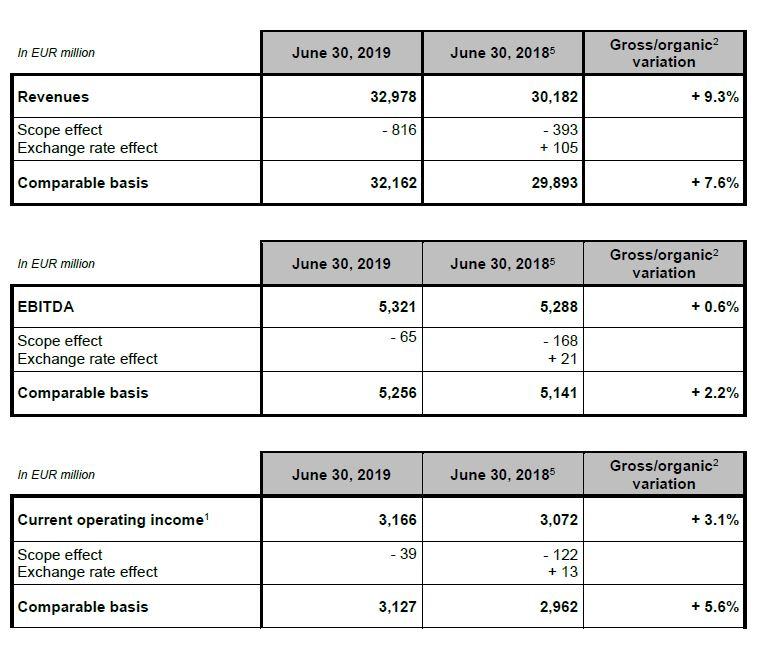

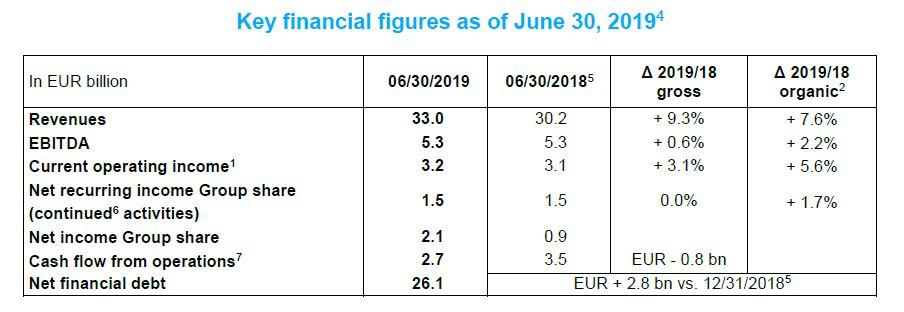

Presenting the 2019 first half financial results, Isabelle Kocher, ENGIE’s CEO, said: “The Group results improved, thanks to a solid second quarter mainly driven by Energy Management, Nuclear, lower than average temperatures and improved Client Solutions performance on a sequential basis from the first to the second quarter. We reaffirm our 2019 guidance3 of net recurring income (Group share) between EUR 2.5 billion to EUR 2.7 billion, based on the positive momentum built over the second quarter and our visibility for rest of the year."

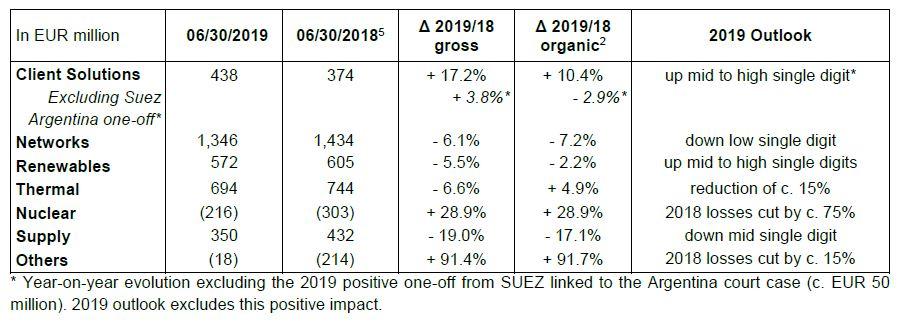

- Energy management results were strong, driven by gas contract renegotiations and international activities;

- Nuclear was driven by achieved price improvements and higher availability following the restart of all seven Belgian production units;

- Client Solutions results improved significantly on an underlying basis performance on a sequential basis from the first to the second quarter but remained atypical due to dynamics in certain markets. SUEZ one-offs additionally contributed;

- Renewables were impacted by lower hydro power production in France partly offset by commissioning of wind capacities;

- Thermal was affected by the disposal of Glow, partly offset by positive Power Purchase Agreement (PPA) effects in Latin America and positive contribution from gas power plants in Australia and Europe;

- Supply activities continued to suffer mainly from margin contractions in French retail;

- Networks were impacted by several headwinds, particularly in gas transmission in France with the end of subscriptions on the North-South pipe and tariff linearization.

Cash flow from operations7 decreased due to timing effects from commodity related margin calls, notwithstanding increasing operating cash flow and improving operating working capital requirements. Management team expects a substantial improvement for the full year 2019.

Net financial debt increased in comparison with end of 20185, due to high Capex which were only partly offset by disposal proceeds. ENGIE also paid a higher than usual dividend during the first half of 2019 (EUR0.75 per share paid in May, no more interim dividend next October).

The Group’s robust financial structure has been reaffirmed by S&P, which confirmed its A- rating in April, and by Fitch, which confirmed its A rating in June, both maintaining their stable outlook. In June, as announced, Moody’s downgraded its rating from A2 to A3 following the adoption of the Loi PACTE in France which has prompted a reappraisal of its one notch uplift for government support.

ENGIE continued to pursue its strategy, focused on zero-carbon transition leadership in the first half of 2019, with strategic progress made particularly in Renewables, complemented by the TAG acquisition in Networks. Management team expects growth to further accelerate over the second half, driven by improving underlying business performance across the main activities of the Group.

In Client Solutions, ENGIE and its partners were awarded a 35-year energy efficiency contract in Ottawa (Canada) to deliver and modernize heating and cooling systems for Government buildings. In addition, ENGIE acquired Conti in North America, a company delivering services in the building, design, engineering and construction sectors. Over the second half, Client Solutions results are expected to benefit from contract phasing effects expected to subside, from increasing order backlog and contributions from tuck-in acquisitions as well as from the performance plan to continue to address markets with increasing competitive intensity affecting margins.

In Networks, ENGIE announced on June 13, 2019 that the consortium in which it holds a majority stake has completed the acquisition of a 90% shareholding in TAG, the largest gas transmission network owner in Brazil. TAG has a portfolio of long-term contracts providing an attractive earnings stream and rebalancing ENGIE’s geographic exposure in Networks activities. Over the second half, Networks results will continue to be impacted by the constraints which were evident in the first half, partly offset by the organic2 French distribution and transmission tariff increases. The TAG acquisition will also positively contribute to earnings.

In Renewables, 1.4 GW of wind and solar capacity was commissioned in the first half, confirming a marked acceleration after the commissioning of 1.1 GW for the full year 2018, and 8.7 GW are now installed, under construction or secured to reach the 9 GW target of commissionings over 2019-21. The new joint-venture in Mexico with Tokyo Gas demonstrates our ability to deploy our DBSO8 model and attract strong partners to accelerate the development of our portfolio, and the signing of a strategic Memorandum of Understanding with EDP aims at creating a leading global offshore wind player. Over the second half, Renewables results are expected to be enhanced by the ramp-up of wind contributions (especially in Brazil), improving hydrology in France and new DBSO8 margins to be recorded mainly in the second half.

In Thermal, ENGIE continued to execute its strategy of carbon footprint reduction. ENGIE closed the disposal of its 69.1% stake in Glow in Thailand and Laos (3.2 GW of generation capacity, of which 1.0 GW is coal), ending its participation in coal in Asia-Pacific. ENGIE also announced the disposal of its German and Dutch coal assets (capacity of 2.3 GW), reducing coal to below 4% of its global power generation capacity after closing of this transaction. Over the second half, Thermal results will be impacted by these disposals.