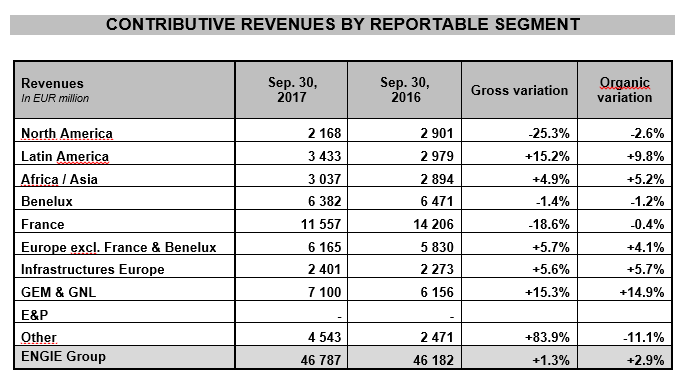

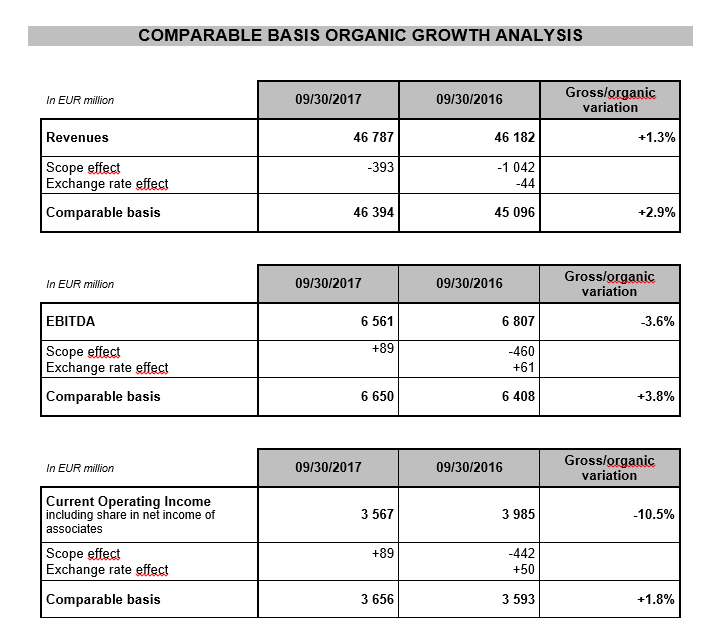

Revenues as of September 30, 2017 are EUR 46.8 billion euros, up +1.3% on a gross basis and +2.9% on an organic basis compared to end of September 2016. This organic increase is in particular attributable to the impacts of new assets commissioned, of price rises in Latin America and of the 2016 price revisions in the infrastructures business in France. Considering adverse weather effects, these positive developments are partially offset by reduced B2B sales of natural gas in France and by a decrease in renewable energy generation in France, mainly coming from hydro.

EBITDA amounted to EUR 6.6 billion, down -3.6% on a gross basis, mainly because of the scope effects linked to disposals, and up +3.8% on an organic basis compared to end of September 2016. This increase confirms the very good performance of the growth engines, i.e. renewable and thermal contracted, infrastructures and customer solutions activities, which show a gross growth of +4.6% over the period, partly offset by adverse volume impacts (hydraulic and nuclear power production).

EBITDA for the first nine months was driven by the positive impacts of the sustained performance of the Group’s growth engines, driven by the results of the “Lean 2018” performance program and by assets commissioning in Latin America. These positive elements are partially offset by the climate effects lowering the renewable energy generation in France. Besides, the merchant activities benefit from a very good performance of thermal power generation in Europe and in Australia, partially compensated by the price effects on outright power production and by the shutdown of the Tihange 1 nuclear power plant in Belgium (from September 2016 to May 2017 and since September 12, 2017).

The difference between reported and organic evolution is due to negative scope effects, mainly linked to the disposals of merchant power generation assets in the United States in June 2016 and in February 2017 and of the Paiton power plant in Indonesia end of 2016, coupled with the recognition in EBITDA of the nuclear contribution in Belgium, partially offset by a favorable foreign exchange effect mainly attributable to the Brazilian real. The temperature effect in France is slightly positive over the period but unfavorable compared to end of September 2016.

Organic EBITDA performance as of September 30, 2017 is very contrasted between the reportable segments :

- For North America segment, the decline is driven by the end of contracts in the power production activities and lower performance in the retail business, offset to some extent by the good performance of services business combined with cost savings.

- For Latin America segment, the increase is due to the commissioning of assets in Mexico and Peru, to tariff reviews in Mexico and Argentina and to higher prices in Brazil.

- For Africa / Asia segment, the growth reflects the outstanding performance of the generation and retail businesses in Australia due to electricity price increase, the improved gas distribution margins in Thailand as well as the commissioning of AzZour North in Kuwait and the successful closing of Fadhili power plant contract in Saudi Arabia. These factors are partially offset by lower availability of assets in Thailand and Turkey.

- For Benelux segment, the significant decrease is mainly due to the drop in electricity sale prices compared to 2016 and to the lower availability of nuclear assets because of the unplanned shutdown of Tihange 1 from early September 2016 to the end of May 2017 and since September 12, 2017. These impacts are partially offset by a good performance in gas and electricity sales and services activities, coupled with cost savings of the “Lean 2018” program.

- For France segment, the decline is due to a lower wind and hydro renewable energy generation and to lower volumes and margins in the retail gas business. These impacts are partially offset by the good performances in the retail electricity market and in the networks activities.

- For Europe excluding France and Benelux segment, the increase is linked to a positive price effect on sales activities (power and gas), to an increase in prices and volumes for renewable power production in the United Kingdom (First Hydro power plant), to favorable weather conditions for gas distribution activities in Romania and to cost savings of the “Lean 2018” performance plan.

- For Infrastructures Europe segment, the slight decrease is related to the lower gas storage capacity sales in France, to the annual revision of gas transport tariffs (+4.6% at April 1, 2016 and -3.1% at April 1, 2017) and to an adverse temperature effect, partially offset by a still positive impact of the annual revision of gas distribution tariffs since 2016 (+2.8% at July 1, 2016 and -2.05% at July 1, 2017).

- For Global Energy Management and Global LNG segment, the decline is mainly due to negative price effects, to lower margins in midstream activities and to difficult gas supply conditions in the south of France during the cold snap in January 2017. This was partially offset by the positive impact of a price revision to a long-term LNG supply contract concluded in Q2 2017 and by cost savings of the “Lean 2018” performance plan.

- For the Other segment, the sharp increase is driven mainly by a good performance from gas fired thermal power generation in Europe and also by savings linked to the restructuring at corporate level within the framework of “Lean 2018”.

Current Operating Income amounts to EUR 3.6 billion, down -10.5% on a gross basis and up +1.8% on an organic basis compared to end of September 2016, driven by the growth engines up +4.0% over the period. The organic growth recorded at EBITDA level is partly offset by higher depreciation and amortization charges than those of the previous year following the three-yearly review of dismantling obligations related to Belgian nuclear power plants at the end of 2016.

As of September 30, 2017, net debt reaches EUR 23.3 billion, down EUR -1.5 billion from year-end 2016, mainly thanks to the effects of the portfolio rotation program and to a favorable forex impact.

Cash Flow From Operations (CFFO) amounts to EUR 4.9 billion for the first nine months, down EUR 1.9 billion versus September 30, 2016. This evolution reflects mainly an adverse evolution in working capital variation of EUR -1.2 billion (mainly due to a favorable price effect in 2016 in gas inventories), restructuring costs and scope effects (notably the disposal of power generation assets in the United States). However, the intrinsic operational cash flow generation remains robust.

At the end of September 2017, the net debt (excluding E&P internal debt) to EBITDA ratio comes out at 2.35x, in line with the target of a ratio less than or equal to 2.5x. The average cost of gross debt declines compared to end 2016 at 2.6%.

The Group confirms its 2017 financial targets(2), without any change in the E&P accounting treatment (7):

- a net recurring income group share in the mid-range of the EUR 2.4 to 2.6 billion target, based on an indicative EBITDA range of EUR 9.3 to 9.9 billion;

- a net debt/EBITDA ratio less than or equal to 2.5x and a “A” category rating;

- a dividend of EUR 0.70 per share with respect to 2017, paid in cash (8).

Key facts

Develop low CO2 power generation activities

From January 1 to September 30, 2017:

- Construction in Indonesia of the first ENGIE geothermal power generation plant in the world;

- Fadhili independent power project awarded in Saudi Arabia;

- Announcement of the closing of asset disposals in the United States and in Asia;

- Nearly 78 MW of photovoltaic projects won in France, strengthening ENGIE´s leading position in photovoltaic solar in the country;

- Acquisition of 100% of La Compagnie du Vent;

- In China, 30% equity investment through capital increase in UNISUN, a solar photovoltaic (PV) company;

- ENGIE and EDPR bidding in the third offshore wind call for tenders in Dunkirk;

- Transfer to Toshiba of ENGIE’s 40% stake in NuGen project in the UK;

- Mexican Ministry of Energy awards three geothermal exploration permits: a key step forward for ENGIE and Reykjavik Geothermal;

- As part of the second solar bidding session organized by the French Energy Regulatory Commission, ENGIE, through its subsidiaries ENGIE Green, La Compagnie du Vent, CNR and Solairedirect, has been awarded 10 photovoltaic projects in France, representing nearly 100 MW of installed capacity;

- ENGIE will build and operate the Sainshand wind farm (55 MW) in Mongolia, its first renewable project in the country, located in the Gobi desert;

- EDP Renováveis and ENGIE consortium is awarded long-term CfD for 950 MW offshore wind project in UK (Moray project);

- The Abraaj Group, a leading investor operating in growth markets, and ENGIE announced a partnership to build a wind platform in India (the “Platform”);

- Solairedirect, an ENGIE subsidiary, inaugurates the Group’s largest solar farm in France (82 MW), in Gréoux-les-Bains in the Alpes-de-Haute-Provence department;

- During an auction by the Brazilian Federal Government, ENGIE won concession contracts for a 30 year-period for two hydropower plants (832 MW installed capacity) for an amount of around EUR 950 million.

Since October 1, 2017:

- ENGIE has signed a contract to build, own and operate (BOO) a 250 MW wind farm in Egypt;

- ENGIE announced the signing of an agreement with Energy Capital Partners for the sale of its generation assets in the United Kingdom;

- Mirfa Independent Water and Power Plant commences full operation in Abu Dhabi.

Develop global networks, mainly gas

From January 1 to September 30, 2017:

- SUEZ, ENGIE and CHRYSO join forces for the 1st industrial processing of liquefied biomethane issued from used waters in France;

- Signing of a financing agreement for Nord Stream 2;

- Ship-to-ship LNG bunkering service started in the port of Zeebrugge;

- ENGIE, Société d’Infrastructures Gazières (“SIG”, held by CNP Assurances and Caisse des Dépôts) and GRTgaz have signed the acquisition of Elengy (a wholly-owned subsidiary of ENGIE operating LNG terminals) at 100% by GRTgaz (the French natural gas transmission operator, owned 75% by ENGIE and 25% by SIG).

Since October 1, 2017:

- Gas4Sea partners – ENGIE, Mitsubishi Corporation and NYK – have been selected by Norwegian multinational energy group Statoil to be their LNG marine fuel supplier in the port of Rotterdam, in the Netherlands, for four crude shuttle tankers;

- ENGIE confirms it has launched a strategic review of its upstream and midstream LNG activities (liquefaction, transport and international trading of LNG). Its downstream LNG activities, such as regasification and LNG ex-terminal sales, are not part of the review.

Develop integrated solutions for its clients

- Collaboration with Schneider Electric to digitize the energy sector;

- Acquisition of Keepmoat Regeneration, which enables ENGIE to become the leading provider of regeneration services for local authorities in the United Kingdom;

- ENGIE signed up to the capital increase of SUEZ in the context of its acquisition of GE Waters & Process Technologies, to the extent of its stake in SUEZ, namely around EUR 244 million;

- Acceleration of the installation of Natural Gas Vehicles (NGV) stations, with the opening of more than 20 new stations in France over the coming twelve months;

- Acquisition of EV-Box, the largest European electric vehicle charging player;

- 100% of the projects presented in the context of the auction of the French energy regulation Commission on photovoltaic self-consumption have been won by ENGIE;

- ENGIE has been chosen by the shipyard MV Werften for the construction of 2 XXL cruise ships;

- ENGIE and Axium secure 50-year comprehensive energy management contract with the Ohio State University in the United States;

- ENGIE launched its home energy (B2C) business in the United Kingdom;

- Acquisition of Icomera, specialist of onboard communications solutions for public transport;

- ENGIE announced the acquisition of a 40% stake in Tabreed and becomes worldwide leader of independent district cooling;

- ENGIE wins major contract with Transport for London;

- Carrefour and ENGIE join forces to develop biomethane in France;

- The French Conseil d’Etat has decided to annul the Decree of May 16, 2013 about regulated tariffs for the sale of natural gas, a transitional phase should be organized;

- The first hydrogen bus line in France will be deployed by the consortium GNVERT (subsidiary of ENGIE) and VAN-HOOL;

- ENGIE, via its subsidiary ENDEL ENGIE has announced its acquisition of CNN MCO, a French company specializing in the maintenance, management, and upkeep of all types of naval vessels. The acquisition is part of ENGIE’s transformation strategy, strengthening the Group’s portfolio of B2B services and solutions;

- ENGIE, through its subsidiary ENGIE AXIMA, has opened exclusive negotiations to buy MCI, French specialist in industrial and commercial refrigeration.

Since October 1, 2017:

- ENGIE, the leading green electricity supplier in France, plans to double the number of green electricity customers by the end of 2018, reaching 2 million customers;

- ENGIE accelerates its development in the off-grid energy market by joining forces with Fenix, a pioneer in Africa’s Solar Home System market.

Other significant events

- Early in September, ENGIE accompanied the sale of shares launched by the French State as part of its share buyback program authorized by the General Meeting of May 12, 2017 and therefore undertook to acquire, concurrently to the placement with institutional investors through an accelerated bookbuilding process, 11.1 million of its own shares (i.e. 0.46% of the capital of ENGIE).

- Besides, to support its ambitious development strategy in renewable energies and energy efficiency, ENGIE issued on March 15 and on September 19 its second and third Green Bonds for respectively EUR 1.5 and EUR 1.25 billion. With this transaction, the total amount of bonds issued by ENGIE in Green Bond format since 2014 reaches EUR 5.25 billion, confirming the Group’s commitment to play a leading role in the energy transition whilst supporting the development of the green finance.

- Moreover, ENGIE took note of the decision of October 6 of the Conseil Constitutionnel to cancel the 3% tax on dividend payments. The financial impact of this decision as well as the proposed exceptional corporate tax contribution provided for in the amended 2017 budget bill are currently being calculated and will be presented in the 2017 financial statements.

- Lastly, on October 9, Fitch credit rating agency assigned ENGIE SA a strong investment grade issuer rating of ‘A’ with stable outlook. ENGIE SA holds also the highest rating among its utilities peers. According to Fitch, the assigned ratings reflect ENGIE’s scale and diversification and the increased regulated and contracted EBITDA, which have helped to limit the impact of commodity price weakness, the challenging growth in customer solutions, and its conservative financial policy.

CONTRIBUTIVE REVENUES BY REPORTABLE SEGMENT