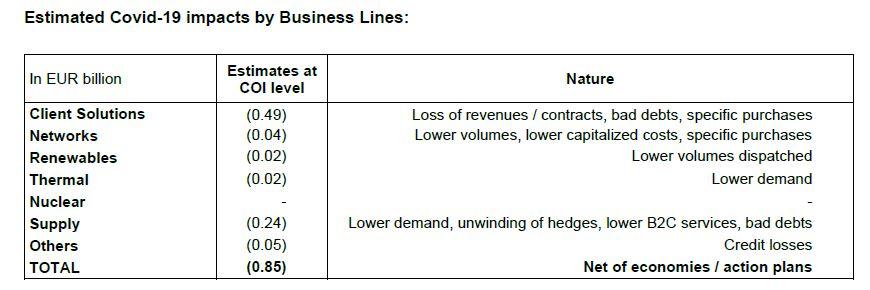

These estimates have been prepared in accordance with a standard guidance applied across our businesses under a dedicated oversight process (losses of revenues being inherently subject to more judgement than the identification of specific costs incurred). These estimates relate to operating items only, and are presented net of savings and mitigating management action plans. By construction, these estimates exclude foreign exchange and commodity price effects incurred in our various businesses, whether positive or negative.

Client Solutions: Activities strongly impacted by Covid-19 in Q2

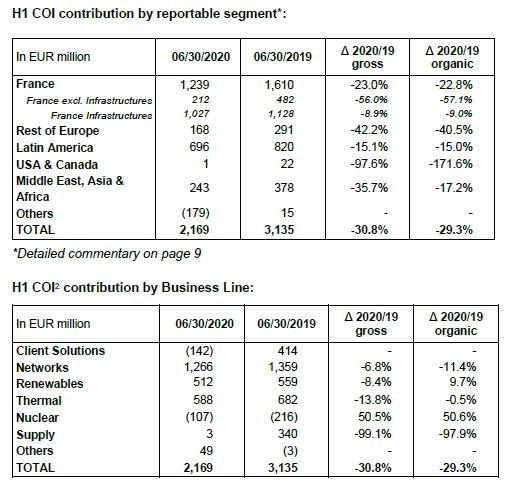

Client Solutions’ COI decreased significantly to EUR -142 million, mainly as a result of the Covid-19 crisis.

After a year over year increase of +5% in Q1 2020, Client Solutions revenues decreased by ‐16% in Q2. The Business Line experienced a strong impact in the asset-light business model predominately in Europe but also in the US. Revenues decreased significantly in all geographies during the containment periods with a very gradual recovery.

In France, as well as in other countries in Europe and Latin America, the Group utilized government temporary unemployment schemes. To further mitigate revenue impacts, the Group focused on variabilising costs as much as possible. Subcontractor and labour costs were reduced in all geographies. Other costs areas such as energy, equipment, consumed materials, consulting and IT were also lowered. All in all, ENGIE managed to reduce costs by 9% in Q2 2020.

Covid-19 weighed strongly on Suez’s results.

Temperature and energy price effects in Europe also negatively impacted the asset-based activities. Excluding these negative effects, DHC and on-site generation activities were relatively resilient, showing for example an increase in installed capacity of heat and cold of 2.5%.

Lastly, start-up costs from ENGIE Impact and other investments for the future were also reflected in asset-light results.

Networks: Performance demonstrates overall operational and financial resilience

Networks’ COI was EUR 1,266 million, down 11% on an organic basis.

In France, the Networks performance was impacted by unusually mild temperature and Covid-19 on distributed volumes, particularly during the second quarter, despite lower levels of expenditure in distribution and transmission activities during lockdown. Nevertheless, negative volume effects will be recovered in the medium-term under the clawback accounts mechanism.

Networks in Mexico and Argentina suffered from negative volume effects.

Lastly, headwinds related to price and temperature effects weighed on Networks in the rest of the world.

Overall, in Networks, the Group maintained strong operational performance with high levels of network safety and reliability. In France, along with the pick-up in activity levels, gas smart meter installation is resuming.

In Latin America, following the acquisition of 90% of TAG in June 2019, ENGIE, with its partner Caisse de Dépôt et Placement du Québec, successfully acquired the remaining 10% in July 2020. In addition, earlier this year ENGIE closed the acquisition of a 30-year greenfield concession project in northern Brazil that comprises the construction, operation and maintenance of a 1,800 km electric power transmission line, a new substation and the expansion of 3 additional substations.

Renewables: Continued growth and operational progress; FX impact from weaker BRL

Renewables COI contribution was EUR 512 million, up 10% on an organic basis. This is mainly due to higher hydroelectric and wind generation volumes in France, relatively favourable wind conditions in most European countries, only partly offset by less favourable hydro conditions in Brazil. Successful commissioning in North America also contributed to this increase.

During the first half of 2020, almost 1.2 GW of onshore wind and solar capacity was added, including 0.9 GW of capacity commissioned and, as of June 30th, 2020 5.5 GW of renewables capacity is under construction.

On July 27th, 2020, ENGIE and its partners finalized the commissioning of WindFloat Atlantic, a 25 MW floating wind farm in Portugal, the world’s first semi-submersible floating wind farm. This commissioning is a landmark achievement for the sector as floating wind technology contributes to the diversification of energy sources and provides access to untapped marine areas.

On July 21st, 2020, ENGIE and EDP Renováveis announced the creation of Ocean Winds, a joint venture in the floating and fixed offshore wind energy sector equally controlled by both partners. The new company will act as the exclusive investment vehicle of each partner to capture offshore wind opportunities around the world and aims to become a top five offshore global operator by combining the development potential of both partners.

On July 2nd, 2020, ENGIE announced the signing of an agreement to sell 49% of its equity interest in a 2.3 GW US renewables portfolio to Hannon Armstrong, a leading investor in climate change solutions. ENGIE will retain a controlling share in the portfolio and continue to manage the assets. When commissioned, this 2.3 GW portfolio, will comprise 1.8 GW onshore wind and 0.5 GW solar photovoltaic projects and will represent a major milestone in achieving ENGIE’s goal of commissioning 9 GW additional renewable capacity between 2019 and 2021. ENGIE has secured nearly USD 2 billion of tax equity commitments for this portfolio. Tax equity financing is the traditional structure used in the United States to support the development of renewable projects. This tax equity financing – the largest ever in the US – demonstrates ENGIE’s successful development in this market.

Lastly, in March 2020, ENGIE finalized Renvico’s acquisition to strengthen its growth in onshore wind in Italy and France. This acquisition has enabled ENGIE to double its installed onshore wind capacity in Italy to over 300 MW.

Thermal: Robust operational performance maintained and expected COI impact of scope changes

Thermal COI amounted to EUR 588 million, flat on an organic basis. The Thermal business has shown resilience, as a result of its highly contracted portfolio and high achieved spreads and ancillaries mainly in Europe.

The negative impacts of the Covid-19 crisis leading to lower demand in Chile and Peru, and the significant liquidated damages received in 2019 in South America have been fully offset by the performance of thermal assets in Europe, the positive timing effects on the reinstatement of the Capacity Remuneration Mechanism in the UK and higher generation in Brazil, including Pampa Sul since its COD in June 2019.

In June 2020, the sale of New York’s Astoria Energy facilities was finalized and represents another step in ENGIE’s transition in the US from a merchant generator.

In March 2020, ENGIE reaffirmed its leading position as an independent power producer in the Middle East with the commissioning of Fadhili’s 1.5 GW gas plant, a cogeneration plant in Saudi Arabia in which ENGIE has a 40% equity ownership.

Nuclear: Performance benefitted from improved achieved prices in H1

Nuclear COI reached EUR -107 million, up 51% on an organic basis. Nuclear activities benefited from higher energy margin due to a positive price effect, and lower Opex, partly offset by higher depreciation.

The ongoing Long-Term Operations (LTO) works have continued well with works for Doel 1 and 2 complete and Tihange 1 underway. Including these LTO, the nuclear availability rate for H1 2020 stood at 66%.The availability rate in 2021 is expected to increase significantly.

Supply: Performance impacted by lower volumes due to Covid-19 and temperature

Supply COI amounted to EUR 3 million, down 98% on an organic basis. Financial performance was highly affected by Covid-19 (EUR -240 million) in Europe and in the US due to lower gas and electricity consumption during the lockdown periods (primarily B2B). This sharp and unexpected reduction in demand led to a negative volume effect as related margins were been booked, together with a negative price effect as power and gas positions had to be unwound in a lower price environment. Also, lower B2C services were provided during the lockdowns. Warm temperature in France and Benelux also contributed to the strong decrease. These effects were only marginally offset by better results in Romania and B2C margins in France.

Others

Others’ COI strongly increased, up to EUR 49 million. This increase reflects mainly higher contribution of GTT thanks to a good order book and GEM’s (Global Energy Management) good performance in a context of high market volatility.

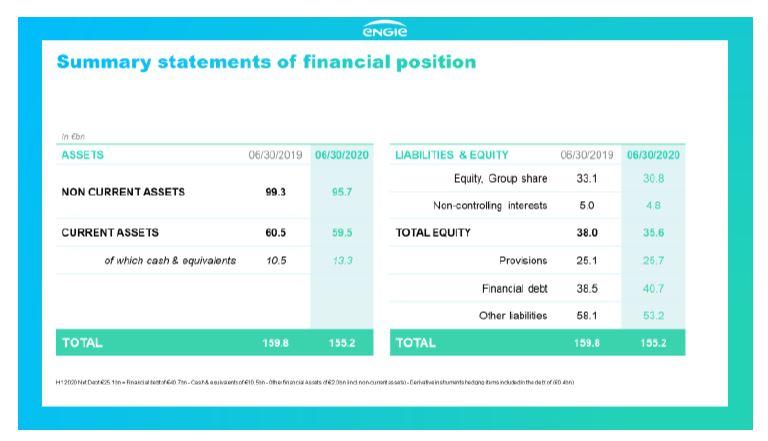

Strong Financial Position and Liquidity

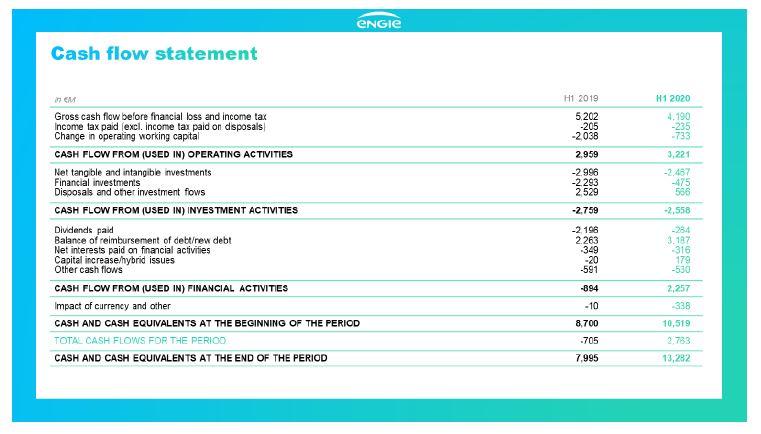

ENGIE has maintained a sharp focus on maintaining a robust financial position through securing a strong liquidity position, disciplined capital allocation and OPEX and SG&A reduction. The Group has one of the strongest balance sheets in its sector, with EUR 23.5 billion of liquidity (net cash + undrawn credit facilities – outstanding commercial paper) including EUR 13.1 billion of cash, as of end of June.

Issuances of a triple tranche senior bond for a total of EUR 2.5 billion in March 2020 and EUR 750 million in June 2020 further improved ENGIE’s financial position.

Net financial debt stood at EUR 25.1 billion, down EUR 0.8 billion compared with December 31, 2019. This variation was mainly due to (i) cash flow from operations (EUR 3.0 billion), (ii) the impact of the portfolio rotation program (EUR 0.6 billion, including notably the EUR 0.4 billion proceeds from the Astoria sale in the United States) and (iii) other elements (EUR 0.5 billion) mainly related to foreign exchange rates and partly offset by new right-of-use assets. These items were partly offset by (i) capital expenditures over the period (EUR 3 billion) and (ii) dividend paid to non-controlling interests and treasury stocks changes (EUR 0.3 billion).

Cash flow from operations amounted to EUR 3.0 billion, up EUR 0.3 billion. This increase resulted from working capital requirement improvement. Firstly from margin calls on derivatives for EUR 0.7 billion and secondly from cash action plans at working capital requirement level of EUR 0.6 billion, partly offset by the EBITDA decrease.

At the end of June 2020, the net financial debt to EBITDA ratio amounted to 2.6x, increasing compared with the end of 2019. The average cost of gross debt was 2.38%, down 32bps compared with the end of 2019, thanks to optimized liability management and to a slight decrease in interest rates in Brazil and to a lesser extent in Europe. In addition, Brazilian real depreciation has reduced the proportion of higher-rate debt to lower-rate euro-denominated debt.

At the end of June 2020, net economic debt7 to EBITDA ratio stood at 4.3x, also increasing compared with the end of 2019.

On April 24th S&P lowered its long-term rating to BBB+ and its short-term rating to A-2, and on May 5th Moody’s affirmed its long-term rating of A3 and changed the outlook from stable to negative.

Governance Update

Since February 2020, the CEO transition has been carried out by Claire Waysand, General Secretary, as Interim CEO, as part of a collective management team together with Paulo Almirante, EVP and COO and Judith Hartmann, EVP and CFO.

ENGIE expects to announce the appointment in September, with the aim of the new CEO starting by the end of the year.

The process is well on track, in line with schedule announced earlier.

Dividend policy maintained

As previously communicated at the Group’s General Meeting on May 14th, 2020, ENGIE affirms its intent to resume dividend payment, within the framework of the policy announced last year, i.e. 65% to 75% of pay-out ratio on the basis of net recurring income Group share. The Board will decide on the dividend to be proposed at the time of the 2020 financial closing.

2020 Guidance

ENGIE anticipates 2020 net recurring income Group share to be between EUR 1.7 billion and EUR 1.9 billion. This guidance is based on an indicative EBITDA range of EUR 9.0 billion to EUR 9.2 billion and COI range of EUR 4.2 billion to EUR 4.4 billion.

ENGIE expects a strong recovery from Q2 levels. In Client Solutions ENGIE has focused on variabilizing costs and the order backlog remains healthy. In Supply, there has been a swift recovery in B2B power and gas demand and B2C services activity has resumed.

For 2020 ENGIE expects CAPEX to be between EUR 7.5 billion and EUR 8.0 billion, including c. EUR 4 billion of growth investments, c. EUR 2.5 billion of maintenance CAPEX and c. EUR 1.3 billion of nuclear funding.

ENGIE anticipates an economic net debt/EBITDA ratio above 4.0x for 2020 and below or equal to 4.0x over the long-term.

This guidance assumes continued, gradual return from lockdowns across ENGIE’s key geographies and does not anticipate new major lockdowns in key regions.

Focused on energy transition that drives growth

With decarbonization at the heart of its strategy, ENGIE is fully aligned with the EU Green Deal objectives and is well positioned to be a key contributor in most of the deal’s components. The EU Green Deal’s objective to increase the volume of renewables tenders and simplify the tendering processes will bring additional opportunities to the development of ENGIE’s Renewables business, one of its key pillars to growth.

As leader in energy efficiency solutions in France and in Belgium, ENGIE is very well-positioned to benefit from the stimulus package’s increased support for building renovation, efficient new-build, city planning and clean mobility. For green gases, ENGIE is already focused on producing large volumes of green hydrogen and is also committed to having 12TWh of biomethane injection in the network by 2023.

Lastly, ENGIE has a long track record of operating and maintaining district heating and cooling facilities and is well positioned to provide these solutions to additional cities and industries. For instance, in France, ENGIE has a pipeline of more than 10 DHC networks for which development and / or decarbonization could be accelerated, and there are further opportunities to accelerate industry decarbonation.

H1 financial review

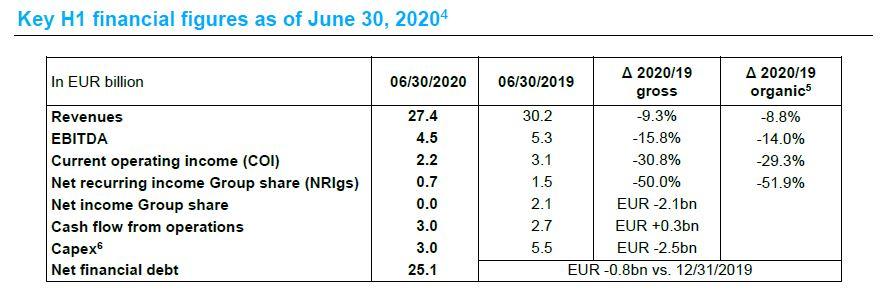

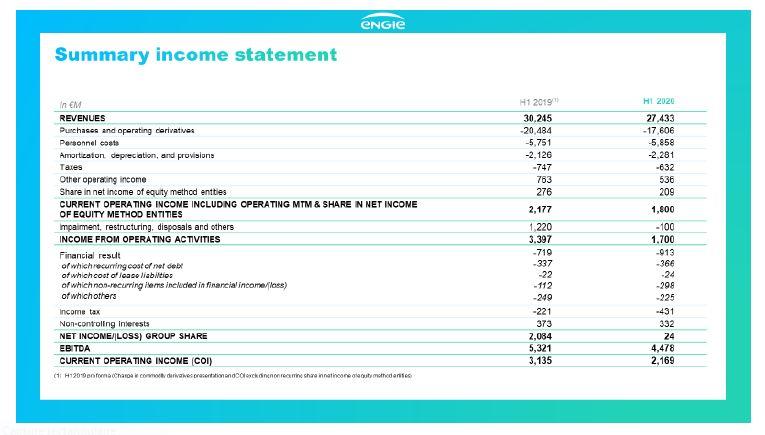

Revenues of EUR 27.4 billion

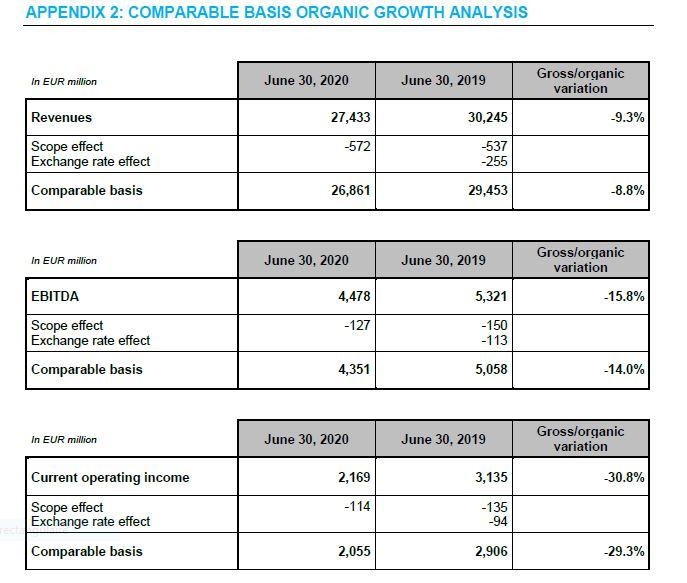

Revenues were EUR 27.4 billion, down 9.3% on a gross basis and 8.8 % on an organic basis.

The reported revenue decrease includes a negative foreign exchange effect, mainly due to the depreciation of the Brazilian real against the euro and to a lesser extent to the depreciation of the Argentinian peso against the euro, only partly offset by the appreciation of the US dollar against the euro, and to a smaller degree to an aggregate slightly positive scope effect. Changes in the scope of consolidation included various acquisitions in Client Solutions, primarily in the United States and in France, partly offset by the disposals of the stake of Glow in Thailand in March 2019 and the B2C Supply activities in the UK at the beginning of 2020.

The organic2 revenue decrease was primarily driven by the Covid-19 crisis and mild temperatures, impacting mainly Supply and to a lesser extent, Client Solutions activities across all geographies, the termination of an LNG contract in North America and to a lesser extent lower distribution in Networks.

These impacts have only been partly offset by higher revenues in Brazil thanks to the commissioning of Pampa Sul in Thermal and Umburanas in Renewables and a higher level of thermal dispatch.

EBITDA of EUR 4.5 billion

EBITDA was EUR 4.5 billion, down 15.8% on a gross basis and 14.0% on an organic basis.

These gross and organic variations are overall in line with the current operating income decrease, except for the increase in depreciation attributable to the increase of the dismantling asset resulting from the triennial review of nuclear provisions that occurred at the end of last year and to the amortization of some gas distribution assets in France, which are not taken into account at EBITDA level.

In addition, the Lean 2021 plan continued to deliver results at EBITDA and COI levels, and is currently slightly above plan.

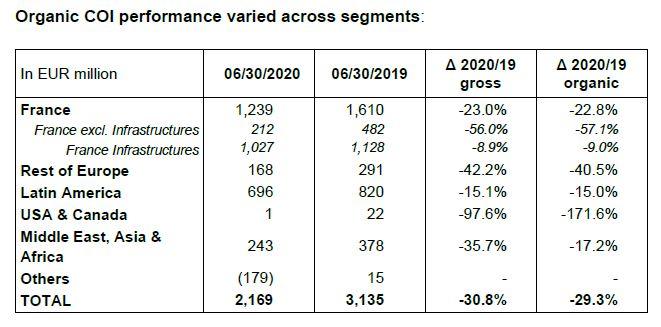

Current operating income of EUR 2.2 billion

Current operating income amounted to EUR 2.2 billion, down 30.8% on a reported basis and 29.3% on an organic basis.