Presenting the 2019 financial results, Judith Hartmann, EVP and Group Chief Financial Officer, said:

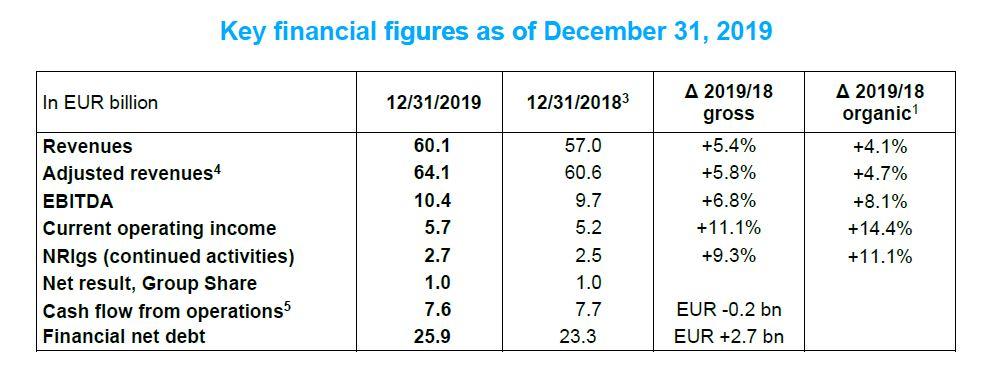

In 2019, the Group reported good financial performance, with revenues of EUR 60.1 billion, an organic increase of 4%, and NRIgs of EUR 2.7bn, up 11% organically. These results were driven by increased nuclear availability and energy management performance. 2019 saw a range of activity enhancing the Group’s growth profile, including commissioning of 3.0 GW of new renewable generation capacity, quadruple our 2018 run-rate and in line with our medium-term target. We strengthened our Latin American presence with the acquisition of a major Brazilian gas transmission network. Recent acquisitions built momentum in Client Solutions. We also continued to decarbonize our power generation portfolio with the completion of coal disposals in Asia and Europe. Alongside this performance, greater medium-term visibility was reached with the updates of the French gas network remuneration scheme and the Belgian nuclear provision and funding arrangements. Going forward, we remain firmly committed to a strong investment grade credit rating, which should enable us to seize attractive investment opportunities while continuing to offer one of the strongest balance sheets in the sector.

Jean-Pierre Clamadieu, Chairman of the Board of Directors of ENGIE, added:

The Board and top management are fully aligned to pursue ENGIE’s transformation path to be a leader in the energy and climate transition. The interim collective management in place - namely Paulo Almirante, Judith Hartmann and Claire Waysand – has the priority to maintain the engagement of the teams and to reach our operational and financial performance. They will set up and implement a roadmap to simplify, clarify and strengthen our business model. They can count on my support to ensure the success of this transition period.

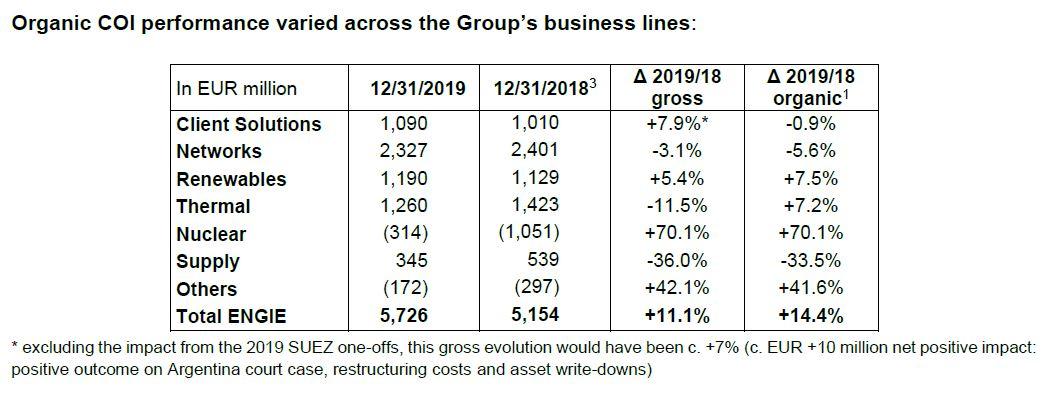

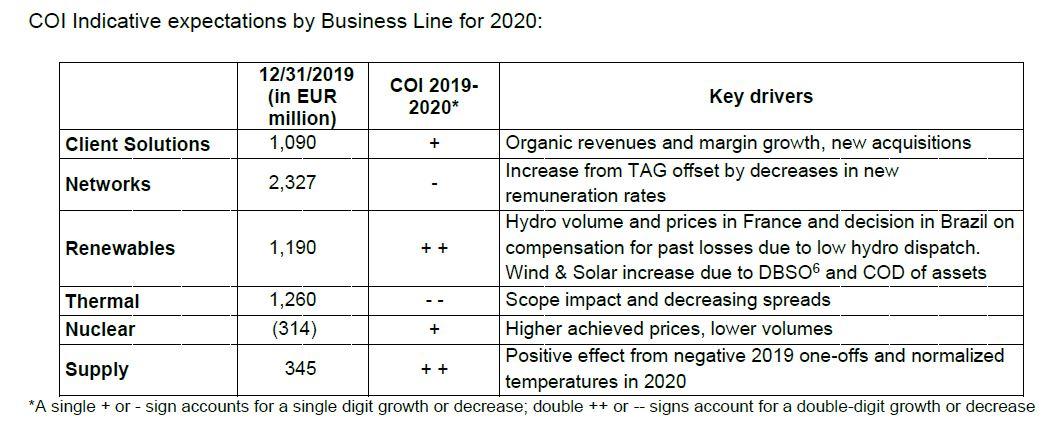

In 2019, the drivers of the gross COI evolution were as follows:

- Nuclear was driven by higher availability of Belgian production units and slightly more favorable achieved prices;

- In business line Others, increasing Energy Management results were mainly driven by the partial sale of a gas supply contract, performance of market activities and gas contract renegotiations;

- Client Solutions results benefited from the contribution of acquisitions and the performance of decentralized energy activities, partly offset by investments in business development capability and some operational restructuring actions;

- Networks was impacted by several negative effects outside France (mainly one-offs and temperature) as well as several adverse factors in France that were expected and are mostly temporary (mainly tariff smoothing in transmission). Networks also benefited from the first year contribution of the TAG gas transmission pipeline in Brazil, acquired in mid-2019;

- Renewables benefited from higher Brazilian hydro prices and increasing commissioning of renewable capacity (3.0 GW in 2019). The target of 9 GW to be commissioned from 2019 to 2021 is now fully secured;

- Supply activities continued to be impacted by a difficult market context, mainly from margin contractions in French retail, by positive 2018 one-offs in Benelux and adverse temperature effects in Australia and France;

- Thermal was impacted by the disposal of Glow partly offset by Power Purchase Agreement (PPA) performance and positive market price conditions in Chile as well as the reinstatement of the capacity remuneration mechanism in the UK.

ENGIE continued to pursue its strategic focus on the energy transition in 2019.

In Client Solutions, ENGIE and its partners won commercial contracts for the University of Iowa (United States), government buildings in Ottawa (Canada), a “smart region” around Angers (France) and industrial buildings in Singapore. In addition, ENGIE made several acquisitions including Conti in North America, Otto Industries in Germany and Powerlines in Austria. ENGIE Impact was created to bring large customers with solutions to build their sustainability roadmap and accelerate their energy transition.

In Networks, ENGIE announced on June 13, 2019 that the consortium in which it holds a majority stake completed the acquisition of a 90% shareholding in TAG, the largest gas transmission network owner in Brazil. TAG has a portfolio of long-term contracts providing an attractive earnings stream and improves diversification of ENGIE’s geographic footprint in Networks activities. In January 2020, ENGIE also further strengthened its position in Brazil by announcing the acquisition of a project of a 1,800 km power transmission line. Finally, ENGIE gained visibility on the financial outlook of its French gas networks activities with the conclusion of the regulatory reviews between the end of 2019 and the beginning of 2020.

In Renewables, 3.0 GW of renewable capacity was commissioned and the 9 GW commissioning target over 2019-21 is now fully secured. The new joint-venture in Mexico with Tokyo Gas and the strategic partnership signed with Edelweiss Infrastructures Yield in India at the beginning of 2020 demonstrate ENGIE’s ability to deploy the DBSO6 model and attract partners for the development of its portfolio. In addition, ENGIE, along with financial partners, won a bid to acquire a 1.7 GW hydroelectric portfolio from EDP in Portugal. Finally, in January 2020, ENGIE reached an agreement with EDPR for the 50/50 joint-venture in offshore wind to create a global offshore wind player.

In Thermal, ENGIE continued to execute its carbon footprint reduction strategy, with coal now approximately 4% of global power generation capacity, following the disposal of its 69.1% stake in Glow in Thailand and Laos (3.2 GW of generation capacity, of which 1.0 GW is coal), ending its participation in coal in the Asia-Pacific region, and the disposal of its German and Dutch coal assets (capacity of 2.3 GW).

In Nuclear, an arrangement on Belgian nuclear provisions was reached reducing uncertainty for all parties regarding the level of provisions and their funding.

New set of Corporate Social Responsibility objectives

Convinced that Corporate Social Responsibility is one of the success criteria for its future, ENGIE has adopted a new set of objectives to be met by 2030 (list of 19 objectives), aligned to the United Nations Sustainable Development Goals.

Among these objectives, 3 key objectives will be integrated in a recurring reporting given the large role they play in moving ENGIE forward:

- • Greenhouse Gases emission from production of electricity should be reduced from 149 Mt in 2016 to 43

Mt in 2030 (for 80 Mt in 2019). ENGIE obtained the 2° certification by the SBTi (Science Based Targets

initiative) of its Greenhouse Gases emission trajectory, recognized as compatible with the Paris

Agreement; - on gender diversity, the share of women in the management of the Group should increase from c. 23% in

2016 to 50% in 2030 (for 24% in 2019), through internal promotions and external recruitment; - the share of renewable energy in the power production capacity mix should reach 58% in 2030, compared

to 20% in 2016 (for 28% in 2019).

Analysis of financial results as of December 31, 2019

Revenues of EUR 60.1 billion

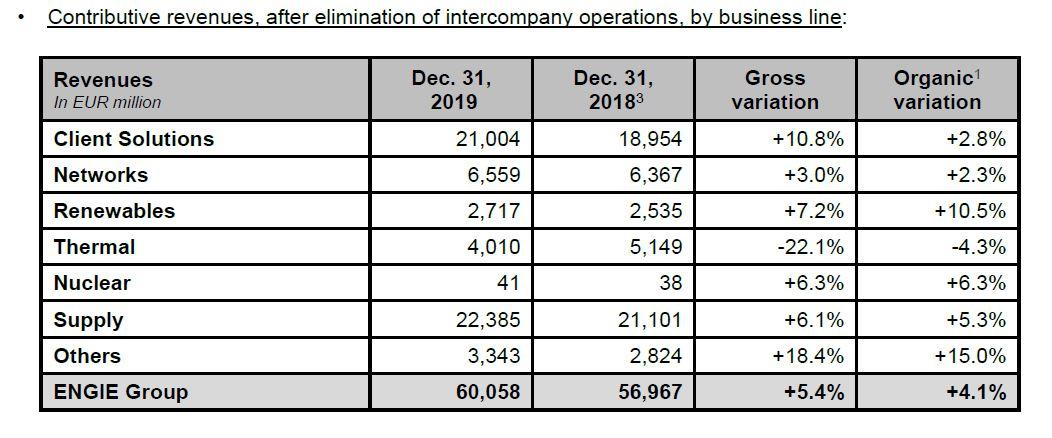

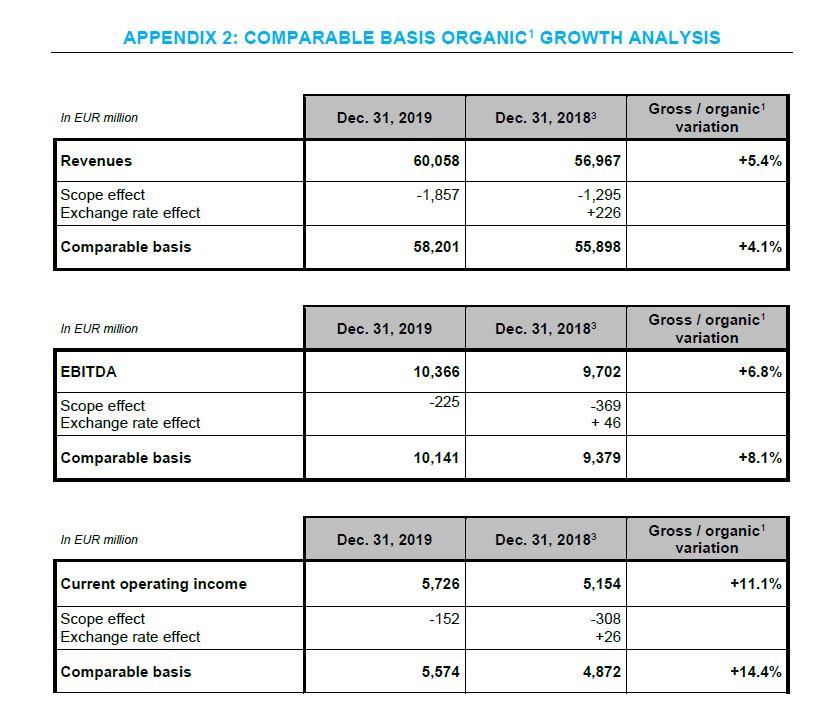

Revenues were EUR 60.1 billion, up 5.4% on a gross basis and 4.1% on an organic1 basis.

Reported revenue growth was driven by scope effects, including various acquisitions in Client Solutions (primarily in the United States with Conti, France and Latin America with CAM) and in BtoB Supply in the US, partially offset by the disposals of ENGIE’s stake in Glow in Thailand in March 2019 and of BtoB Supply activities in Germany at the end of 2018. This growth also includes a slightly positive foreign exchange effect, mainly due to the appreciation of the US dollar, partly offset by the depreciation of the Argentinian peso and the Brazilian real against the euro.

Organic1 revenue growth was primarily driven by Supply revenues in North America, France and Europe, growth in Client Solutions in Europe, energy management services and favorable market conditions for Global Energy Management (GEM) activities and strong momentum in Latin America (PPA portfolio growth in Chile as well as commissioning of new wind and solar farms in Brazil). This growth was partially offset by lower revenues from Supply activities in the UK and Australia and from Thermal activities in Europe.

Clients Solutions revenues were up 11% on a gross basis and 3% on an organic1 basis, benefiting from a positive effect of acquisitions and favorable market context for industrial clients in Europe.

EBITDA of EUR 10.4 billion

EBITDA was EUR 10.4 billion, up 6.8% on a gross basis and 8.1% on an organic1 basis.

These gross and organic1 variations are overall in line with the current operating income growth, except for the increase in depreciation mainly due to the commissioning of assets in Latin America and in France, especially in Networks which are not taken into account at EBITDA level.

In addition, Lean 2021, which contributes to the organic increase at EBITDA and COI levels, exceeded the 2019 targets and is on track to meet the target set for 2021.

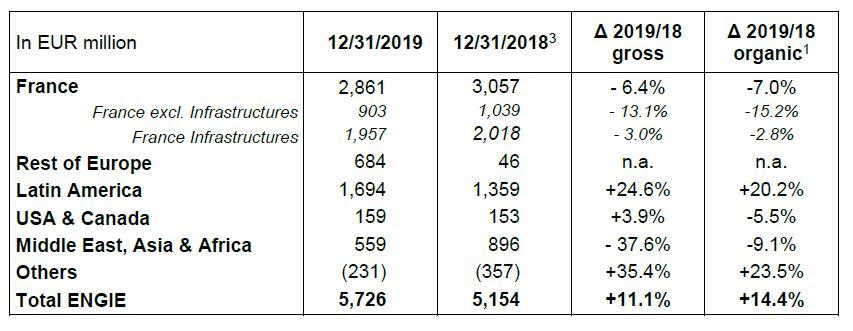

Current operating income of EUR 5.7 billion

Current operating income amounted to EUR 5.7 billion, up 11.1% on a reported basis and 14.4% on an organic1 basis.

The reported COI growth includes a positive foreign exchange effect, mainly due to the appreciation of the US dollar, partly offset by the depreciation of the Argentinian peso and the Brazilian real against the euro. This positive effect is partly offset by an aggregate negative scope effect, including the disposal of the 69.1% stake in Glow in Thailand and Laos, partly offset by various acquisitions predominantly in Networks (TAG) and in Client Solutions.